The crypto market continues to recover from the sharp downturn triggered by US President Donald Trump’s abrupt tariff announcement.

While traders are still processing the impact, several blockchain teams are taking proactive steps to stabilize sentiment and rebuild confidence across digital assets.

WLFI Leads Token Buyback

Over the past 24 hours, World Liberty Financial (WLFI), Aster, and Sonic Labs each announced large-scale token buyback programs. These initiatives aim to ease selling pressure and demonstrate long-term commitment to their ecosystems.

On October 11, WLFI disclosed that it had allocated $10 million to repurchase its native WLFI tokens using the USD1 stablecoin.

While others panic, we stack. 🦅

Today we bought $10 million worth of $WLFI — and this won’t be the last time.

We know how the game is played.— WLFI (@worldlibertyfi) October 11, 2025

According to the team, the initiative forms part of a broader resilience plan designed to steady prices as the broader market remains volatile.

Blockchain data shows the buyback was executed using a Time-Weighted Average Price (TWAP) model. The algorithm spreads purchases evenly over time to prevent sudden price swings.

By dividing orders into smaller intervals, WLFI avoided distorting its own market and achieved an average purchase rate closer to fair value.

Notably, the project previously confirmed that all repurchased tokens will be permanently burned. This strategy reduces circulating supply and strengthens price support over time.

Aster and Sonic Follows

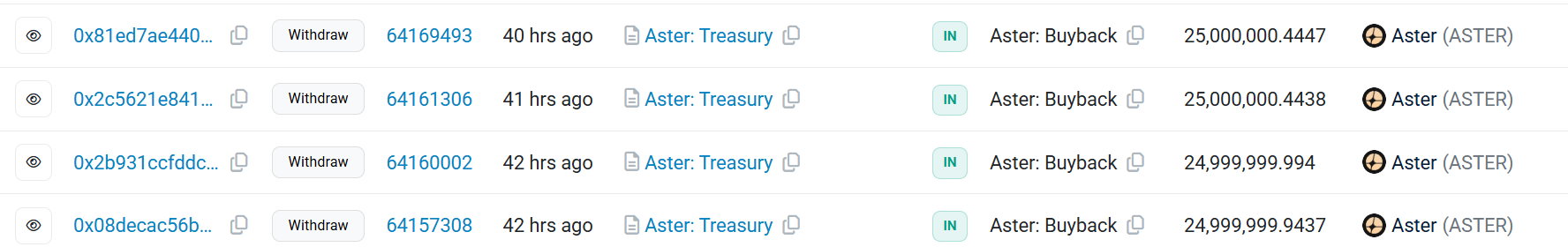

On the other hand, Aster, a decentralized exchange backed by Binance founder Changpeng Zhao, followed suit with a 100 million ASTR token buyback.

Unlike WLFI’s open-market strategy, Aster transferred tokens from its treasury wallet but emphasized that the effort reflects its long-term confidence in the project.

Meanwhile, the timing coincides with the rollout of its Stage 2 Airdrop Checker, which has spurred higher user engagement as Aster continues to challenge perpetuals leader Hyperliquid.

At the same time, Sonic Labs also acted to shield its ecosystem from further declines.

While most networks were struggling to stay online, Sonic operated flawlessly. Zero pending transactions, near-instant finality, and sub-cent fees across every DEX and app.

And while others pulled back, we stepped forward by adding $6 million in open-market buying, increasing… pic.twitter.com/BjlyIkzm7D

— Sonic (@SonicLabs) October 11, 2025

On October 11, Sonic Chief Executive Mitchell Demeter revealed that the firm purchased 30 million $S tokens—roughly $6 million worth—and added them to its treasury.

Indeed, Demeter argued that holding native assets provides more substantial long-term returns than stablecoins.

“Through it all, the Sonic network performed exactly as designed. Zero pending transactions, hundreds of TPS sustained for hours, near-instant finality, and sub-cent fees. No congestion across DEXs or infrastructure. Pure, consistent performance,” he added.

These buyback programs underscore how blockchain teams use token repurchases and burns to absorb selling pressure and stabilize markets.

As a result, DWF Labs Managing Partner Andrei Grachev said his firm plans to support struggling projects recovering from the recent market downturn. This would include deploying a combination of capital injections, loans, and repurchase programs.

The post These 3 Altcoins Turned the Market Crash Into a Comeback With Massive Buybacks appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Sky

Sky  OKB

OKB  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  MYX Finance

MYX Finance  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  Midnight

Midnight  Binance-Peg WETH

Binance-Peg WETH  NEXO

NEXO  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  LayerZero

LayerZero  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  pippin

pippin  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Story

Story  WrappedM by M0

WrappedM by M0  Stable

Stable  Decred

Decred  Kinesis Gold

Kinesis Gold  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  River

River  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Resolv USR

Resolv USR  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Ether.fi

Ether.fi  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  PRIME

PRIME  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Lido DAO

Lido DAO  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  Aerodrome Finance

Aerodrome Finance  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  ADI

ADI  Axie Infinity

Axie Infinity  Staked Aave

Staked Aave