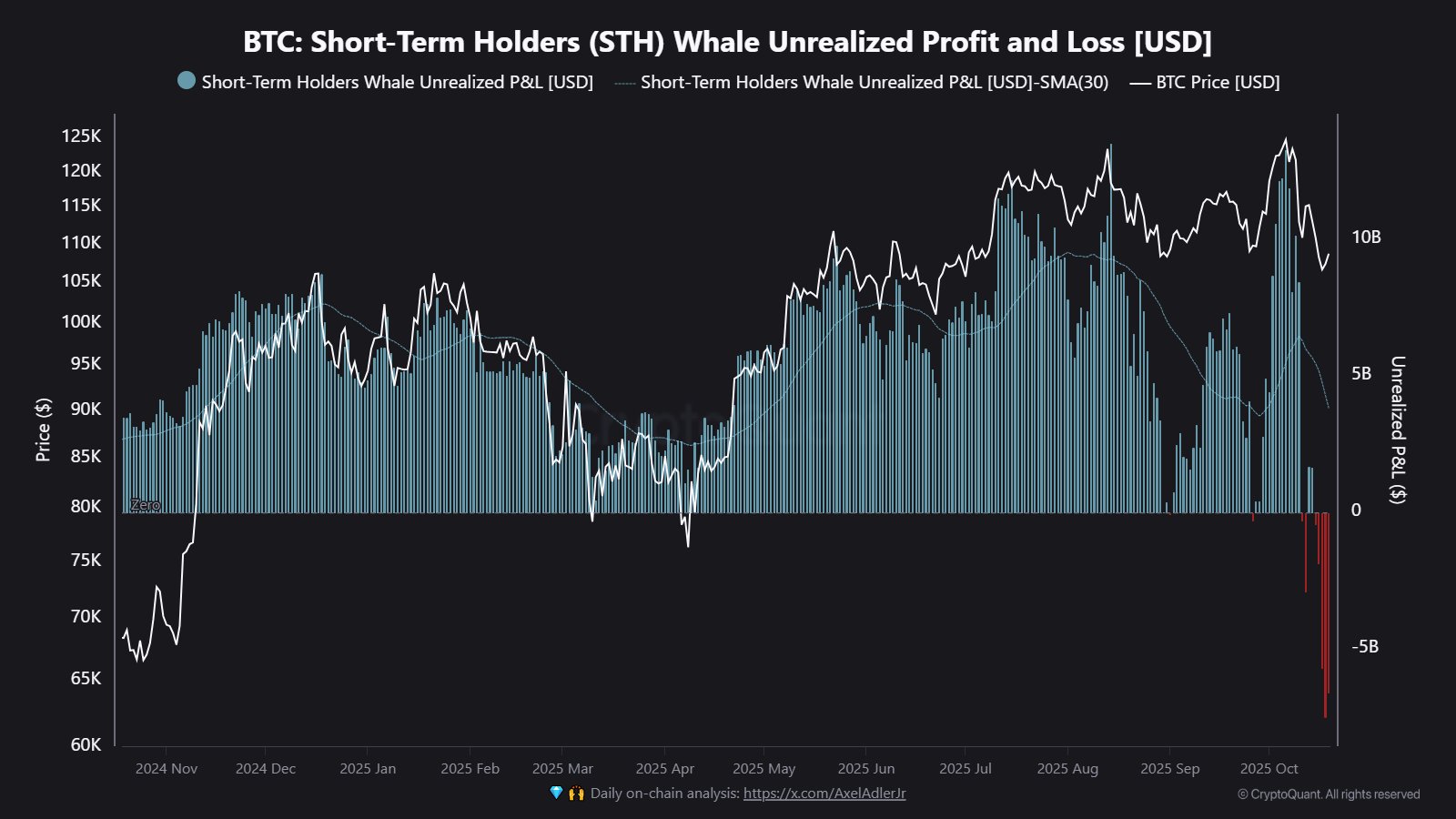

On-chain data indicates that new Bitcoin whales are now facing nearly $7 billion in losses, the largest since October 2023.

Notably, Bitcoin is still struggling to recover from the sharp drop it suffered on Oct. 10. Despite climbing back to retest the $110,000 mark, the world’s largest crypto asset remains about 13% below its all-time high of over $126,000, reached earlier this month.

The recent slide has put pressure on large investors, as new data shows that a growing number of large whales are sitting on heavy unrealized losses.

With Bitcoin currently trading at around $110,000, this group faces nearly $6.95 billion in unrealized losses, the largest seen since October 2023. Data from an accompanying chart confirms that this is the first time these short-term whales are seeing unrealized losses since November 2024.

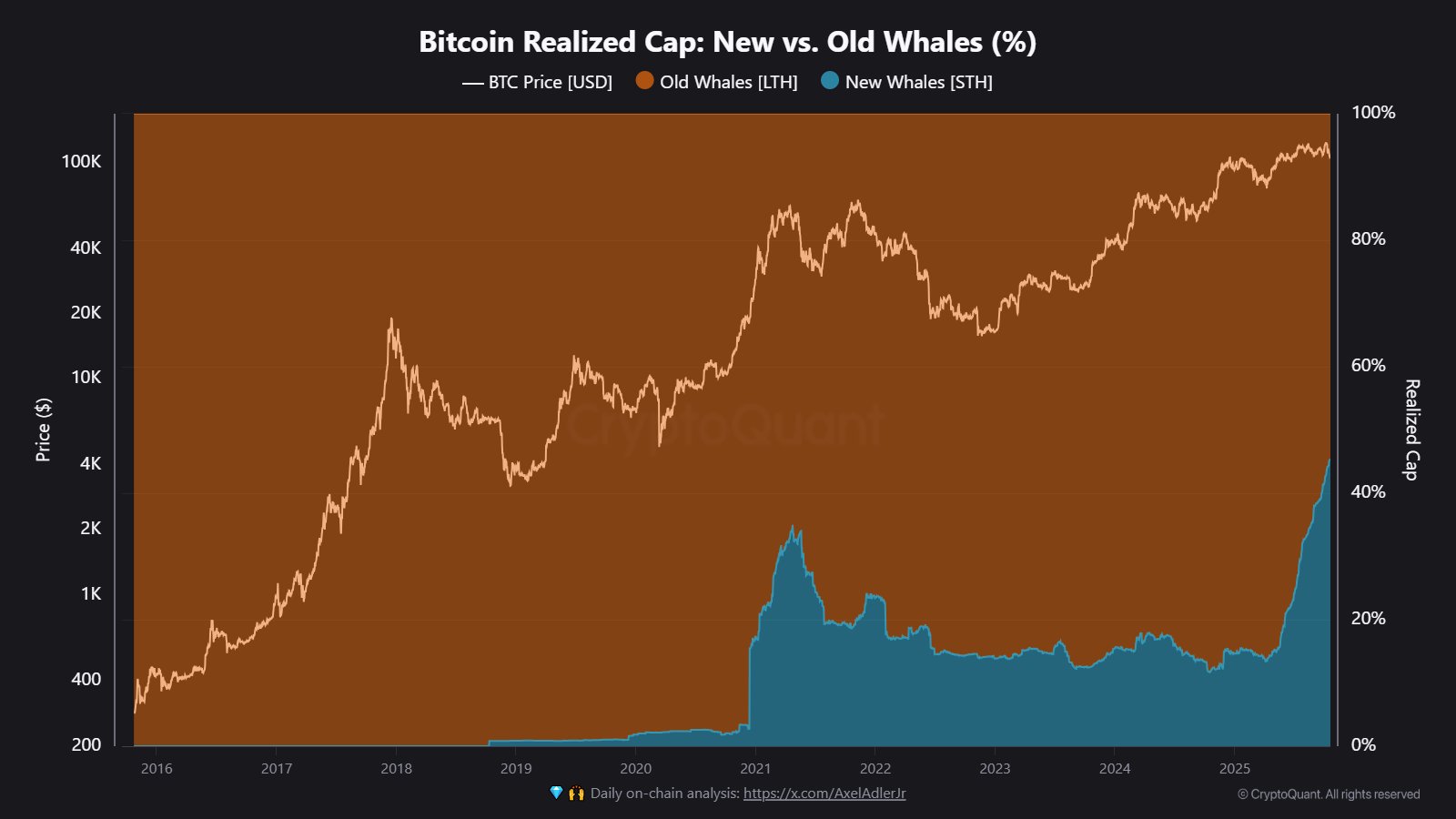

CryptoQuant added that these newer whales now hold about 45% of Bitcoin’s total whale realized cap, showing how much of the big-money market lies in this category. Interestingly, the chart confirms that earlier in the year, they held below 20%.

Still, many of these whales continue to buy more Bitcoin despite their paper losses. Notably, market analyst Crypto Patel noted that over 26,500 BTC recently moved into whale accumulation wallets.

🐳 Whales are loading up.

Over 26,500 #BTC just flowed into whale accumulation wallets, that’s not traders, that’s big money moving off exchanges.

Historically, every spike like this has happened when fear is high… and whales are quietly buying. pic.twitter.com/JiXWlBfJrZ

— Crypto Patel (@CryptoPatel) October 19, 2025

He explained that these transfers typically occur when fear dominates the market, a pattern that has often marked the early stages of accumulation before major rallies. Patel said this shows large investors are quietly adding to their holdings while most traders stay cautious.

Bitcoin in a Favorable Position

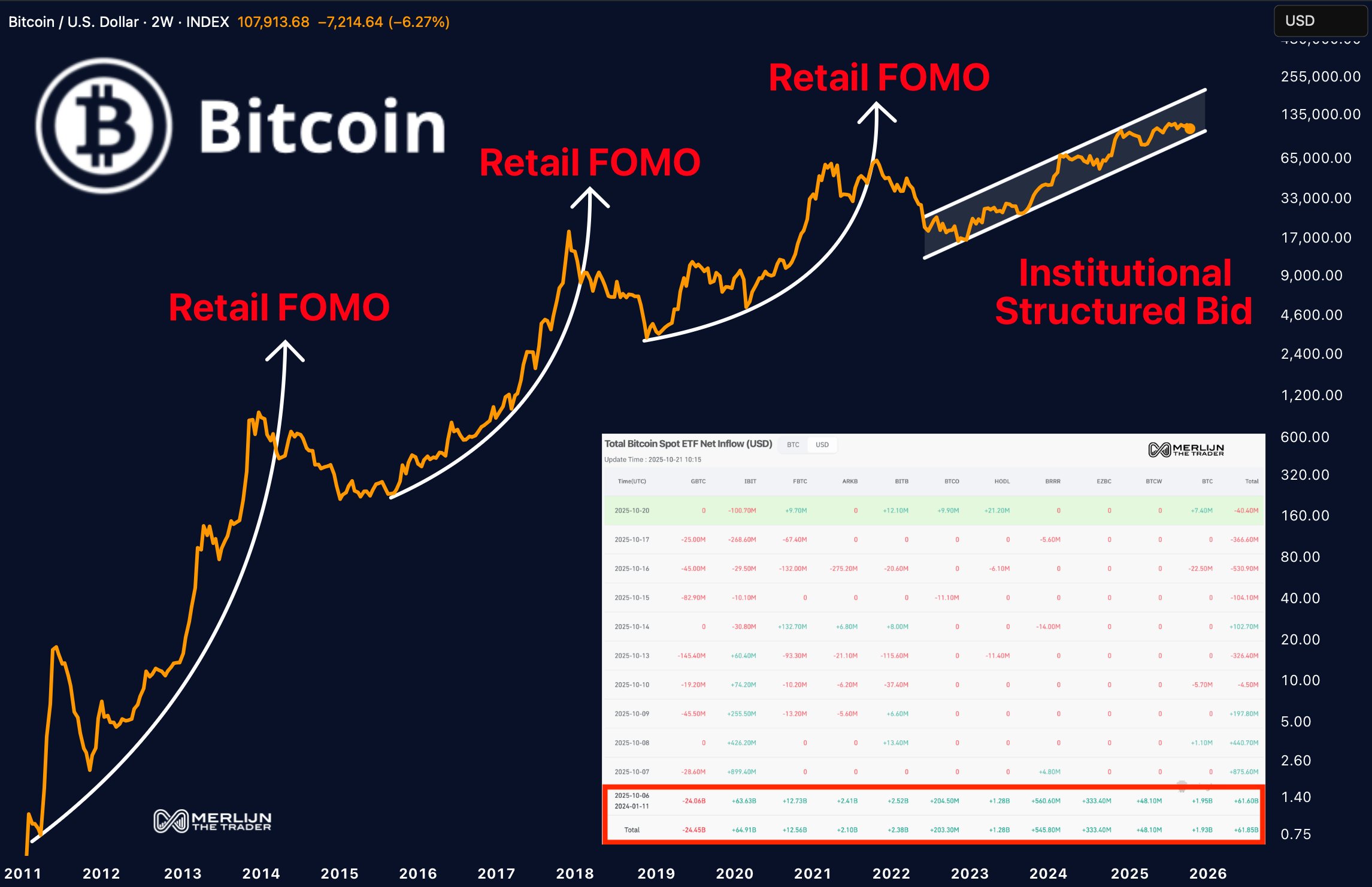

Meanwhile, amid the current market uncertainty, analyst Merlijn the Trader said this cycle looks very different from previous ones. In past bull runs, emotion and hype drove prices to new highs.

This time, structural factors, especially strong inflows from Bitcoin ETFs, are determining the market. Merlijn described the current phase as calm and deliberate, suggesting that big players are building positions early, as they prepare for what he called a major wave of institutional demand.

Also, data from Glassnode shows that leverage in the Bitcoin market has dropped sharply. The firm said open interest fell by about 30%, flushing out excess leveraged trades.

#Bitcoin open interest has dropped by ~30%, flushing excess leverage from the market. With funding now near neutral, the market is far less vulnerable to another liquidation cascade.

🔗 pic.twitter.com/l4hkNnZdZX

— glassnode (@glassnode) October 21, 2025

With funding rates now close to neutral, the market looks more balanced and less exposed to another wave of forced liquidations. This reset could make the market healthier and less volatile in the short term.

Interestingly, market analyst Ted Pillows pointed out that Bitcoin is now testing a crucial support range between $107,000 and $108,000. He said that if this zone holds, the market could see a bounce. However, if Bitcoin falls below it, prices might slide toward $100,000 in the near term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  OKB

OKB  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  Worldcoin

Worldcoin  KuCoin

KuCoin  MYX Finance

MYX Finance  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  Decred

Decred  Stable

Stable  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Story

Story  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  pippin

pippin  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Lighter

Lighter  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  LayerZero

LayerZero  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  River

River  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Kaia

Kaia  Resolv USR

Resolv USR  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Kinesis Silver

Kinesis Silver  Ether.fi

Ether.fi  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Aerodrome Finance

Aerodrome Finance  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  SPX6900

SPX6900  Telcoin

Telcoin  Marinade Staked SOL

Marinade Staked SOL  JasmyCoin

JasmyCoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Olympus

Olympus  Axie Infinity

Axie Infinity  ADI

ADI  DoubleZero

DoubleZero  Staked Aave

Staked Aave