Bitcoin faces renewed macro pressure after the latest US jobs report signaled a stronger-than-expected labor market, pushing Treasury yields higher and reducing the likelihood of near-term Federal Reserve rate cuts.

The US economy added 130,000 jobs in January, nearly double consensus expectations. At the same time, the unemployment rate fell to 4.3%, showing continued labor market resilience.

While strong employment is positive for the broader economy, it complicates the outlook for risk assets like Bitcoin.

US job growth unexpectedly accelerated in January and the unemployment rate fell to 4.3%, signs of labor-market stability that could give the Fed room to keep interest rates unchanged for some time while policymakers monitor inflation pic.twitter.com/dHZX5mWOvr

— Reuters (@Reuters) February 11, 2026

Strong Jobs Data Delays Rate Cut Expectations

Markets had been anticipating potential rate cuts in the coming months amid slowing growth concerns. However, a resilient labor market reduces the urgency for monetary easing.

As a result, investors repriced expectations for Federal Reserve policy.

Bond markets reacted immediately. The US 10-year Treasury yield jumped toward the 4.2% level, rising several basis points after the report. The two-year yield also climbed, reflecting reduced probability of near-term cuts.

Ten year treasury yields jumped 8 bps to 4.20% (which has been a magnet for the market) on the jobs report. Given the mix of huge downward revisions and higher than expected Jan hiring – the direction is likely sideways until CPI report on Friday. pic.twitter.com/GOM1uNl19B

— Kathy Jones (@KathyJones) February 11, 2026

Higher yields tighten financial conditions. They increase borrowing costs across the economy and raise the discount rate used to value risk assets.

Why Higher Yields Pressure Bitcoin

Bitcoin is highly sensitive to liquidity conditions. When Treasury yields rise, capital tends to rotate toward safer, yield-generating assets such as government bonds.

At the same time, a stronger dollar often accompanies rising yields. A firmer dollar reduces global liquidity and makes speculative assets less attractive.

This combination creates headwinds for crypto markets.

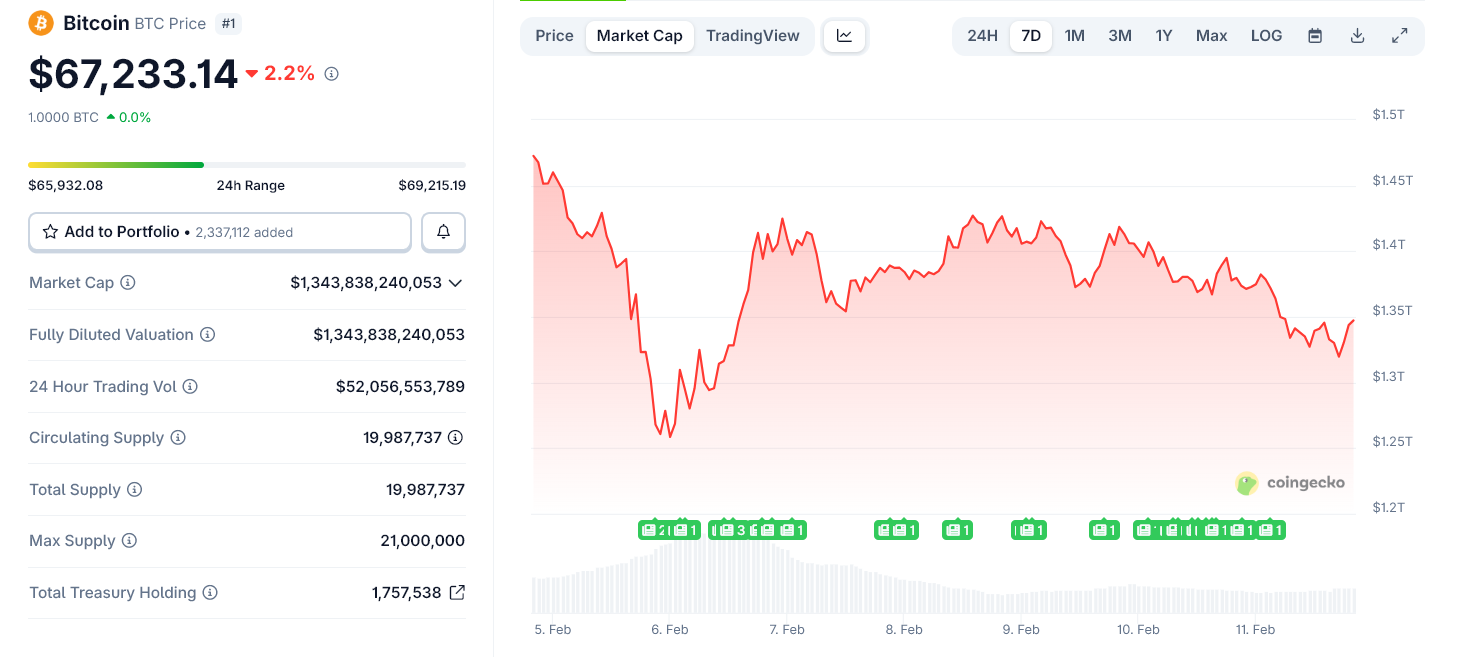

Although Bitcoin briefly stabilized near the $70,000 level earlier in the week, the jobs data increases the risk of renewed volatility. Without a clear signal that the Fed will ease policy, liquidity remains constrained.

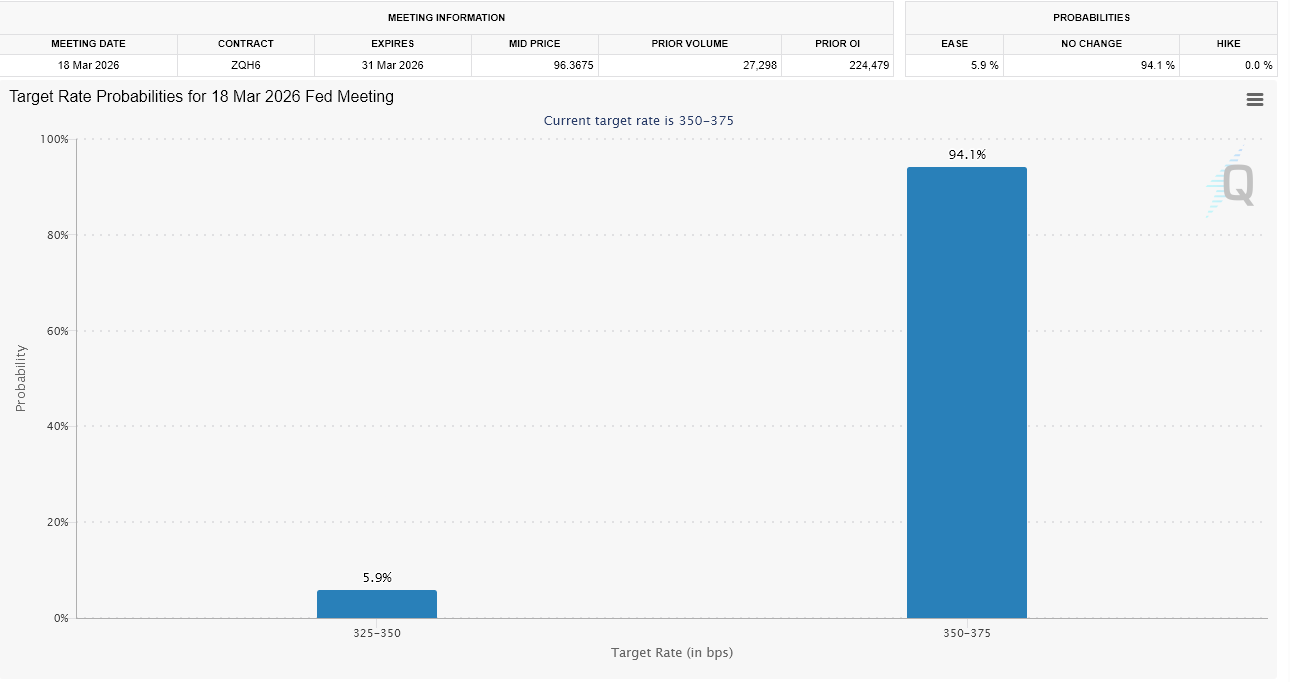

“For Bitcoin, this report is a short-term headwind. A beat of this magnitude dampens the probability of a March rate cut and reinforces the Fed’s pause at 3.50%-3.75%. The cheaper money catalyst that risk assets need to mount a sustained recovery just got pushed further out. Expect the dollar to firm and yields to reprice higher, both of which pressure BTC into a range in the near term,” David Hernandez, Crypto Investment Specialist at 21shares told BeInCrypto.

Market Structure Amplifies Macro Stress

The recent crash demonstrated how sensitive Bitcoin has become to macro shifts. Large ETF flows, institutional hedging, and leveraged positioning can accelerate moves when financial conditions tighten.

A stronger labor market does not guarantee Bitcoin will fall. However, it reduces one of the key bullish catalysts: expectations of easier monetary policy.

“In the short term, Bitcoin looks defensive. The key level to watch is $65,000. However, if this strong report turns out to be temporary rather than a sign the economy is heating up again, the Fed could still cut rates later this year. When that happens, Bitcoin’s limited supply becomes important again. Strong data today may delay a rally, but it doesn’t break the long-term bullish case,” Hernandez said.

The Bottom Line

The latest US jobs report reinforces a “higher-for-longer” rate environment.

For Bitcoin, that is not immediately catastrophic. But it does make sustained upside more difficult.

Unless liquidity improves or yields retreat, the macro backdrop now leans cautious rather than supportive for crypto markets.

The post Why the US Jobs Data Makes a Worrying Case for Bitcoin appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Zcash

Zcash  USD1

USD1  Hedera

Hedera  sUSDS

sUSDS  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Dai

Dai  PayPal USD

PayPal USD  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Rain

Rain  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  MemeCore

MemeCore  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pepe

Pepe  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Aster

Aster  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Pi Network

Pi Network  Sky

Sky  syrupUSDC

syrupUSDC  Circle USYC

Circle USYC  Global Dollar

Global Dollar  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Ondo

Ondo  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Pump.fun

Pump.fun  BFUSD

BFUSD  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Cosmos Hub

Cosmos Hub  Ethena

Ethena  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  Algorand

Algorand  NEXO

NEXO  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  USDtb

USDtb  Render

Render  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  VeChain

VeChain  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  syrupUSDT

syrupUSDT  pippin

pippin  Arbitrum

Arbitrum  USDD

USDD  Binance Staked SOL

Binance Staked SOL  Ondo US Dollar Yield

Ondo US Dollar Yield  Bonk

Bonk  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  Dash

Dash  Sei

Sei  Pudgy Penguins

Pudgy Penguins  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  TrueUSD

TrueUSD  EURC

EURC  Virtuals Protocol

Virtuals Protocol  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  MYX Finance

MYX Finance  Kinetiq Staked HYPE

Kinetiq Staked HYPE  PancakeSwap

PancakeSwap  tBTC

tBTC  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Decred

Decred  Optimism

Optimism  Stable

Stable  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Lighter

Lighter  Story

Story  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  Kinesis Gold

Kinesis Gold  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  LayerZero

LayerZero  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  JUST

JUST  Humanity

Humanity  Kaia

Kaia  Liquid Staked ETH

Liquid Staked ETH  Ether.fi

Ether.fi  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  BitTorrent

BitTorrent  Bitcoin SV

Bitcoin SV  Wrapped Flare

Wrapped Flare  FLOKI

FLOKI  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Sun Token

Sun Token  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  AINFT

AINFT  SPX6900

SPX6900  Injective

Injective  Maple Finance

Maple Finance  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  Aerodrome Finance

Aerodrome Finance  sBTC

sBTC  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  River

River  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Savings USDD

Savings USDD  PRIME

PRIME  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  Marinade Staked SOL

Marinade Staked SOL  ADI

ADI  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  Starknet

Starknet  Legacy Frax Dollar

Legacy Frax Dollar  Staked Aave

Staked Aave  Olympus

Olympus