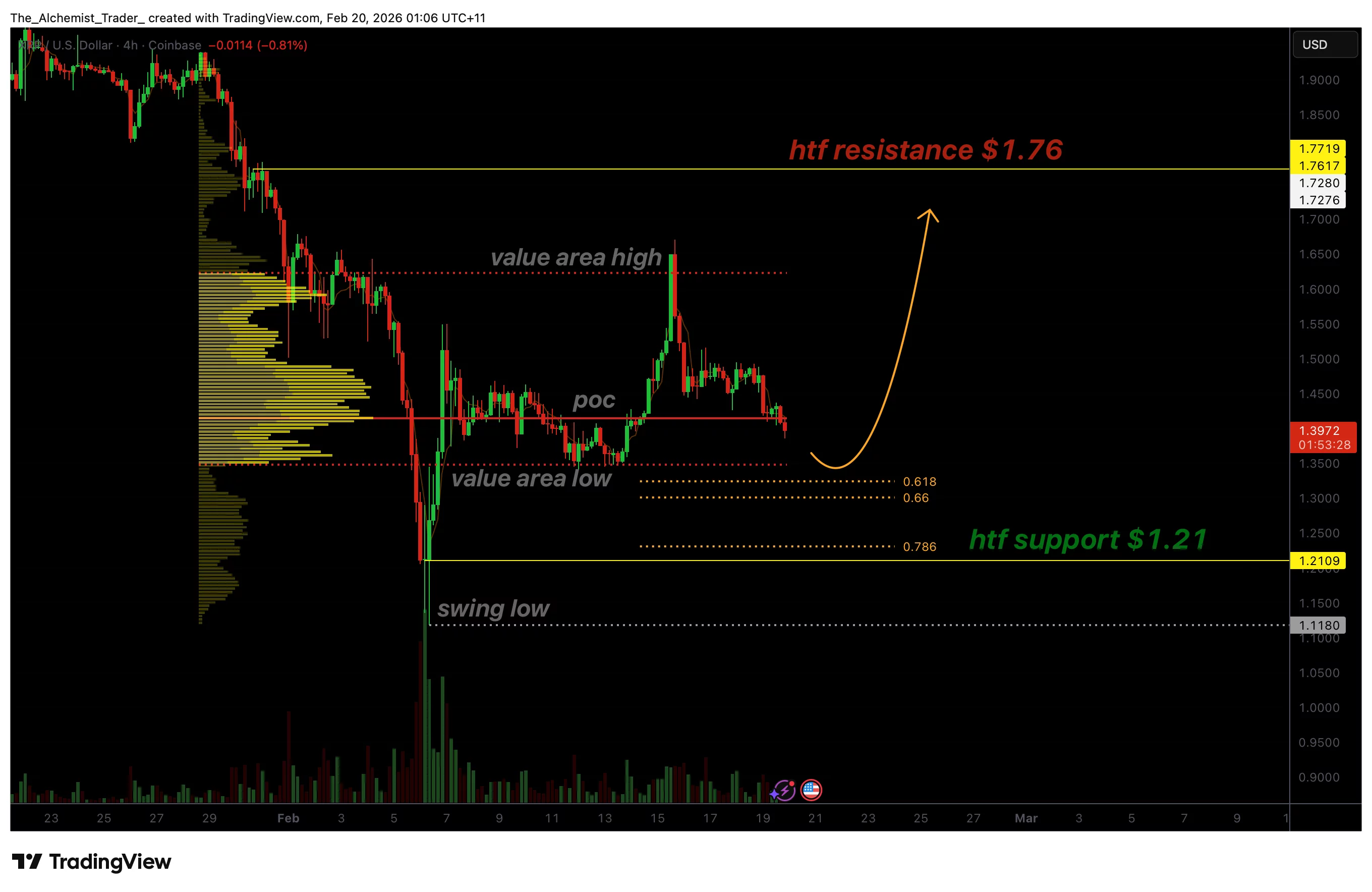

$XRP price breaks local bearish market structure, shifting momentum, with price now testing a key volume support zone that could establish a higher low for higher prices.

- Local bearish structure invalidated, signaling momentum shift

- Key volume support zone being defended, favoring higher-low formation

- $1.76 resistance becomes upside target, if bullish volume confirms continuation

$XRP ($XRP) Price action has begun to show early signs of recovery after breaking its local bearish market structure. Following a period of sustained downside pressure, the market has transitioned back into a technically significant support region where buyers are attempting to regain control. This development suggests that the corrective phase may be nearing completion, provided key support levels continue to hold.

Markets often transition through phases of imbalance before stabilizing around high-liquidity zones. The current move back into a major volume support cluster highlights a potential shift away from bearish continuation toward rotational price behavior. Whether this develops into sustained upside momentum will depend heavily on how price reacts within this support region.

$XRP price key technical points

- Local bearish market structure has been broken, signaling momentum shift

- Major volume support cluster is being tested, including POC and Fibonacci confluence

- $1.76 high-timeframe resistance becomes the upside target, if higher low confirms

$XRP price breaks local bearish structure as rising volume targets $1.70 – 1″>

$XRP price breaks local bearish structure as rising volume targets $1.70 – 1″>

$XRP price has rotated back into an important technical region defined by strong volume participation. This zone includes the point of control (POC), the value area high, and the 0.618 Fibonacci retracement, creating a powerful confluence of support levels.

When multiple technical indicators align in one region, it often increases the probability of price stabilization. Such areas typically attract liquidity and institutional interest, making them ideal locations for higher lows to form during trend transitions.

The return to this volume area indicates that sellers are losing immediate dominance, while buyers are beginning to defend price more aggressively.

Establishing a higher low is critical

The most important technical requirement moving forward is the confirmation of a higher low. A higher low represents a shift in market structure from bearish to constructive and often marks the early stages of trend continuation to the upside.

For this scenario to remain valid, the value area low must continue acting as support. Acceptance below this level would weaken the bullish thesis and reopen downside risks. However, sustained holding above value strengthens the probability that accumulation is taking place.

Once a higher low is confirmed, $XRP gains structural support for continuation within the newly developing trend.

Market structure transition underway

The recent break of local bearish structure is a meaningful technical event. Previously, price action was characterized by lower highs and continued weakness. That pattern has now been disrupted, indicating a transition from distribution toward potential accumulation.

Market structure shifts rarely occur instantly. Instead, they typically unfold through rotations between support and resistance levels. The current consolidation within the volume support region may represent the early phase of this transition.

As buyers defend support and absorb supply, momentum can gradually build for a larger expansion move.

Resistance at $1.76 comes into focus

If the higher low successfully forms, attention shifts toward high-timeframe resistance near $1.76. This level represents the next major technical objective and aligns with prior rejection zones within the broader trading range.

A rotational move toward resistance would confirm that the market has transitioned out of its corrective phase and into a recovery structure. However, reaching this target will require strong bullish participation.

Bullish volume is the deciding factor

While structural signals are improving, confirmation ultimately depends on bullish volume expansion. Breakouts or rotations without volume often fail, leading to renewed consolidation or reversals.

Increasing buy-side volume would validate demand returning to the market and strengthen the probability of continuation toward resistance. Without this confirmation, price may remain range-bound despite structural improvement.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, the market is attempting to transition from bearish control into a more constructive environment. The break of the local bearish structure, combined with strong volume support, suggests that a higher low may be forming.

In the near term, consolidation around the volume support zone is likely as the market searches for equilibrium. As long as the value area low holds, the probability favors a rotational move for $XRP toward the $1.76 resistance level.

A decisive increase in bullish volume would confirm continuation, while failure to hold support would delay the recovery. For now, the technical landscape favors stabilization and potential upside rotation as the market attempts to establish a new structural trend.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Cronos

Cronos  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pepe

Pepe  Aster

Aster  Aave

Aave  Falcon USD

Falcon USD  Bittensor

Bittensor  OKB

OKB  Global Dollar

Global Dollar  Bitget Token

Bitget Token  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  Filecoin

Filecoin  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Arbitrum

Arbitrum  Usual USD

Usual USD  Bonk

Bonk  Stable

Stable  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  pippin

pippin  USDai

USDai  clBTC

clBTC  Sei

Sei  EURC

EURC  Stacks

Stacks  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  PancakeSwap

PancakeSwap  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Tezos

Tezos  Virtuals Protocol

Virtuals Protocol  WrappedM by M0

WrappedM by M0  Decred

Decred  Kinesis Gold

Kinesis Gold  Story

Story  JUST

JUST  Lighter

Lighter  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Injective

Injective  COCA

COCA  Ether.fi

Ether.fi  LayerZero

LayerZero  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  AINFT

AINFT  Kaia

Kaia  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Gnosis

Gnosis  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  The Graph

The Graph  ADI

ADI  SPX6900

SPX6900  IOTA

IOTA  Humanity

Humanity  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Celestia

Celestia  Renzo Restaked ETH

Renzo Restaked ETH  Aerodrome Finance

Aerodrome Finance  crvUSD

crvUSD  sBTC

sBTC  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  Optimism

Optimism  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  Olympus

Olympus  Conflux

Conflux  Helium

Helium  Marinade Staked SOL

Marinade Staked SOL  Maple Finance

Maple Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  BTSE Token

BTSE Token  Telcoin

Telcoin  Ethereum Name Service

Ethereum Name Service  Staked Aave

Staked Aave  Starknet

Starknet