The Ethereum supply on exchanges has dropped to historic lows since 2016, as institutional and corporate demand for accumulation has expanded. The supply ratio shift indicates a change in holder behavior toward long-term retention, as opposed to retail short-term selling pressure.

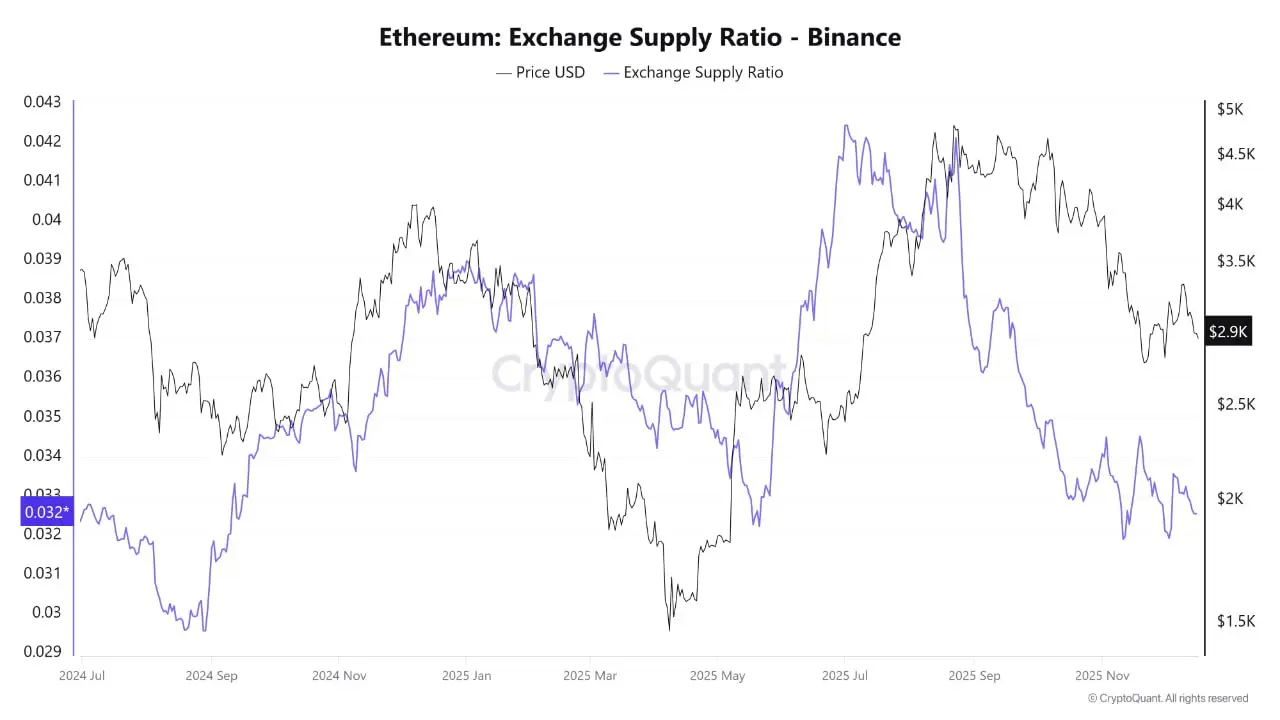

According to on-chain data provided by CryptoQuant analytics, the Exchange Supply Ratio (ESR), which measures the portion of all ETH held by exchange platforms, has decreased to approximately 0.137 across all exchanges. The drop marks the lowest since 2016 during the early development of the Ethereum blockchain. Across Binance, the largest crypto exchange platform by trading volume and with the highest ETH supply, the ESR has decreased to approximately 0.0325.

ETH supply shift indicates diminished intent for immediate liquidation

According to the ESR figures provided by CryptoQuant analyst Arab Chain, there is a persistent net outflow of Ethereum tokens from exchanges to external or private wallets. The analysis by Arab Chain on CryptoQuant noted that such patterns often align with accumulation phases after a period of volatility, as markets absorb more liquidity with low selling pressure.

Ethereum Exchange Supply Falls to Its Lowest Levels Since 2016

“This dynamic reflects increased trader caution and a decline in short-term selling pressure.” – By @ArabxChain pic.twitter.com/QdqLdtzYIo

— CryptoQuant.com (@cryptoquant_com) December 17, 2025

Across all exchanges, the charts tracking the ESR metric show a persistent decline from mid-2024 to late 2025, fluctuating from approximately 0.165 steadily downwards to the current level of around 0.137. Meanwhile, the ETH price has also been fluctuating between $4,500 and its all-time high of $4,953.73 on August 24, 2025, to the current price of $2,830 based on CoinMarketCap data.

Binance, the largest exchange by trading volume, has recorded a similar pattern, starting from 0.038 in mid-2024, to the current range of 0.032-0.0325. The Ethereum token price tends to follow a similar pattern, exhibiting a positive correlation between the ETH price and ESR.

The Ethereum blockchain’s transition to a Proof-of-Stake consensus mechanism has incentivized staking, allowing users to lock tokens and earn rewards. The consensus mechanism has attracted almost 36 million ETH currently staked and requiring transfer off exchanges towards dedicated wallets or protocols. The transition in consensus mechanisms has contributed to the acceleration of the decline in supply across all exchanges.

Layer 2 ecosystems, such as Base, amplify the supply shift to DEXs

Risks associated with exchange failures, such as the 2022 FTX exchange collapse, have prompted the adoption of self-custody for enhanced security and control. Additionally, Layer 2 ecosystems, including Base, Arbitrum, and Optimism, have also attracted liquidity, further reducing the exchange-held supply. Layer 2 ecosystems on Ethereum offer scaling solutions that facilitate cheaper and faster transactions, pulling ETH supply from centralized exchanges (CEX) to decentralized exchanges (DEX). DEXs, such as PancakeSwap and Uniswap, have all been built on these protocols to facilitate direct P2P crypto trading.

According to on-chain data, approximately 67 public companies, government entities, and institutions that hold ETH as part of a reserve strategy now hold roughly 6.71 million ETH, valued at around $19.02 billion. Additionally, Ethereum-focused ETFs hold approximately 6.22 million ETH, valued at $17.63 billion. These values represent 5.55% and 5.14%, respectively, of the total ETH supply.

The reduction in ETH supply across exchanges and rising institutional demand have created a low-liquidity, high-demand environment, leading to a supply squeeze. According to the Arab Chain analysis on CryptoQuant, increased selling pressure may have contributed to the ETH price drop; however, continued buying pressure, particularly from institutional investors, could drive the ETH price upward in the long term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Zcash

Zcash  Litecoin

Litecoin  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Rain

Rain  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Aave

Aave  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Sky

Sky  OKB

OKB  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Quant

Quant  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  Midnight

Midnight  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  MYX Finance

MYX Finance  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Wrapped BNB

Wrapped BNB  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Function FBTC

Function FBTC  Aptos

Aptos  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  LayerZero

LayerZero  clBTC

clBTC  pippin

pippin  Sei

Sei  Stacks

Stacks  EURC

EURC  Jupiter

Jupiter  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Decred

Decred  WrappedM by M0

WrappedM by M0  Story

Story  Kinesis Gold

Kinesis Gold  Stable

Stable  Pudgy Penguins

Pudgy Penguins  Optimism

Optimism  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Curve DAO

Curve DAO  River

River  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Ether.fi

Ether.fi  Wrapped Flare

Wrapped Flare  Kinesis Silver

Kinesis Silver  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Maple Finance

Maple Finance  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  crvUSD

crvUSD  PRIME

PRIME  Humanity

Humanity  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  Bitcoin SV

Bitcoin SV  sBTC

sBTC  JasmyCoin

JasmyCoin  IOTA

IOTA  Resolv USR

Resolv USR  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  Celestia

Celestia  Olympus

Olympus  ADI

ADI  Marinade Staked SOL

Marinade Staked SOL  SPX6900

SPX6900  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Aerodrome Finance

Aerodrome Finance  Telcoin

Telcoin  Axie Infinity

Axie Infinity