BitMine’s proposal to dramatically expand its authorized share count has sparked a growing backlash among shareholders, even as the company doubles down on Ethereum as its core treasury asset.

While Tom Lee has framed the move as a long-term flexibility play rather than an immediate dilution event, a widening group of investors says the structure, timing, and incentives raise uncomfortable questions.

5 Reasons Tom Lee’s BitMine Strategy Isn’t Winning Fans

Tom Lee’s push to expand BitMine’s authorized share count was intended to reinforce the company’s long-term conviction in Ethereum.

Instead, it has exposed a growing rift amidst fears that the proposal weakens governance just as dilution risks are rising.

Critics are not rejecting the Ethereum thesis itself, but rather questioning whether the structure, timing, and incentives behind the plan truly protect shareholder value. Five core concerns now explain why Lee’s strategy is struggling to win fans.

1. Urgency Undermines the “Future Split” Narrative

One of the sharpest critiques centers on timing. Lee has pointed to future stock splits, potentially when Ethereum reaches extreme price levels, as justification for authorizing more shares today.

Investors argue this rationale conflicts with BitMine’s current reality. Specifically, the company already has roughly 426 million shares outstanding out of 500 million authorized, leaving little room to maneuver.

“Why authorize shares today for a theoretical split potentially years away?” one analyst asked, adding that shareholders would “happily vote yes on a split if/when the price justifies it.”

The urgency, critics argue, aligns more closely with BitMine’s need to continue issuing equity to buy ETH.

2. Scale Without Guardrails

The sheer size of the request, from 500 million to 50 billion authorized shares, has also alarmed investors.

Even to reach BitMine’s stated Alchemy of 5% ETH allocation target, the company would need to issue only a fraction of that amount.

“So why the request for 50 BILLION?” wrote analyst Tevis, calling it “massive overkill” that gives management “the biggest carte blanche in history.”

Critics argue that the proposal eliminates the need for future shareholder approvals, thereby removing an important governance checkpoint.

3. ETH Growth vs. Shareholder Value

Another fault line lies in executive incentives. Proposal 4 ties Tom Lee’s performance compensation to total ETH holdings rather than ETH per share.

While investors broadly support performance-based pay, some argue that the chosen metric encourages scale at any cost.

Tevis warned that a “Total ETH” KPI could reward growth even if dilution erodes per-share exposure. Meanwhile, an ETH-per-share target would add a critical safeguard.

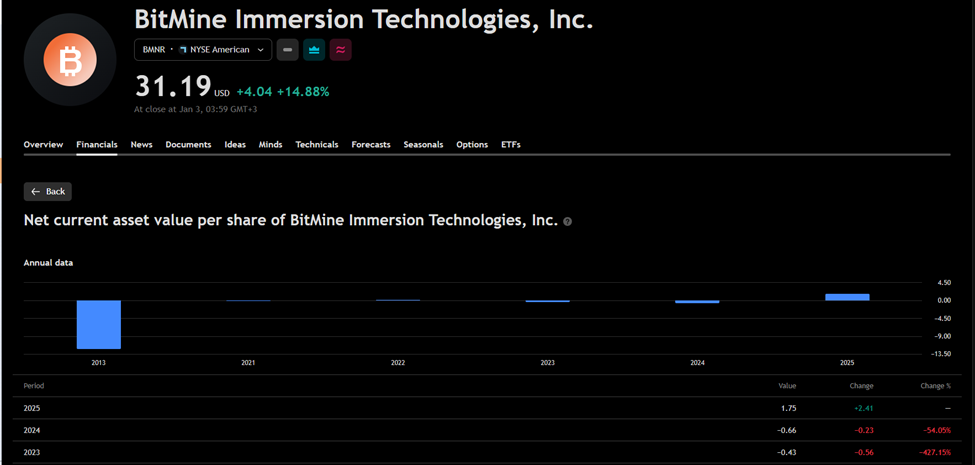

4. Below-NAV Issuance Fears

Dilution concerns have intensified as BitMine no longer trades at a clear premium to NAV. Tevis said he was “not concerned about dilution at all” when shares traded above NAV, but that calculus changes near parity.

Broad authorization, critics argue, lowers the barrier to issuing shares below NAV, an outcome that would permanently reduce ETH backing per share.

“If BMNR issues new stock at a discount to NAV… the amount of ETH backing every single share permanently decreases,” Tevis wrote.

5. Equity vs. Spot ETH Questioned

The debate now cuts deeper, with some investors arguing it may be better to own ETH instead. Others echoed similar concerns, warning that the proposal “paves the way for shareholders to get shat on at short notice via ATM dilution.”

Solid thread Tevis

For me, would it not be better to just own $ETH?

I think whichever lens you view it through, going from 500M to 50B is not good and a red flag

Despite the justification, I just don’t buy it and like you allude to, it pathes the way for shareholders to get…

— Weary Centurion (@weary_centurion) January 4, 2026

Despite the criticism, many dissenting shareholders stress they remain bullish on Ethereum and supportive of BitMine’s broader strategy.

What they want, they say, are clearer guardrails, before handing management a blank check tied to one of crypto’s most volatile assets.

The post 5 Arguments Dismantling Tom Lee’s Case for BitMine’s Share Expansion appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  Bitget Token

Bitget Token  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  MYX Finance

MYX Finance  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  LayerZero

LayerZero  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Decred

Decred  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Story

Story  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Stable

Stable  pippin

pippin  Kinesis Gold

Kinesis Gold  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  River

River  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Kaia

Kaia  Maple Finance

Maple Finance  Wrapped Flare

Wrapped Flare  Resolv USR

Resolv USR  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Ether.fi

Ether.fi  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Lido DAO

Lido DAO  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  SPX6900

SPX6900  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Humanity

Humanity  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  Axie Infinity

Axie Infinity  ADI

ADI  Staked Aave

Staked Aave