Bitcoin is currently priced at $114,500, with a total market capitalization of $2.28 trillion and a 24-hour trading volume clocking in at $49.29 billion. The intraday price range stretched between $113,599 and $115,755, giving traders just enough rope to swing but not quite enough to lasso a breakout.

Bitcoin Chart Outlook

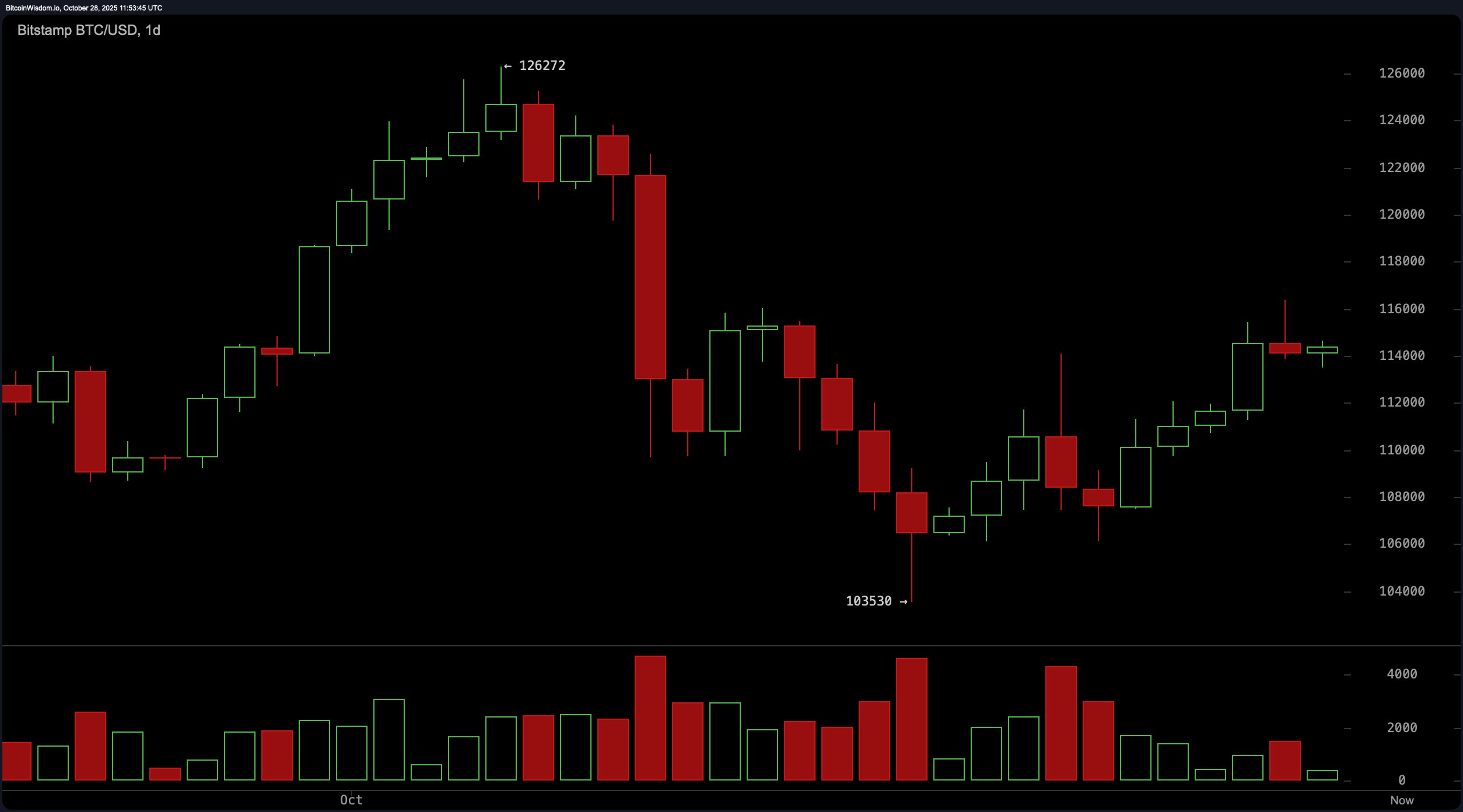

Starting with the 1-day chart, bitcoin is fresh off a mid-October nosedive that found its footing at approximately $103,530. Since then, the chart has quietly flirted with higher lows and steady closes, signaling a recovery narrative—albeit one written in pencil rather than pen.

A bullish confirmation is still hanging in the balance, with $116,000 acting like a velvet rope at the entrance to the next rally. Without a decisive push above that mark, the threat of a reversal looms, potentially dragging the price back toward the $110,000–$108,000 range.

The 4-hour chart paints a more optimistic—but cautious—tale. A clear stair-step rally took shape after October 23, peaking near $116,381 before easing into consolidation. The price has hovered above $114,000 with small-bodied candles reflecting indecision—think of it as bitcoin checking its rearview mirror before merging into fast-moving bullish traffic. A retest of the $113,500 zone on high volume could indicate weakness, while a renewed surge past $116,400 might just put the turbo back into the trend engine.

Now zooming into the 1-hour chart, things look more like a tug-of-war. After peaking at $116,381, bitcoin pulled back to a low of $113,487 before staging a mild rebound. The short-term trend is showing classic lower highs and lower lows, hinting at a cooling period. Despite a valiant attempt to build bullish momentum above $113,500, the effort is lacking volume support. Until that changes, the lower time frame remains neutral at best, with potential upside only if $115,000 is breached convincingly.

Oscillators on the day are a study in ambivalence. The relative strength index (RSI), stochastic, commodity channel index (CCI), average directional index (ADX), and awesome oscillator all indicate neutral sentiment—like a poker table full of players holding nothing stronger than a pair of sevens. The momentum oscillator, however, registered a value of 7,194, hinting at short-term weakness, while the moving average convergence divergence (MACD) stands at −627, suggesting some underlying bullish divergence that’s trying to peek through.

Moving averages, however, are throwing out mixed signals with the flair of a Wall Street soap opera. All exponential moving averages (EMAs) from 10 to 200 days are bullish, with prices above each threshold. Simple moving averages (SMAs), however, are more skeptical, with both the 30-day and 100-day showing bearish action. It’s a tale of two trend lines—one hinting at underlying strength, the other cautioning against premature celebration.

In sum, bitcoin’s technical landscape on October 28 resembles a cautious climb, where bulls are grinding uphill but haven’t yet broken into a sprint. The next directional cue hinges on volume and a clean break above $116,000. Until then, the market remains in a holding pattern—ready, but not quite willing, to commit to its next move.

Bull Verdict:

If bitcoin bulls manage to reclaim $116,000 with conviction and volume, the macro trend could finally shift from cautious optimism to full-throttle momentum. With exponential moving averages across the board showing strength and the 4-hour chart still holding higher ground, a breakout could target the $120,000 level in short order—provided buyers stop flirting and start committing.

Bear Verdict:

Should bitcoin fail to defend the $113,500 support, especially on increased volume, bears could seize short-term control. Momentum is already faltering, and with simple moving averages flashing warning lights, a pullback toward $112,000 or even $110,000 is well within reach. The longer it lingers below $116,000, the more likely that this recovery stalls into yet another disappointment.

FAQ ⏱️

- Where is bitcoin trading right now? Bitcoin is hovering around $114,500 as of October 28, 2025.

- What price levels matter most today?Key levels include $116,000 for a breakout and $113,500 as critical support.

- Is the current trend bullish or bearish?The trend is cautiously bullish, but volume and confirmation are missing.

- What’s the short-term outlook for bitcoin?Sideways with upside potential—if $116,000 breaks cleanly.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Zcash

Zcash  Litecoin

Litecoin  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Rain

Rain  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Bitget Token

Bitget Token  Aave

Aave  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Sky

Sky  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Pepe

Pepe  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  NEXO

NEXO  Midnight

Midnight  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  Render

Render  syrupUSDT

syrupUSDT  VeChain

VeChain  MYX Finance

MYX Finance  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  pippin

pippin  clBTC

clBTC  Sei

Sei  EURC

EURC  LayerZero

LayerZero  Stacks

Stacks  Jupiter

Jupiter  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Decred

Decred  WrappedM by M0

WrappedM by M0  Story

Story  Kinesis Gold

Kinesis Gold  Stable

Stable  Pudgy Penguins

Pudgy Penguins  JUST

JUST  Optimism

Optimism  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  Lighter

Lighter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  Curve DAO

Curve DAO  River

River  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  Gnosis

Gnosis  Sun Token

Sun Token  Kinesis Silver

Kinesis Silver  Wrapped Flare

Wrapped Flare  Ether.fi

Ether.fi  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Maple Finance

Maple Finance  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Humanity

Humanity  Injective

Injective  crvUSD

crvUSD  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  JasmyCoin

JasmyCoin  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Lido DAO

Lido DAO  The Graph

The Graph  sBTC

sBTC  Legacy Frax Dollar

Legacy Frax Dollar  Bitcoin SV

Bitcoin SV  Resolv USR

Resolv USR  Jupiter Staked SOL

Jupiter Staked SOL  IOTA

IOTA  Savings USDD

Savings USDD  ADI

ADI  Olympus

Olympus  Celestia

Celestia  Marinade Staked SOL

Marinade Staked SOL  SPX6900

SPX6900  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Aerodrome Finance

Aerodrome Finance  Telcoin

Telcoin  Axie Infinity

Axie Infinity  Staked Aave

Staked Aave