By Omkar Godbole (All times ET unless indicated otherwise)

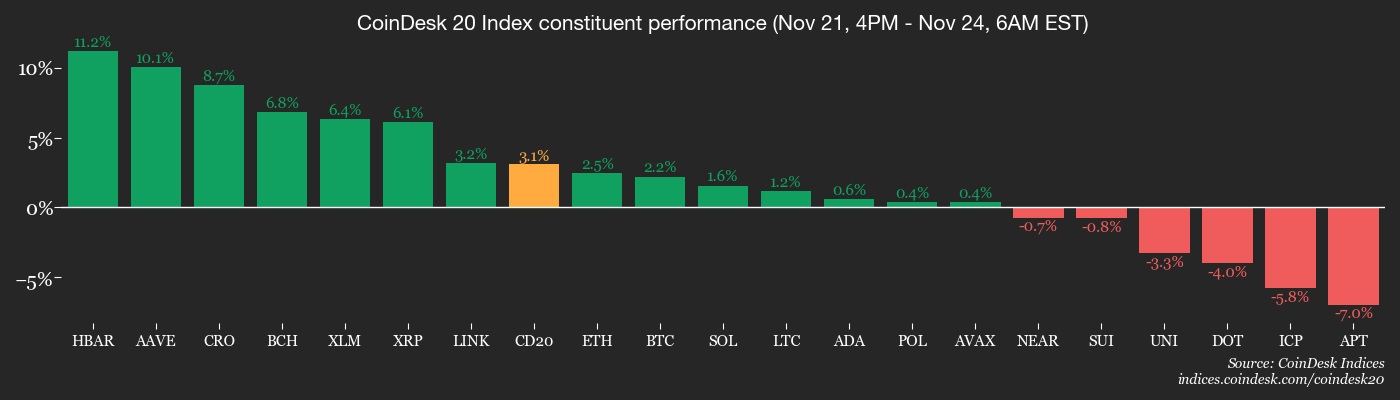

The new week isn’t kicking off on the brightest note. Bitcoin BTC$86,234.74 is already pulling back from its weekend bounce, slipping down to $86,000 from around $88,000. The CoinDesk 20 Index (CD20) is also feeling the chill, sliding to 2,758 points from its weekend high of 2,816.

BTC’s been on a tough four-week losing streak, marked by institutional capitulation. What’s next? Sharp sell-offs like this usually shake investor confidence, which doesn’t bounce back overnight. That makes a quick rally back to $100,000 or more by year-end pretty unlikely.

You can tell the mood from analysts’ comments, which mostly avoid clear directional views.

“In the short term, a rebound is highly likely, but if we fall again and lose the $80,000 level, the probability of facing a much tougher period becomes significantly higher,” CryptoQuant said in a post on X.

A bounce cannot be ruled out because a December interest-rate cut in the U.S. has returned to the table, with traders now assigning a 75% chance of a reduction after dovish remarks by Federal Reserve officials late last week. These odds could climb if this week’s U.S. data — producer price index, retail sales, GDP, and PCE — signal cooling inflation and slower growth.

“For crypto, the macro delta is simple: easing prints would reduce real yields and likely draw marginal buyers back in; sticky inflation or hawkish commentary would keep risk asset liquidity constrained. Expect headline-driven volatility around these releases,” Timothy Misir, head of research at BRN, said in an email.

That said, here is a quick reminder to those expecting Fed-driven booms like 2020-21. The game has changed. As Financial Strategist Russell Napier said, the post-Covid world is characterized by “fiscal dominance/state capitalism,” where governments, not central banks, lead the charge to reduce debt-to-GDP ratios.

In this new setup, governments leverage control over commercial banks and policy tools to direct liquidity into growth-driving economic activities that “inflate away” debt. This makes assets that benefit from fiscal spending and store-of-value appeal among the best investments right now.

This is a big shift from the pre-Covid, Fed dominance era, when new money flowed first to asset managers, sparking rallies in all corners of the financial markets: the classic Cantillon effect I first explained back in 2019!

Investors pinning their hopes solely on Fed stimulus for markets might want to rethink their playbook. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

- Crypto

- Nov. 24: Monad’s public mainnet to start up with native token MON.

- Nov. 24: Two new spot crypto ETFs — Grayscale Dogecoin Trust ETF (GDOG) and Grayscale XRP Trust ETF (GXRP) — are expected to go live on NYSE Arca.

- Macro

- Nothing scheduled.

-

Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

- Governance votes and calls

- GRASS$0.3554 to host token holder call at 1 p.m. on the token’s role in its ecosystem and initiatives ahead.

- Unlocks

- NIL$0.09242 to unlock 4% of its circulating supply worth $10.84 million.

- NEWT$0.1133 to unlock 1.89% of its circulating supply worth $6.25 million.

- Token Launches

- Monad (MON) to list on Kraken, Gate, Bitrue and Indoax.

- Sparkle (SSS) to list on Gate.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

- Nothing scheduled.

Market Movements

- BTC is up 0.95% from 4 p.m. ET Friday at $86,003.98 (24hrs: -0.3%)

- ETH is up 1.14% at $2,799.37 (24hrs: -0.55%)

- CoinDesk 20 is up 2% at 2,753.16 (24hrs: +0.12%)

- Ether CESR Composite Staking Rate is down 25 bps at 2.81%

- BTC funding rate is at 0.0034% (3.7777% annualized) on Binance

- DXY is little changed at 100.09

- Gold futures are down 0.30% at $4,067.20

- Silver futures are down 0.22% at $49.81

- Nikkei 225 closed down 2.40% at 48,625.88

- Hang Seng closed up 1.97% at 25,716.50

- FTSE is unchanged at 9,543.30

- Euro Stoxx 50 is unchanged at 5,510.71

- DJIA closed on Friday up 1.08% at 46,245.41

- S&P 500 closed up 0.98% at 6,602.99

- Nasdaq Composite closed up 0.88% at 22,273.08

- S&P/TSX Composite closed up 0.85% at 30,160.65

- S&P 40 Latin America closed up 0.24% at 3,036.63

- U.S. 10-Year Treasury rate is down 1.3 bps at 4.05%

- E-mini S&P 500 futures are up 0.25% at 6,636.50

- E-mini Nasdaq-100 futures are up 0.47% at 24,419.25

- E-mini Dow Jones Industrial Average Index are unchanged at 46,311.00

Bitcoin Stats

- BTC Dominance: 59.08% (-0.31%)

- Ether-bitcoin ratio: 0.03252 (0.77%)

- Hashrate (seven-day moving average): 1,039 EH/s

- Hashprice (spot): $35.59

- Total fees: 2.32 BTC / $200,985

- CME Futures Open Interest: 131,785 BTC

- BTC priced in gold: 21.2 oz.

- BTC vs gold market cap: 5.77%

Technical Analysis

- The chart shows daily swings in Tether gold’s USDT-denominated price.

- The token, XAUT, has chalked out a triangular consolidation over the past five weeks, marking a pause in the broader bullish trend.

- The next move depends on the direction in which the triangular consolidation resolves. A bullish breakout would mean resumption of the broader rally, while a downside break would signal a bullish-to-bearish trend change.

Crypto Equities

- Coinbase Global (COIN) closed on Friday at $240.41, (+0.96%), +2.16% at $245.60 in pre-market

- Circle Internet (CRCL) closed at $71.33, (+6.53%), +0.71% at $71.84

- Galaxy Digital (GLXY) closed at $23.42, (-2.37%), +2.95% at $24.11

- MARA Holdings (MARA) closed at $10.07, (-1.76%), +1.39% at $10.21

- Riot Platforms (RIOT) closed at $12.71, (-0.67%), +2.2% at $12.99

- Core Scientific (CORZ) closed at $14.73, (-2.77%), +1.83% at $15

- CleanSpark (CLSK) closed at $9.73 (-2.84%), +5.14% at $10.23

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI) closed at $38.04, (-1.91%)

- Exodus Movement (EXOD) closed at $14.65, (+3.03%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $170.50 (-3.74%), -5.41% at $167.55, +1.07% at $172.32

- Semler Scientific (SMLR) closed at $19.03, (+3.36%)

- SharpLink Gaming (SBET): closed at $9.52 (+2.37%), +1.58% at $9.67

- Upexi Inc (UPXI) closed at $2.52, (+2.43%), +3.17% at $2.60

- Lite Strategy (LITS) closed at $1.70 (+0.59%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $238.4 million

- Cumulative net flows: $57.62 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: $55.7 million

- Cumulative net flows: $12.65 billion

- Total ETH holdings ~6.13 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin Mining in China Rebounds, Defying 2021 Ban (Reuters): Miners are quietly exploiting surplus power in China’s energy-rich provinces, reviving operations in defiance of official policy as weak enforcement and higher bitcoin prices create profit incentives.

- Gold Steadies as Market Weighs Chance of Another Fed Rate Cut (Bloomberg): Gold has traded sideways since reaching a record $4,380 per ounce on Oct. 20, though it’s still up 55% in 2025. Strategist Ahmad Assiri sees limited movement until Fed policy becomes clearer.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  HTX DAO

HTX DAO  Ripple USD

Ripple USD  syrupUSDC

syrupUSDC  Sky

Sky  Pepe

Pepe  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  MYX Finance

MYX Finance  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  LayerZero

LayerZero  clBTC

clBTC  Sei

Sei  EURC

EURC  Jupiter

Jupiter  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  pippin

pippin  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Story

Story  WrappedM by M0

WrappedM by M0  Chiliz

Chiliz  Decred

Decred  Kinesis Gold

Kinesis Gold  Stable

Stable  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  River

River  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Resolv USR

Resolv USR  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Injective

Injective  crvUSD

crvUSD  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Legacy Frax Dollar

Legacy Frax Dollar  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  SPX6900

SPX6900  Aerodrome Finance

Aerodrome Finance  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  ADI

ADI  Axie Infinity

Axie Infinity  Staked Aave

Staked Aave