Today in crypto, Bitcoin rallied to a new high on Sunday, Stripe CEO says stablecoins will force banks to offer users real interest on deposits, and US-listed spot Bitcoin exchange-traded funds (ETFs) kicked off October with billions in inflows.

Bitcoin rally to $125,000 fueled by US gov’t shutdown, macro factors: Analysts

Bitcoin breached a new all-time high over the weekend, prompting analysts to call for a renewed accumulation phase that could fuel a rally to $150,000 before the end of the year.

Bitcoin (BTC) set a new all-time high above $125,700, and its market capitalization briefly crossed the $2.5 trillion milestone for the first time in crypto history, Cointelegraph reported earlier on Sunday.

The rally was supported by multiple macroeconomic factors, including the recent US government shutdown — the first since 2018 — which some analysts say has renewed interest in Bitcoin’s store-of-value role.

In the past, similar conditions have led to “major price milestones,” according to Fabian Dori, chief investment officer at digital asset banking group Sygnum Bank.

The US government shutdown has “renewed discussion around Bitcoin’s store-of-value role, as political dysfunction underscores interest in decentralised assets,” Dori told Cointelegraph. “At the same time, the broader environment — characterised by loose liquidity conditions, a service-led acceleration in the business cycle, and narrowing underperformance relative to equities and gold — has drawn attention to digital assets,” he added.

Stripe CEO says stablecoins will force banks to offer users competitive interest on deposits

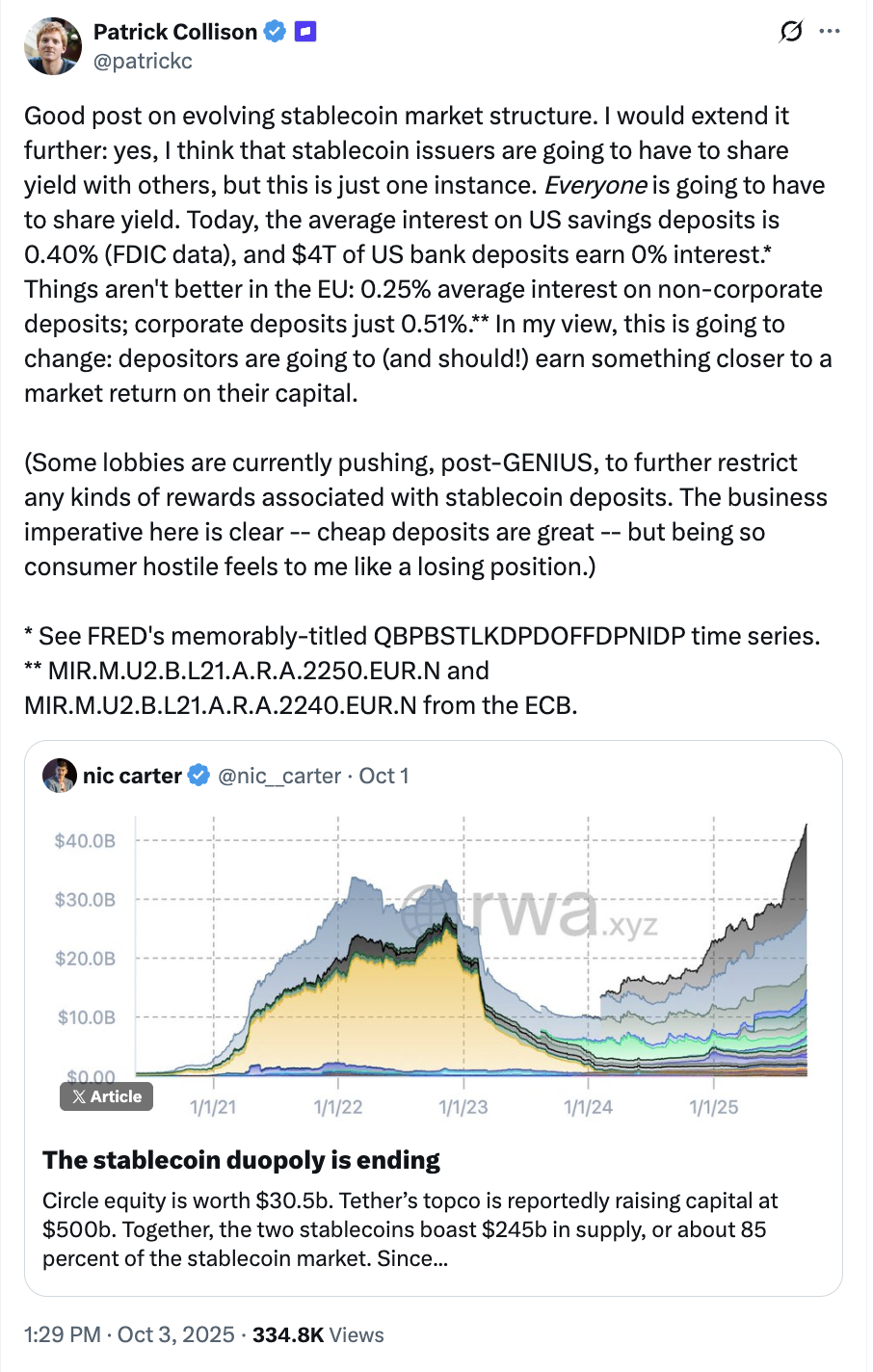

Stripe CEO Patrick Collison said that stablecoins will force banks to offer competitive interest rates to customers due to the rise of yield-bearing stablecoin options.

Collison cited average savings rates offered for customer deposits in the United States and Europe, which all came in well below 1%, as ripe for disruption by stablecoins. He wrote:

“Depositors are going to, and should, earn something closer to a market return on their capital. Some lobbies are currently pushing post-GENIUS to further restrict any kinds of rewards associated with stablecoin deposits. The business imperative here is clear — cheap deposits are great, but being so consumer-hostile feels to me like a losing position.”

The stablecoin market cap crossed $292 billion in October, according to data from RWA.XYZ, as the sector continued to grow following a comprehensive regulatory bill signed into law in the United States.

Bitcoin ETFs kickstart “Uptober” with $3.2 billion in second-best week on record

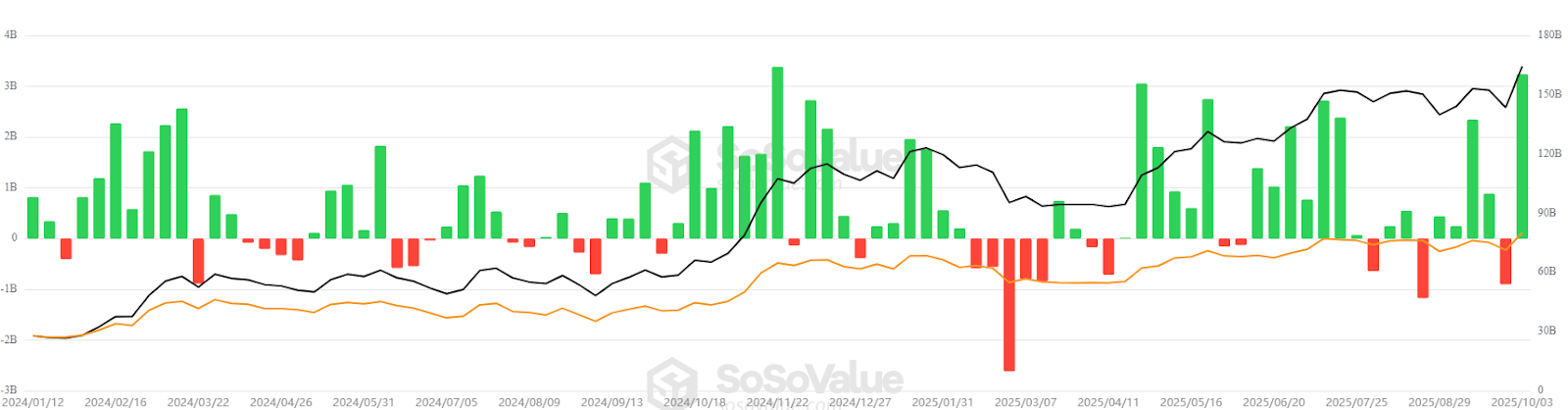

US-listed spot Bitcoin ETFs began the historically bullish month of October with their second-best week of inflows since launch, signaling renewed investor optimism.

Spot Bitcoin (BTC) ETFs recorded $3.24 billion worth of cumulative net positive inflows over the past week, nearly matching their record of $3.38 billion in the week ending Nov. 22, 2024, according to data from SoSoValue.

The figure marks a sharp rebound from the previous week’s $902 million in outflows. Analysts attributed the turnaround to growing expectations of another US interest rate cut, which has improved sentiment toward risk assets.

Growing expectations of another US interest rate cut triggered a “shift in sentiment,” attracting renewed investor demand for Bitcoin ETFs, “bringing four-week inflows to nearly $4 billion,” Iliya Kalchev, dispatch analyst at digital asset platform Nexo, told Cointelegraph. “At current run-rates, Q4 flows could retire over 100,000 BTC from circulation — more than double new issuance.“

“ETF absorption is accelerating while long-term holder distribution eases, helping BTC build a stronger base,” near key technical support levels, he added.

Continued ETF inflows may provide significant tailwinds for Bitcoin in October, which is the second-best month for Bitcoin in terms of average historical returns, often referred to as “Uptober” by crypto investors.

This week’s $3.2 billion briefly pushed Bitcoin’s price above $123,996 on Friday, marking an over six-week high last seen on Aug. 14 for the world’s first cryptocurrency, TradingView data shows.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Aave

Aave  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Ripple USD

Ripple USD  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Sky

Sky  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  MYX Finance

MYX Finance  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  LayerZero

LayerZero  clBTC

clBTC  Sei

Sei  Jupiter

Jupiter  EURC

EURC  pippin

pippin  Stacks

Stacks  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Decred

Decred  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Story

Story  Kinesis Gold

Kinesis Gold  River

River  Stable

Stable  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sun Token

Sun Token  Kaia

Kaia  Kinesis Silver

Kinesis Silver  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.fi

Ether.fi  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  crvUSD

crvUSD  Resolv USR

Resolv USR  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  Lido DAO

Lido DAO  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Legacy Frax Dollar

Legacy Frax Dollar  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Olympus

Olympus  Savings USDD

Savings USDD  JasmyCoin

JasmyCoin  SPX6900

SPX6900  Aerodrome Finance

Aerodrome Finance  Marinade Staked SOL

Marinade Staked SOL  DoubleZero

DoubleZero  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  ADI

ADI  Humanity

Humanity  Telcoin

Telcoin  Axie Infinity

Axie Infinity  Staked Aave

Staked Aave