Decentralized finance (DeFi) lending protocol Spark has rotated a portion of its treasury reserves from US government bonds into crypto-native yield strategies, signaling new approaches to onchain yield generation as Treasury returns continue to compress.

On Thursday, Spark said it allocated $100 million of its stablecoin reserves to Superstate’s Crypto Carry Fund (USCC), a regulated basis-trading fund that generates yield from price differentials between spot and futures markets across major digital assets. The fund allows DeFi protocols to earn market-neutral yield from the same derivatives markets traditionally used by hedge funds.

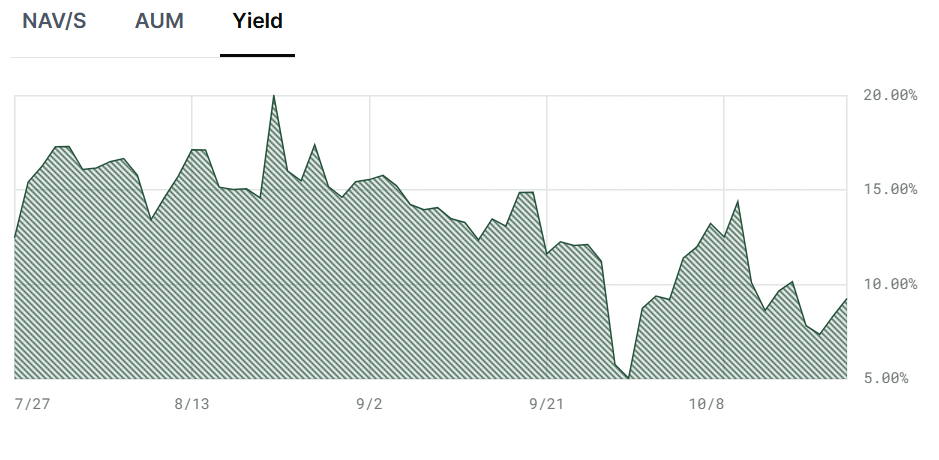

According to Superstate’s website, USCC manages about $528 million in assets and currently produces a 30-day yield of 9.26%.

Superstate CEO Robert Leshner said the fund enables Spark “to maintain exposure to yield opportunities uncorrelated with Federal Reserve rate policy.” Such diversification may prove timely as Fed officials face increasing challenges balancing inflation control with economic growth.

Although the Federal Reserve has struggled to anchor the long end of the yield curve, in part due to mounting US fiscal pressures, the 10-year Treasury yield recently fell below 4%. Spark noted that the Fed’s rate-cutting cycle could pressure stablecoin issuers and DeFi protocols heavily exposed to short-duration Treasurys, forcing them to seek alternative, uncorrelated sources of return.

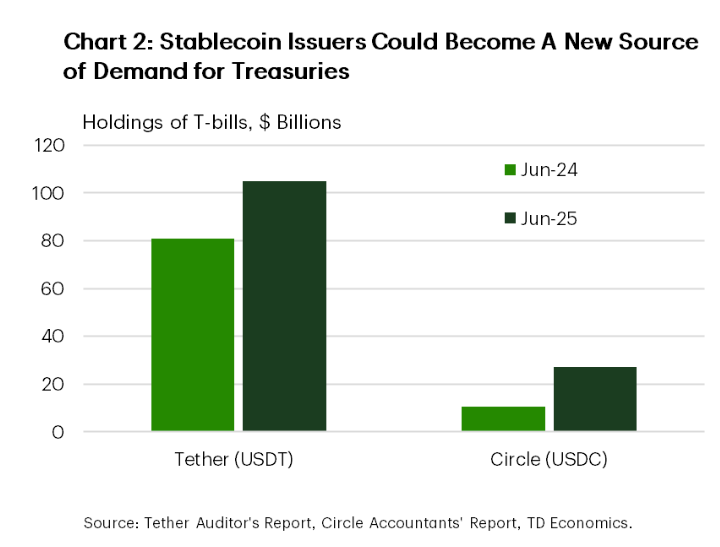

Tether remains by far the largest crypto-native holder of US Treasurys, with more than $100 billion in exposure. USDC issuer Circle ranks a distant second. Together, the two stablecoin giants held over $132 billion in US government debt as of September.

“Right now this is about 2% of the size of the Treasury bills market, but this share will increase should stablecoin supply expand briskly,” according to TD Economics.

Related: US gov shutdown ‘likely’ to end this week: Trump adviser

Onchain yield evolves beyond passive income

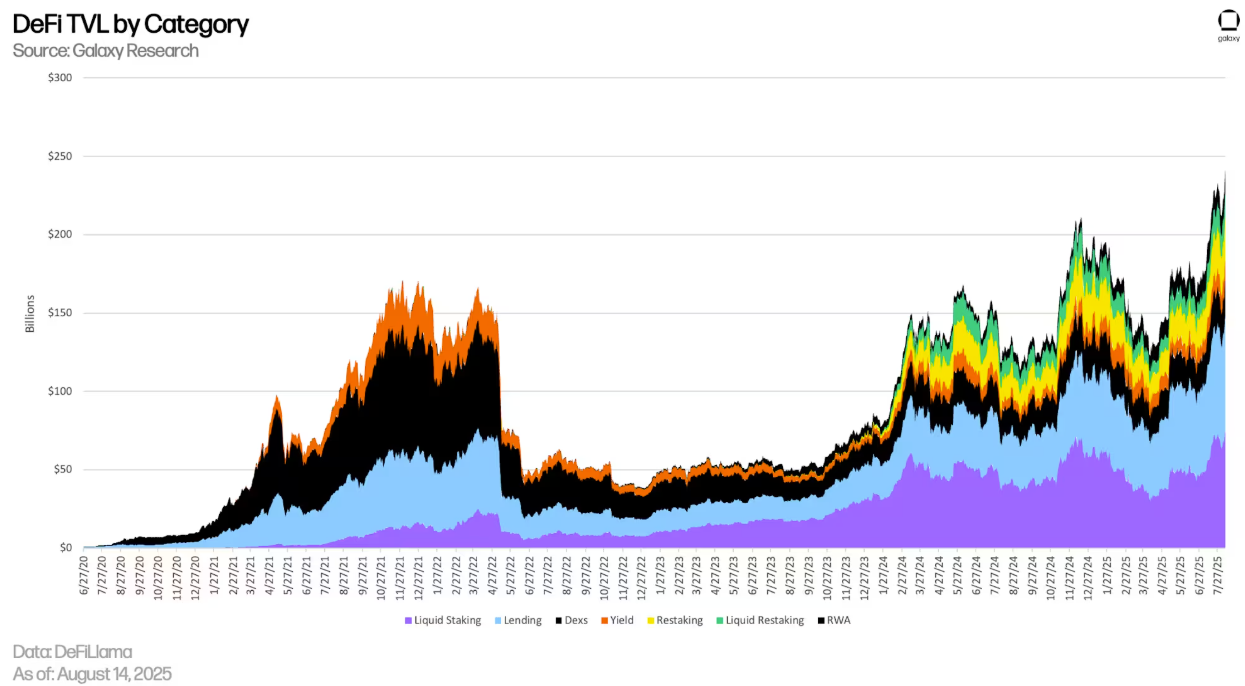

Onchain yield has long been considered one of DeFi’s most compelling use cases. Over time, the mechanisms powering yield have become increasingly sophisticated, expanding from simple lending and staking to complex, market-neutral and restaking strategies.

According to research from Galaxy Digital, onchain yield is no longer just about earning interest — it’s about selecting strategies that balance liquidity, complexity and risk in pursuit of higher returns.

While Spark and Superstate have emphasized the importance of diversifying away from US Treasurys, Galaxy notes that Treasury yields still serve as the benchmark for most onchain yield strategies, effectively setting a “risk-free floor” for stablecoin and DeFi returns.

As those yields decline, protocols are increasingly turning to crypto-native yield sources such as basis trading, validator rewards and restaking mechanisms. Such strategies remain nucorrelated with traditional interest rate policy.

Magazine: Inside a 30,000 phone bot farm stealing crypto airdrops from real users

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Rain

Rain  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Ripple USD

Ripple USD  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Sky

Sky  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  MYX Finance

MYX Finance  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  Midnight

Midnight  Binance-Peg WETH

Binance-Peg WETH  NEXO

NEXO  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  LayerZero

LayerZero  clBTC

clBTC  Sei

Sei  EURC

EURC  Jupiter

Jupiter  Stacks

Stacks  pippin

pippin  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Story

Story  Decred

Decred  Kinesis Gold

Kinesis Gold  River

River  Stable

Stable  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Lighter

Lighter  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Resolv USR

Resolv USR  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  Kinesis Silver

Kinesis Silver  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  AINFT

AINFT  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Injective

Injective  crvUSD

crvUSD  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Lido DAO

Lido DAO  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Legacy Frax Dollar

Legacy Frax Dollar  Humanity

Humanity  Jupiter Staked SOL

Jupiter Staked SOL  Olympus

Olympus  Savings USDD

Savings USDD  Celestia

Celestia  SPX6900

SPX6900  Aerodrome Finance

Aerodrome Finance  Marinade Staked SOL

Marinade Staked SOL  JasmyCoin

JasmyCoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  ADI

ADI  Telcoin

Telcoin  Axie Infinity

Axie Infinity  Staked Aave

Staked Aave