This is a daily analysis of top tokens with CME futures by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

XRP: Rally against BTC has likely just begun

XRP’s (XRP) dollar-denominated prices have surged nearly 60% to new lifetime highs above $3.50 this month. However, against bitcoin

, it appears to be on the verge of kickstarting a significant bull run, as evident from the chart below, which shows the prices for the Binance-listed XRP/BTC ratio.

As of writing, the ratio was probing the upper end of the four-year-long sideways channel that began in early 2021.

Much like coiled springs, sideways channels are periods of energy accumulation. This pent-up energy is eventually unleashed in a powerful directional move; typically, the longer the consolidation, the more substantial the eventual breakout.

Thus, a breakout in the XRP/BTC ratio could mean significant gains for XRP relative to bitcoin.

Supporting the bull case is the Guppy multiple moving average indicator, which has flipped bullish for the first time since 2018. The bullish signal is identified by the short-term EMA band (white) crossing above the long-term ones (red).

XRP/USD : Golden cross is here

XRP looks set for a continued run higher, having defended the support of the January high of $3.39 over the weekend in a classic “breakout and re-test play.” Markets tend to revisit resistance-turned-support to test dip demand and commitment of bulls before staging bigger rallies.

Momentum looks stronger than ever with the bullish golden cross, marked by the 50-day simple moving average (SMA) shifting above the 200-day SMA, while prices are already at record highs. Friday’s high of $3.66 is the immediate resistance, followed by $4.00. Below $3.35, the risk of an extended pullback would increase.

- AI’s take: Given that XRP/BTC is at the “upper end of a four-year-long sideways channel,” this suggests a major, long-term breakout could be imminent. For such a significant event, many traders would lean towards waiting for clear confirmation (e.g., a strong daily or even weekly close above the channel resistance, potentially with high volume) rather than jumping in prematurely.

- Resistance: $3.66, $4.

- Support: $3.35, $3, $2.65.

Ether: Mayer multiple takes out December high

Ether’s (ETH) rally continues, with the 50-day SMA rising to its highest level since March and the 100-day SMA poised to cross above the 200-day SMA in a bullish manner. There is little to no sign of bears looking to reassert themselves, as evident from the small upper wicks attached to most daily candles since July 13.

The Mayer multiple, which gauges the ratio between the spot price and the 200-day SMA to show case momentum, has already crossed the December high to hit its highest since March 2024. Perhaps, it’s only a matter of time before prices do the same, topping the December high of $4,109.

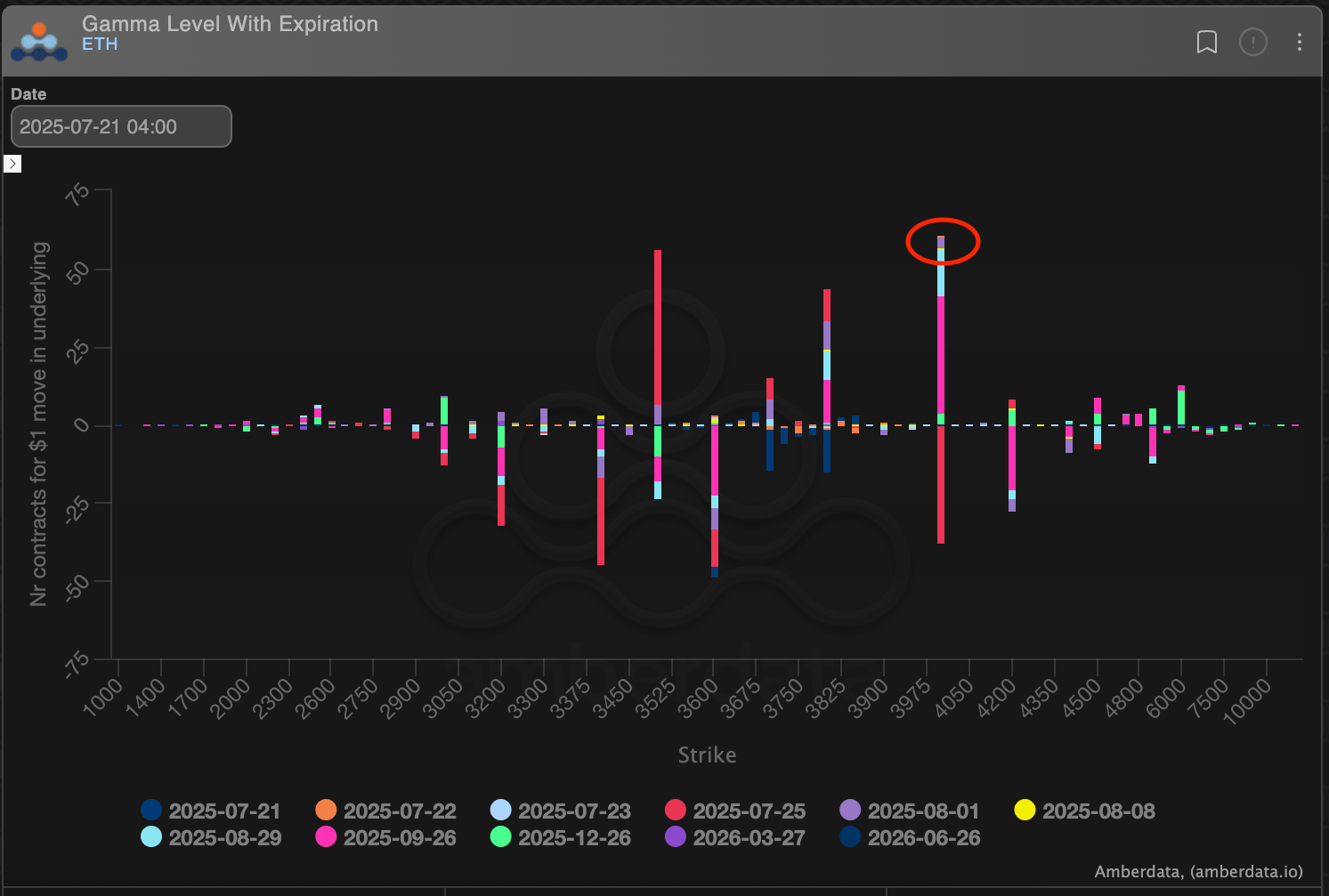

On the way higher, prices may consolidate near $4,000, thanks to the significant positive dealer gamma at that level in the Deribit-listed options market. Dealers typically trade against the market direction in such situations to maintain a net neutral exposure, curbing volatility.

On the downside, $3,480 is the key support. A break below the same would invalidate the bullish higher lows pattern.

AI’s take: The Mayer Multiple suggests strong underlying momentum. This indicator’s higher reading signals ETH is building bullish strength relative to its long-term average, hinting at potential for future price appreciation.

Resistance: $4,000, $4,109, $4,382.

Support: $3,480, $3,081, $2,879.

Bitcoin: Averages signal weak momentum

Bitcoin’s price continues to crisscross the 50-, 100- and 200-hour SMAs, with the three averages now flat-lined in a narrow range, signaling that the upside momentum has weakened. This makes BTC vulnerable to potential risk-off in traditional markets and the ongoing recovery in the dollar index.

A potential failure to hold above the Asian session low of $116,539 would reinforce the bull exhaustion, strengthening the case for a deeper drop to $111,965, the May high. Conversely, a move above $120,000 could bring fresh highs, although prices have consistently failed to establish a foothold above that level since July 14.

- AI’s take: The most prudent approach for many is to wait for Bitcoin to break decisively out of this consolidation phase (either above or below the flat-lined SMAs) with significant volume.

- Resistance: $120,000, $123,181.

- Support: $116,539, $115,739, $111,965.

Solana: Tops key resistance

Solana’s SOL token has topped resistance at around $185 as expected. Further gains appear likely as the MACD histogram prints larger bars above the zero line and the 14-day RSI surpasses 70, both signaling a strengthening of the upward momentum. The Mayer multiple has risen to the highest since January.

A failure to hold above $177 would raise the risk of a deeper price drop.

- AI’s take: Be mindful that an RSI above 70 indicates overbought conditions, so a brief consolidation or pullback isn’t uncommon before further ascent.

- Resistance: $200, $218, $252-$264

- Support: $185, $168, $157.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Litecoin

Litecoin  WETH

WETH  LEO Token

LEO Token  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Polkadot

Polkadot  Monero

Monero  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Cronos

Cronos  Pepe

Pepe  Aave

Aave  Ethena

Ethena  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  OKB

OKB  Pi Network

Pi Network  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Binance-Peg WETH

Binance-Peg WETH  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Algorand

Algorand  VeChain

VeChain  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  sUSDS

sUSDS  Bonk

Bonk  Render

Render  Official Trump

Official Trump  Story

Story  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Binance Staked SOL

Binance Staked SOL  Rocket Pool ETH

Rocket Pool ETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Sei

Sei  Sky

Sky  Lombard Staked BTC

Lombard Staked BTC  Filecoin

Filecoin  SPX6900

SPX6900  USDtb

USDtb  Jupiter

Jupiter  USDT0

USDT0  StakeWise Staked ETH

StakeWise Staked ETH  KuCoin

KuCoin  Liquid Staked ETH

Liquid Staked ETH  Mantle Staked Ether

Mantle Staked Ether  NEXO

NEXO  Injective

Injective  Curve DAO

Curve DAO  Stacks

Stacks  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Pump.fun

Pump.fun  Falcon USD

Falcon USD  Celestia

Celestia  Renzo Restaked ETH

Renzo Restaked ETH  Optimism

Optimism  Solv Protocol BTC

Solv Protocol BTC  Conflux

Conflux  Wrapped BNB

Wrapped BNB  Saros

Saros  FLOKI

FLOKI  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Jupiter Staked SOL

Jupiter Staked SOL  SyrupUSDC

SyrupUSDC  PayPal USD

PayPal USD  PAX Gold

PAX Gold  Fartcoin

Fartcoin  Immutable

Immutable  The Graph

The Graph  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PancakeSwap

PancakeSwap  Sonic

Sonic  clBTC

clBTC  dogwifhat

dogwifhat  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Ethereum Name Service

Ethereum Name Service  MemeCore

MemeCore  Marinade Staked SOL

Marinade Staked SOL  Tether Gold

Tether Gold  Kaia

Kaia  Lido DAO

Lido DAO  Tezos

Tezos  Virtuals Protocol

Virtuals Protocol  Super OETH

Super OETH  Mantle Restaked ETH

Mantle Restaked ETH  Theta Network

Theta Network  ether.fi Staked ETH

ether.fi Staked ETH  cgETH Hashkey Cloud

cgETH Hashkey Cloud  IOTA

IOTA  OUSG

OUSG  JasmyCoin

JasmyCoin  Raydium

Raydium  GALA

GALA  Ondo US Dollar Yield

Ondo US Dollar Yield  Stables Labs USDX

Stables Labs USDX  tBTC

tBTC  Pyth Network

Pyth Network  Aerodrome Finance

Aerodrome Finance  The Sandbox

The Sandbox  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Pendle

Pendle  BitTorrent

BitTorrent  Ripple USD

Ripple USD  Jito

Jito  Usual USD

Usual USD  AB

AB  Zcash

Zcash  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Flow

Flow  Stader ETHx

Stader ETHx  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  USDD

USDD  Solv Protocol Staked BTC

Solv Protocol Staked BTC  Walrus

Walrus  Decentraland

Decentraland  Maple Finance

Maple Finance  Beldex

Beldex  Brett

Brett  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Bitcoin SV

Bitcoin SV  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Helium

Helium  Vision

Vision  Rekt

Rekt  Zebec Network

Zebec Network  TrueUSD

TrueUSD  Onyxcoin

Onyxcoin  Core

Core  Swell Ethereum

Swell Ethereum  Mog Coin

Mog Coin  BUILDon

BUILDon  APENFT

APENFT  Telcoin

Telcoin  THORChain

THORChain  DeXe

DeXe  Savings Dai

Savings Dai  Starknet

Starknet  ApeCoin

ApeCoin  Arweave

Arweave  Reserve Rights

Reserve Rights  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Compound

Compound  Sun Token

Sun Token  dYdX

dYdX  Ether.fi

Ether.fi  Trip

Trip  Kava

Kava  Tokenize Xchange

Tokenize Xchange  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  NEO

NEO  Circle USYC

Circle USYC