The threat actor behind the Coinbase customer breach resurfaced on October 2, moving fresh capital across stablecoin rails before bridging funds away within minutes, according to blockchain investigator ZachXBT.

He reported that roughly 5 million DAI was swapped into an equivalent amount of USDC and sat for only about 35 minutes before being bridged, with a portion routed through Circle’s Cross-Chain Transfer Protocol (CCTP).

This was not the first time the actor signaled activity on-chain. On May 21, the same wallet complex transferred more than $42.5 million from Bitcoin to Ethereum through THORChain. On the occasion, the hack left a message trolling ZachXBT.

A $300 Million Breach

Coinbase disclosed on May 15 that a data breach had occurred, affecting less than 1% of its monthly active users, according to the exchange.

A group of overseas support agents with privileged access was bribed and recruited by outside actors.

Those insiders exposed names, contact details, identity documents, and partially masked financial data, which was enough to supercharge impersonation campaigns.

Coinbase emphasized that core infrastructure, including authentication secrets, private keys, and Prime wallets, remained uncompromised, and it pledged to compensate affected users.

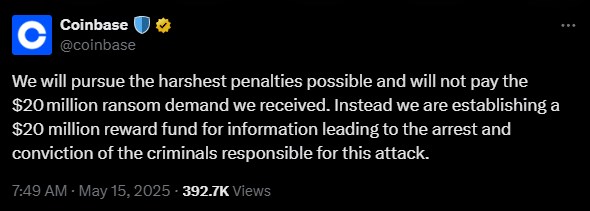

CEO Brian Armstrong stated that the attackers attempted to extort $20 million in Bitcoin.

However, the company refused the ransom and instead announced a $20 million reward fund for information leading to arrests and convictions.

The US Department of Justice initiated an investigation immediately afterward, and Coinbase’s preliminary estimate for remediation and reimbursements ranges from $180 million to $400 million.

That insider-enabled data trove became the raw material for industrial-grade social engineering. Alliance DAO’s Qiao Wang described a highly scripted playbook.

Impostors posing as Coinbase staff flagged “compromised” accounts, steering targets into “verification,” and then captured assets by supplying pre-generated seed phrases for supposed security wallets.

The con blended urgency, authenticity cues from stolen personal data, and technical theater to extract custody.

Meanwhile, market voices, such as Wintermute’s Evgeny Gaevoy, argued that rigid KYC/AML frameworks can paradoxically increase civilian exposure by centralizing sensitive identity data, which, once leaked, fuels more crime.

Normalized Thefts

The October 2 transfers also re-exposed how compliant, allowlisted infrastructures are used in flight.

ZachXBT said part of the funds moved through Circle’s official CCTP, a legitimate bridge that burns USDC on one chain and mints it on another.

That matters because it converts bridging into an issuance workflow rather than an asset swap, potentially complicating freeze-and-seize options if controls are not wired to fire rapidly.

ZachXBT vented recently about how the crypto industry is dependent on government agencies. He said:

“For an industry that was founded on principles of independence from the government it’s embarrassing how reliant we are on them to find a solution for victims.

There’s no other industry that has normalized thefts to the same extent.” In his statement, the investigator emphasized “major problems” without a solution, and these issues continue to worsen.

Among the problems listed, he questioned what would happen when the majority of law enforcement agents are incapable of tracking funds on-chain.

He further questioned when there are jurisdiction barriers, and when there is a lack of action from stablecoin issuers to freeze funds quickly.

Viewed narrowly, the latest movement from the Coinbase threat actor is a status update. Hackers remain active, opportunistic, and confident in outrunning asset-level controls.

Viewed broadly, it is a stress test of the “full stack.” Exchanges’ internal access controls, customer-support vendor management, data-handling hygiene, law enforcement speed, and the responsiveness of stablecoin issuers and bridges when red flags are triggered.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  Bitget Token

Bitget Token  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  MYX Finance

MYX Finance  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  LayerZero

LayerZero  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Decred

Decred  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Story

Story  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Stable

Stable  pippin

pippin  Kinesis Gold

Kinesis Gold  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  River

River  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Kaia

Kaia  Maple Finance

Maple Finance  Wrapped Flare

Wrapped Flare  Resolv USR

Resolv USR  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Ether.fi

Ether.fi  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Lido DAO

Lido DAO  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  SPX6900

SPX6900  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Humanity

Humanity  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  Axie Infinity

Axie Infinity  ADI

ADI  Staked Aave

Staked Aave