Stellar (XLM) price action witnessed sideways movement for weeks. But the coin is ready to move out of this patter.

At press time, XLM price was up over 11% in the last 24 hours, confirming a breakout from a bullish flag pattern.

After weeks of sideways action, XLM may finally be ready to move higher, potentially as far as $1, if key technical indicators continue to hold strong.

From the liquidation setup to rising buying pressure and retail sentiment, all signs point toward another leg up. But one on-chain metric still shows a risk worth watching.

XLM Price Eyes 133% Upside As Stellar Breaks Bullish Flag Pattern

XLM price broke out of a classic bullish flag pattern. In technical analysis, a flag pattern forms when prices move sharply higher (the pole), then consolidate in a downward-sloping range (the flag), before breaking out again in the same direction.

The XLM price chart depicts the height of the original flagpole, from around $0.23 to $0.52, to be about 133%.

A move toward the key psychological level of $1.00 emerges as the new target, using that same height from the breakout zone.

This type of structure typically shows strong market interest and sustained buying. The breakout candle was backed by high volume and is now pushing past short-term resistance near $0.46.

However, to confirm the rally, the first move has to be past $0.52. Do note that this analysis aligns with the expert analysis on X.

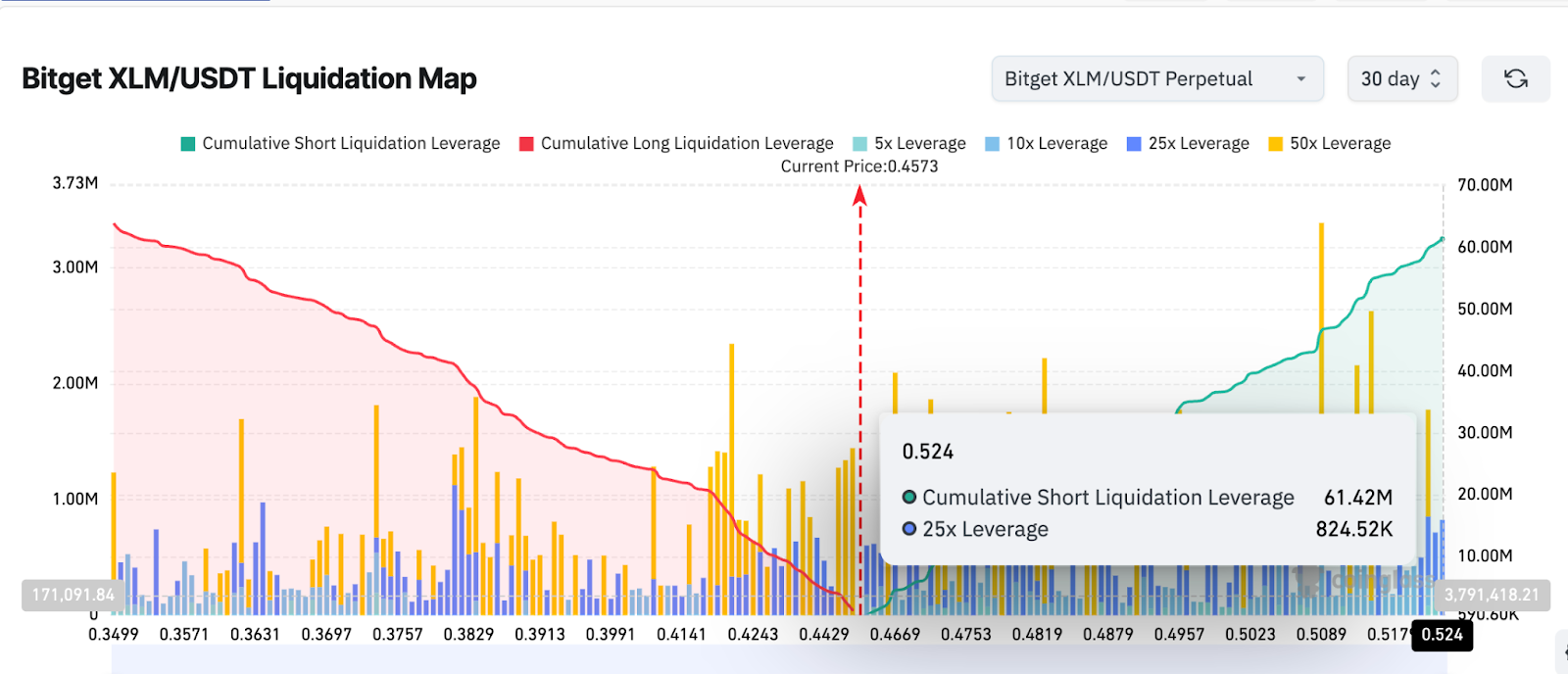

Short Squeeze May Continue With Over $60M in Shorts Still Open

According to the latest liquidation map, many short positions have already been wiped out, but over $52 million in XLM short contracts are still active on Bitget alone. That’s fuel for more upside.

When the XLM price rises quickly, traders betting against Stellar (shorts) are forced to buy back their positions, which pushes prices even higher.

This is known as a short squeeze. It’s what helped XRP rally recently, and Stellar price could be next.

If bulls maintain pressure and spot buying increases, XLM could trigger another liquidation cluster, possibly helping push prices to $0.52 and beyond.

What’s coincidental is that the peak of the short-liquidation cluster sits at $0.52, a level also mentioned on the price chart.

OBV and Bull-Bear Power Confirm Momentum

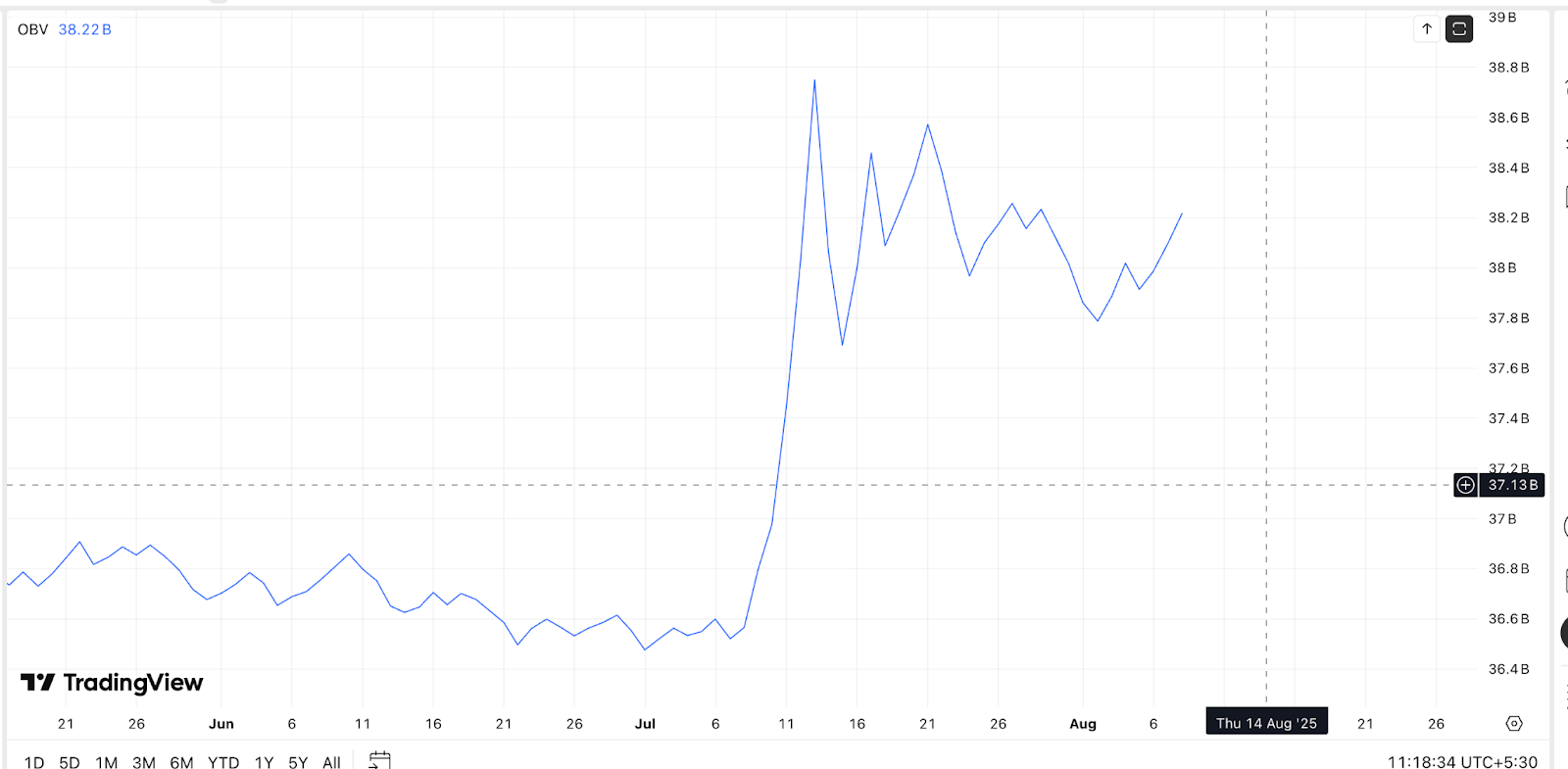

The On-Balance Volume (OBV) is climbing again, forming higher highs alongside price. This is a bullish signal for XLM price.

OBV tracks the running total of trading volume, adding volume on up days and subtracting it on down days. Rising OBV with rising price means demand is increasing.

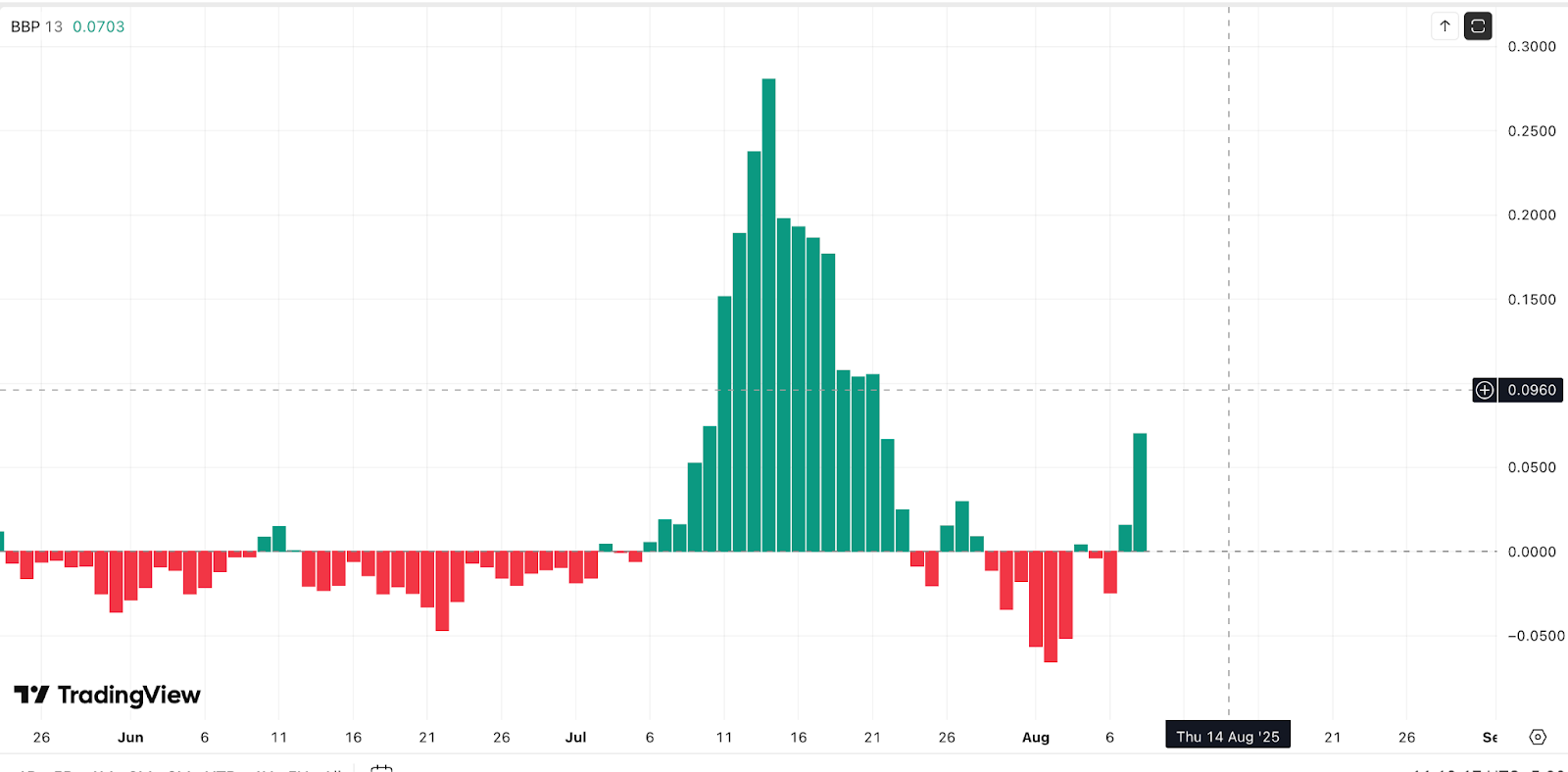

The Bull-Bear Power (BBP) index is flashing green. This tool measures the difference between the highest price buyers are willing to pay and the lowest price sellers are interested in accepting.

A positive, or rather green, BBP indicator during a breakout shows that buying strength is in control.

However, there’s one reason for trading-specific caution.

30-day net exchange flows have turned positive again, rising from under $1 million last week to over $9 million this week. This means more XLM is being sent to exchanges, possibly for profit-taking.

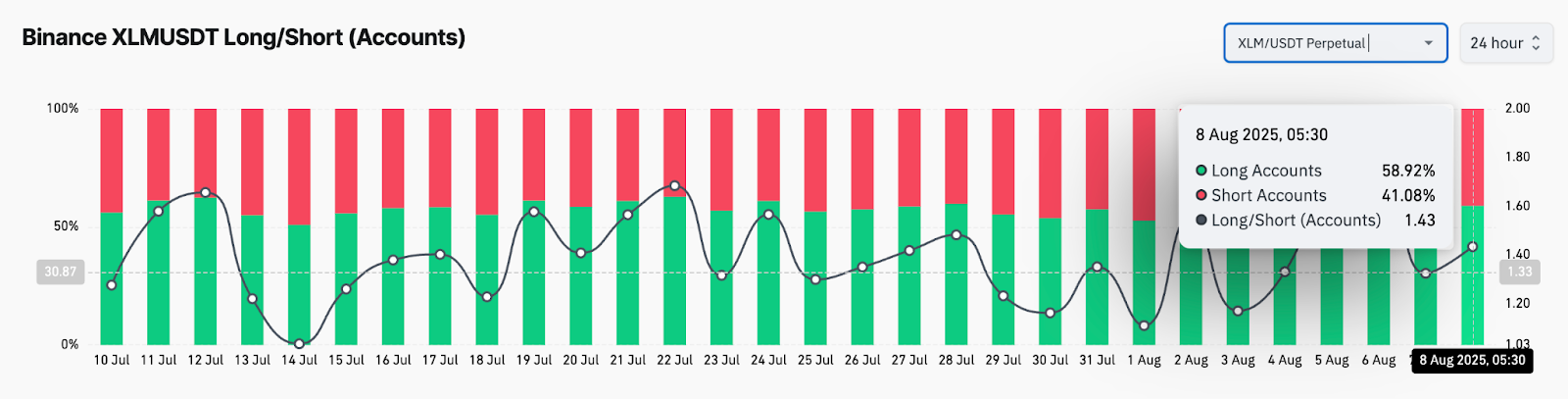

Traders Are Long, With $1 in Sight for Stellar Price

As per what Binance long/short ratio shows, almost 60% of trader accounts are currently long XLM. That means a growing bullish sentiment is in the works in retail circles.

While not extreme, this is enough to support continued price strength, especially if institutions join in.

As long as XLM price stays above $0.46 and bulls maintain volume, a move toward $0.52 is likely. Beyond that, $0.60 and $1.00 remain potential breakout targets based on the full flagpole extension.

However, the short-term setup gets invalidated if price dips back below $0.36, especially if netflows rise further.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Stellar

Stellar  Sui

Sui  Wrapped eETH

Wrapped eETH  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Avalanche

Avalanche  Ethena USDe

Ethena USDe  WETH

WETH  Litecoin

Litecoin  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Uniswap

Uniswap  WhiteBIT Coin

WhiteBIT Coin  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Bitget Token

Bitget Token  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Monero

Monero  Ethena

Ethena  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  Mantle

Mantle  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Pudgy Penguins

Pudgy Penguins  Arbitrum

Arbitrum  Algorand

Algorand  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  POL (ex-MATIC)

POL (ex-MATIC)  USD1

USD1  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Bonk

Bonk  Render

Render  Gate

Gate  Worldcoin

Worldcoin  Rocket Pool ETH

Rocket Pool ETH  Story

Story  Official Trump

Official Trump  sUSDS

sUSDS  Sei

Sei  Binance Staked SOL

Binance Staked SOL  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Sky

Sky  SPX6900

SPX6900  Filecoin

Filecoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Jupiter

Jupiter  StakeWise Staked ETH

StakeWise Staked ETH  Lombard Staked BTC

Lombard Staked BTC  Mantle Staked Ether

Mantle Staked Ether  Liquid Staked ETH

Liquid Staked ETH  KuCoin

KuCoin  USDtb

USDtb  Injective

Injective  Optimism

Optimism  Curve DAO

Curve DAO  Renzo Restaked ETH

Renzo Restaked ETH  USDT0

USDT0  Celestia

Celestia  NEXO

NEXO  Stacks

Stacks  Falcon USD

Falcon USD  Tether Gold

Tether Gold  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  FLOKI

FLOKI  Solv Protocol BTC

Solv Protocol BTC  Pump.fun

Pump.fun  Immutable

Immutable  Lido DAO

Lido DAO  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Fartcoin

Fartcoin  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Wrapped BNB

Wrapped BNB  The Graph

The Graph  Sonic

Sonic  Aerodrome Finance

Aerodrome Finance  PayPal USD

PayPal USD  dogwifhat

dogwifhat  Saros

Saros  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  PancakeSwap

PancakeSwap  Ethereum Name Service

Ethereum Name Service  Tezos

Tezos  PAX Gold

PAX Gold  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Pendle

Pendle  Super OETH

Super OETH  SyrupUSDC

SyrupUSDC  Virtuals Protocol

Virtuals Protocol  clBTC

clBTC  Kaia

Kaia  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Theta Network

Theta Network  Marinade Staked SOL

Marinade Staked SOL  IOTA

IOTA  GALA

GALA  Raydium

Raydium  JasmyCoin

JasmyCoin  MemeCore

MemeCore  ether.fi Staked ETH

ether.fi Staked ETH  Pyth Network

Pyth Network  The Sandbox

The Sandbox  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Mantle Restaked ETH

Mantle Restaked ETH  OUSG

OUSG  Jito

Jito  Ondo US Dollar Yield

Ondo US Dollar Yield  BitTorrent

BitTorrent  Stables Labs USDX

Stables Labs USDX  tBTC

tBTC  Stader ETHx

Stader ETHx  Zcash

Zcash  Ripple USD

Ripple USD  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Brett

Brett  Flow

Flow  Mog Coin

Mog Coin  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Decentraland

Decentraland  Keeta

Keeta  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Walrus

Walrus  BUILDon

BUILDon  AB

AB  Helium

Helium  Usual USD

Usual USD  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Maple Finance

Maple Finance  Telcoin

Telcoin  Rekt

Rekt  Vision

Vision  Swell Ethereum

Swell Ethereum  Solv Protocol Staked BTC

Solv Protocol Staked BTC  Bitcoin SV

Bitcoin SV  Starknet

Starknet  Core

Core  Reserve Rights

Reserve Rights  Arweave

Arweave  Beldex

Beldex  Compound

Compound  Ether.fi

Ether.fi  ApeCoin

ApeCoin  dYdX

dYdX  USDD

USDD  THORChain

THORChain  SuperVerse

SuperVerse  Onyxcoin

Onyxcoin  TrueUSD

TrueUSD  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  AIOZ Network

AIOZ Network  DeXe

DeXe  Fluid

Fluid  APENFT

APENFT  NEO

NEO  Zebec Network

Zebec Network  MultiversX

MultiversX  EigenCloud (prev. EigenLayer)

EigenCloud (prev. EigenLayer)  Savings Dai

Savings Dai