Concerned members of the Gala Games community have identified a series of “unauthorized” withdrawals from the GalaChain bridge.

Spanning almost a month, between October 13 and November 10, the transfers total 140 million GALA, worth approximately $1.5 million at the time.

Given Gala’s chequered past, community members had been “keeping a close eye” on bridging activity.

Regular daily withdrawals of exactly 5 million GALA tokens on Ethereum caught their attention, and when attempting to verify their source, corresponding deposit transactions were missing on GalaScan.

The group, a representative of which reached out to Protos, flagged the transactions to Gala via Discord on November 6, “tagging the CEO and community moderator.”

The group claims that it wasn’t provided with an explanation, but was instead told that the missing bridge transactions may be due to block explorer GalaScan being a “work in progress.”

It wasn’t until four days later that Gala took action. During this time, a further 25 million GALA tokens (approximately $250,000) were withdrawn from the Ethereum bridge.

Read more: Re7 Labs threatens whistleblower over exposure to yield vault collapse

‘Unauthorized’ withdrawals total 140M GALA

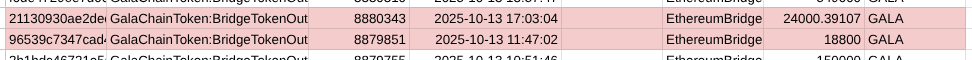

Beginning on October 13, 26 withdrawals of 5 million GALA each were made from the bridge almost every day. The recipients were a series of Ethereum addresses which then swapped the tokens for ETH.

A further 10 million GALA was then withdrawn on November 10, just hours before the bridge was paused.

The bridge’s transaction history downloaded from GalaScan is missing matching bridge transactions on the GalaChain side.

Taking the first suspicious withdrawal as an example, which occurred on October 13 at 15:55 UTC, the surrounding transactions of 18,800 and 24,000 GALA are present in the GalaScan data.

The 5 million GALA minted on Ethereum, however, has no corresponding deposit transaction on GalaChain.

The same pattern was repeated across subsequent daily withdrawals of 5 million GALA each until the bridge was paused.

The group believes these one-sided bridge withdrawals “indicate a likely compromise of privileged access.”

This theory appears supported by the team’s decision to execute a change authorities transaction shortly after pausing the bridge on November 10.

Gala’s response

The group claims that Gala hasn’t publicly disclosed the incident, nor confirmed the cause. Discord announcements about pausing the Ethereum and Solana bridges simply cite “community feedback and concerns.”

Protos has reached out to Gala, but hasn’t heard back before publication of this article. It will be updated in the event we receive a reply.

The incident bears resemblance to a May 2024 hack in which 600 million GALA was sold for $21 million. Gala’s CEO Eric Schiermeyer stated at the time, “We messed up our internal controls… This shouldn’t have happened and we are taking steps to ensure it doesn’t ever again.”

Read more: DeFi karma: Garden hacked for $11M after bridging Lazarus’ loot

The group notes the “similarity between the two incidents, both involving privileged credential misuse, delayed detection, and emergency authority rotation.”

It argues that the pattern of behaviour “suggests ongoing risks to Gala’s infrastructure and token holders.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  MYX Finance

MYX Finance  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  Decred

Decred  LayerZero

LayerZero  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Stable

Stable  WrappedM by M0

WrappedM by M0  Story

Story  pippin

pippin  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Lighter

Lighter  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  River

River  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Resolv USR

Resolv USR  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Axie Infinity

Axie Infinity  Olympus

Olympus  DoubleZero

DoubleZero  ADI

ADI  Staked Aave

Staked Aave