Aave (AAVE), a leading non-custodial liquidity protocol, has established itself as a major player in the decentralized finance (DeFi) ecosystem, controlling approximately half of the DeFi lending market share.

However, as the crypto market remains euphoric amid the broader bull run in 2025, several concerns within Aave emerge that could have severe consequences for the overall market.

The Risks Behind Aave’s DeFi Dominance and Market Control

According to data from DefiLama, Aave’s Total Value Locked (TVL) stands at $36.73 billion. This accounts for nearly 50% of the total $75.98 billion TVL. Furthermore, the protocol’s TVL reached an all-time high of $40 billion last week.

This dominant position makes Aave the ‘backbone’ of decentralized credit systems, enabling users to borrow and lend assets without intermediaries. Nonetheless, this central role also means that if Aave faces issues, it could trigger a ripple effect throughout the entire market.

But what could go wrong? One critical concern is the concentration of influence within the protocol’s governance.

Previously, Sandeep Nailwal, Founder and CEO of Polygon Foundation, expressed concerns about the governance structure within Aave. He highlighted that the protocol is governed by one individual (Stani Kulechov, the founder).

Nailwal noted that Kulechov has significant control over proposals and voting, effectively running the platform based on personal preferences.

“He also threatens the remaining voters to vote as per his proposals (whom i spoke personally after after Polygon proposal). This is when he already has a HUGE delegated voting power,” he wrote.

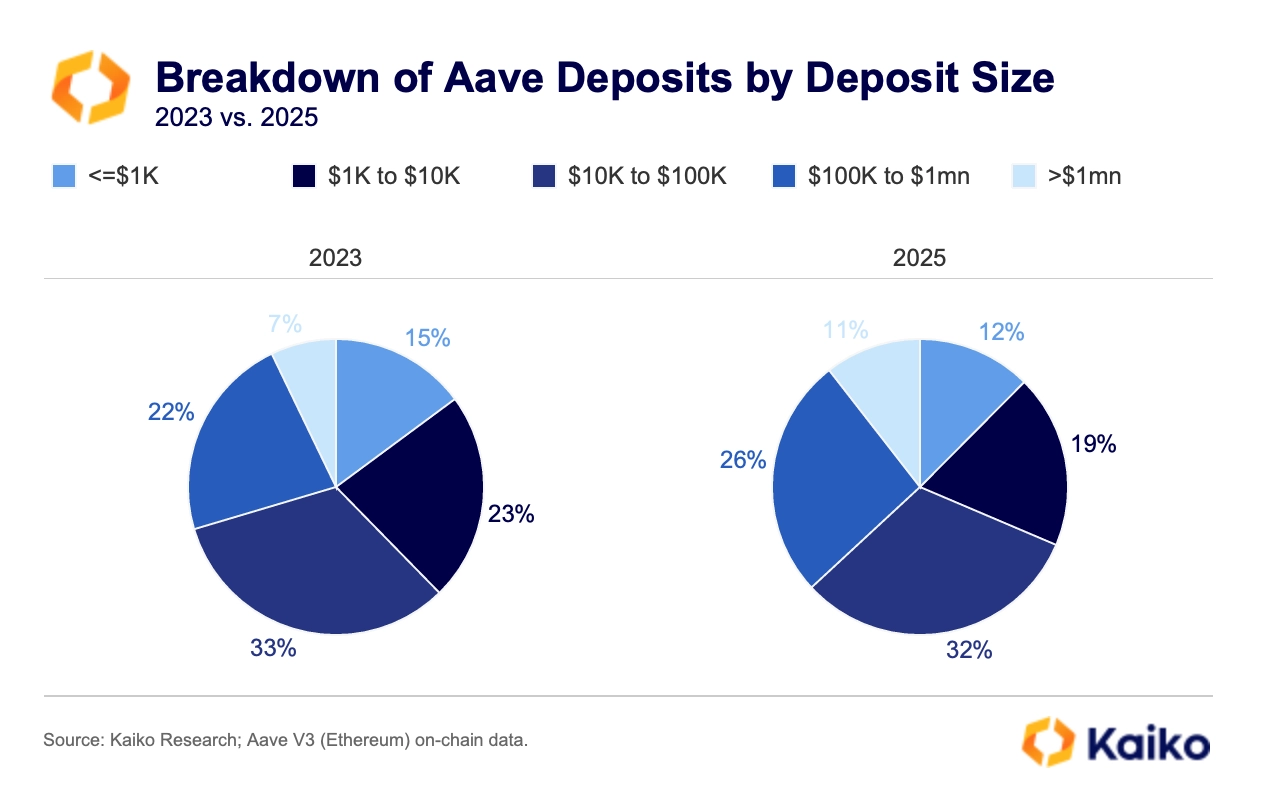

The user base composition further amplifies Aave’s vulnerabilities. Data from Kaiko Research indicated a shift in 2025, with large users holding collateral exceeding $100,000, rising from 29% in 2023 to 37%. Meanwhile, small users with deposits under $1,000 declined from 15% to 12% over the past two years.

“Users with over $100k in collateral grew from 29% in 2023 to 37% in early 2025, with the $100k–$1m collateral group rising to 26% and the $1m+ group to 11%, each up about four points. Over time, growth in large depositors has mostly come at the expense of smaller ones with $1k–$10k deposits,” Kaiko noted.

This concentration of power among high-net-worth participants heightens the potential for liquidity shocks and protocol instability. Should these users withdraw en masse or face liquidation events, the impact could reverberate across interconnected DeFi platforms.

Lastly, overexpansion also poses a significant risk. Aave’s deployment across 16 chains has strained operational resources. Defi Ignas, a prominent analyst, stressed on X that some of these expansions operate at a loss, increasing financial and technical risks.

“We reached an L2 saturation point: Aave deployed on 16 chains, but the new deployments are operating at a loss (Soneium, Celo, Linea, zkSync, Scroll),” the post read.

The implications of these risks extend beyond Aave itself. As one of DeFi’s most dominant players, any disruption, whether stemming from governance failures, user concentration, or over-expansion, could erode trust in decentralized lending and destabilize the broader ecosystem. Thus, addressing these challenges will be critical for Aave.

The post Is Aave on the Verge of Cracking Under Its Own DeFi Power? appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Sky

Sky  OKB

OKB  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  MYX Finance

MYX Finance  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  Midnight

Midnight  Binance-Peg WETH

Binance-Peg WETH  NEXO

NEXO  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  LayerZero

LayerZero  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  pippin

pippin  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Story

Story  WrappedM by M0

WrappedM by M0  Stable

Stable  Decred

Decred  Kinesis Gold

Kinesis Gold  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  River

River  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Resolv USR

Resolv USR  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Ether.fi

Ether.fi  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  PRIME

PRIME  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Lido DAO

Lido DAO  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  Aerodrome Finance

Aerodrome Finance  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  ADI

ADI  Axie Infinity

Axie Infinity  Staked Aave

Staked Aave