Ethereum is showing a strong chart structure as some market analysts suggest a possible price move to $7,000 by mid-2026.

Meanwhile, the asset is holding key levels after a recent pullback, with trading activity reflecting a phase of consolidation. Analysts point to long-term patterns and investor behavior as reasons for this forecast.

Weekly Chart Forms Bullish Pattern

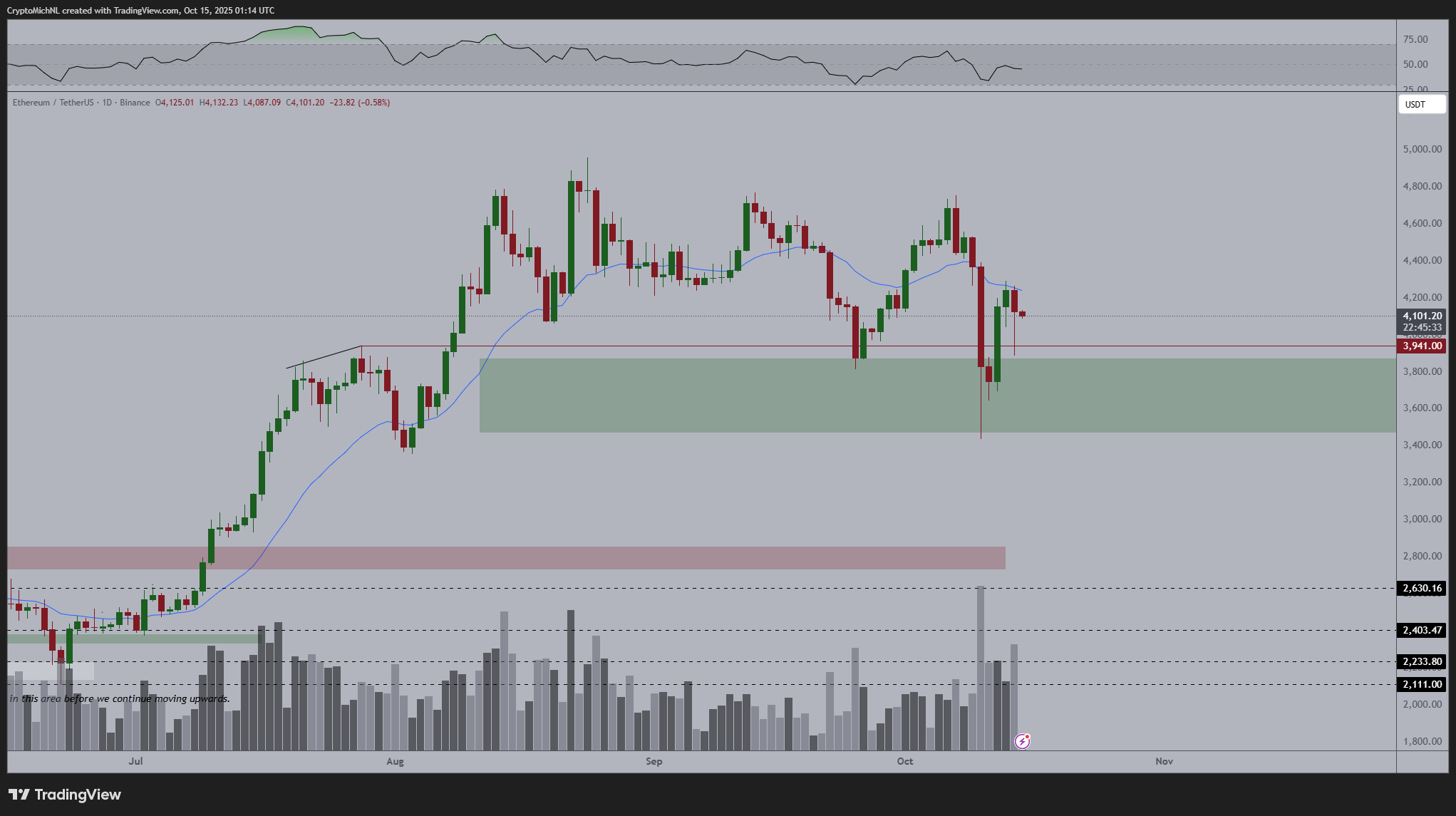

A technical chart shared by analyst Mike Investing shows Ethereum trading inside a flag formation on the weekly timeframe. The setup follows a steady rise in price from late 2024 into early 2025. After reaching above $4,400, ETH corrected slightly and is now trading near $4,100.

$ETH is positioning within an aggressive bullish flag and is about to see a euphoric squeeze.

With $ETH bottomed out and completing its last hard pullback below $4k this year this opportunity is generational.

Bears are in major trouble now.

$7,000 by May 2026.

Mark my words… pic.twitter.com/EDBIFtdY2R

— Mike Investing (@MrMikeInvesting) October 14, 2025

According to the chart, this pullback remains within a bullish structure. The 200-week moving average, currently near $2,447, continues to act as a support line. ETH has stayed above this level, keeping its long-term trend in place. The analyst projects a move to $7,000 by May 2026. He added that any drop below the $3,500–$3,600 zone would put the current setup at risk.

Moreover, analyst Michaël van de Poppe has pointed to a higher low formation in the recent price action. In a post on X, he stated:

“Higher low is created here on $ETH. I think that we’ll see a strong breakout in the coming 1–2 weeks and a new ATH.”

His chart shows ETH rebounding from the $3,600–$3,900 zone, a range that has held as support during past tests. At the time of the latest update, ETH was trading near $4,100 after pulling back from $4,600. Trading volume has started to rise again, which may signal new demand.

You may also like:

- How US-China Conflict Rocked Ethereum: Price Drops and Derivatives Market Cools

- Crypto Market Shows Pain and Potential After Massive Liquidation Event: Bitfinex Alpha

- BitMine Buys The Dip, Ethereum Stash Tops 3M ETH

The 21-day EMA is now flattening. If the asset closes above it, it could lead to a retest of the recent high. RSI levels remain in the middle range, allowing room for further movement in either direction. The current pattern supports the idea of steady accumulation, as long as the price remains above support.

Exchange Balances Reach Multi-Month Lows

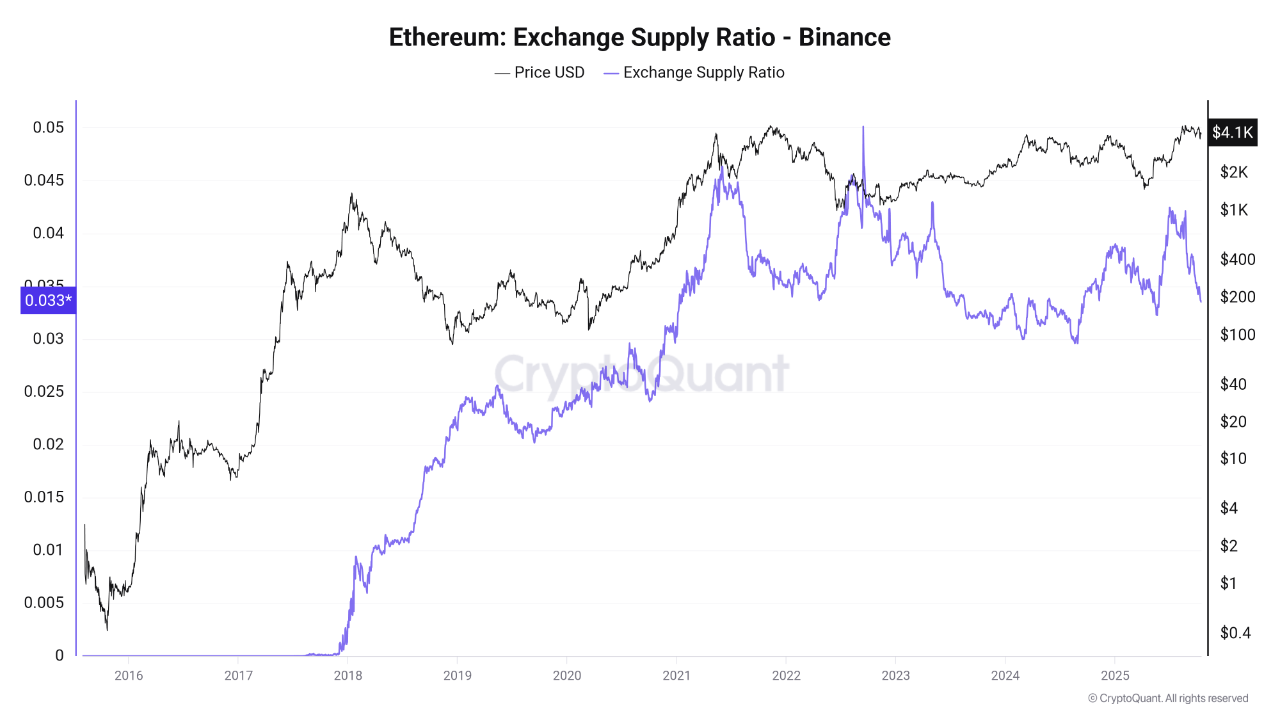

According to data from CryptoQuant analyst Arab Chain, the Ethereum supply on Binance has reached a multi-month low. The supply ratio is now around 0.33. This suggests that more ETH is being moved off exchanges and into self-custody wallets.

Such moves often indicate lower short-term selling activity. In earlier market cycles, similar trends were followed by price increases. Investors appear to be taking a longer-term view, removing coins from exchanges and reducing available supply in the open market.

Whale Activity Rises as Retail Steps Back

Retail is fading $ETH.

Whales are loading up.

I’m following the smart money! pic.twitter.com/iiLb55BXj8

— CryptoGoos (@crypto_goos) October 15, 2025

The post reflects a growing difference in behavior between smaller investors and larger holders. This is backed by recent data. There has been a decrease in retail trading volume, while accumulation of ETH by large wallet holders has been going on simultaneously.

Along with this, the institutional interest in self-storage and staking has continued to increase. The centralized platforms are holding fewer coins, which is contributing to decreasing market liquidity and indicating long-term holding strategies.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  MYX Finance

MYX Finance  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  Decred

Decred  LayerZero

LayerZero  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Stable

Stable  WrappedM by M0

WrappedM by M0  Story

Story  pippin

pippin  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Lighter

Lighter  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  River

River  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Resolv USR

Resolv USR  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Axie Infinity

Axie Infinity  Olympus

Olympus  DoubleZero

DoubleZero  ADI

ADI  Staked Aave

Staked Aave