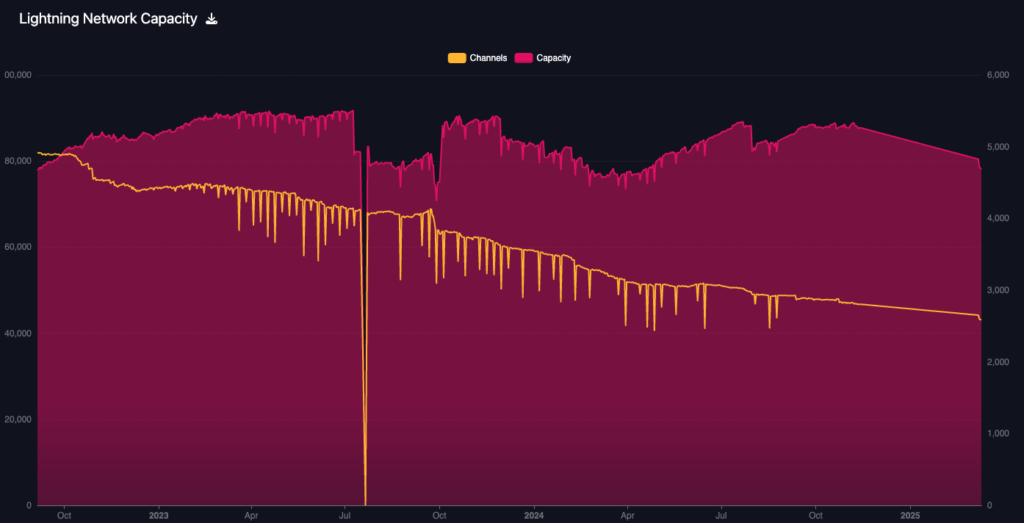

Bitcoin’s Lightning Network capacity has declined from over 5,400 BTC in late 2023 to around 4,200 BTC by August 2025, a roughly 20% drop, per mempool.space data. While the raw figures imply a contraction, analysts and developers suggest the shift reflects structural evolution in routing and protocol design rather than a retreat in adoption.

Lightning capacity vs usage

The network’s capacity metric refers to the total amount of BTC locked in publicly advertised payment channels, which form the graph used to route peer-to-peer transactions.

As River’s 2023 Lightning report explains, this number does not reflect private channels, custodial flows, or multi-path routed payments. The same report found that despite only moderate growth in capacity at the time, routed payments on Lightning increased 1,212% between August 2021 and August 2023.

Coinbase’s integration of Lightning in 2024 brought measurable volume. By mid-2025, Lightspark reported that roughly 15% of Bitcoin withdrawals on the platform were now routed via Lightning.

CoinGate, a European crypto payments processor, has also reported that Bitcoin’s share of crypto payments on its platform regained dominance in 2025, with internal data attributing part of that volume to growing use of second-layer networks, including Lightning. In its 2024 quarterly breakdown, CoinGate noted that Lightning had already accounted for over 16% of all Bitcoin orders, up from around 6.5% two years earlier.

The decline in public capacity accompanies a longer-term drop in public node and channel counts, which have been in steady decline since 2022, according to data from mempool.space.

Developers attribute part of this trend to the consolidation of routing through better-managed hub nodes and the adoption of protocol enhancements like channel splicing. These changes allow wallets to resize channels without on-chain transactions, reducing the need for new channels and enabling more efficient use of liquidity.

Continued Lightning development

While the public graph may appear smaller, recent developments may be expanding the scope of the network’s use cases. In January 2025, Tether announced the rollout of USDt over Lightning via Taproot Assets, in collaboration with Lightning Labs.

This opens the door to dollar-denominated payments and stablecoin-backed remittances on the network, which would not require BTC to be locked in channels, effectively decoupling usage from Bitcoin-denominated capacity metrics. Lightning Labs CEO Elizabeth Stark said the integration combines the security of Bitcoin with the speed and scalability of Lightning.

At a structural level, developers are also addressing issues that affect payment reliability and channel health. Research on jamming attacks and replacement cycling vulnerabilities continues through the Bitcoin Optech working groups, while features like BOLT12 Offers and liquidity automation tooling are making Lightning more robust for commercial usage.

There is also a noticeable expansion in application layers using the Lightning protocol. One example is L402, a specification that enables pay-per-request APIs using Lightning-native authentication and micropayments, now deployed in early AI agent stacks such as LangChainBitcoin.

The design enables automated agents to pay per inference call or API response without requiring fiat accounts or static keys, offering a new machine-to-machine payment stream that does not rely on capacity growth to scale.

These protocol and use-case shifts provide context for why public capacity alone may no longer be a complete indicator of the network’s adoption trajectory.

Developers argue that Lightning’s current evolution is less about growing visible liquidity and more about increasing the utility of each satoshi already in motion.

While the public capacity trendline may be descending, the underlying metrics on usage, integration, and technical progress tell a different story.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  MYX Finance

MYX Finance  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  Decred

Decred  LayerZero

LayerZero  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Stable

Stable  WrappedM by M0

WrappedM by M0  Story

Story  pippin

pippin  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Lighter

Lighter  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  River

River  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Resolv USR

Resolv USR  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Axie Infinity

Axie Infinity  Olympus

Olympus  DoubleZero

DoubleZero  ADI

ADI  Staked Aave

Staked Aave