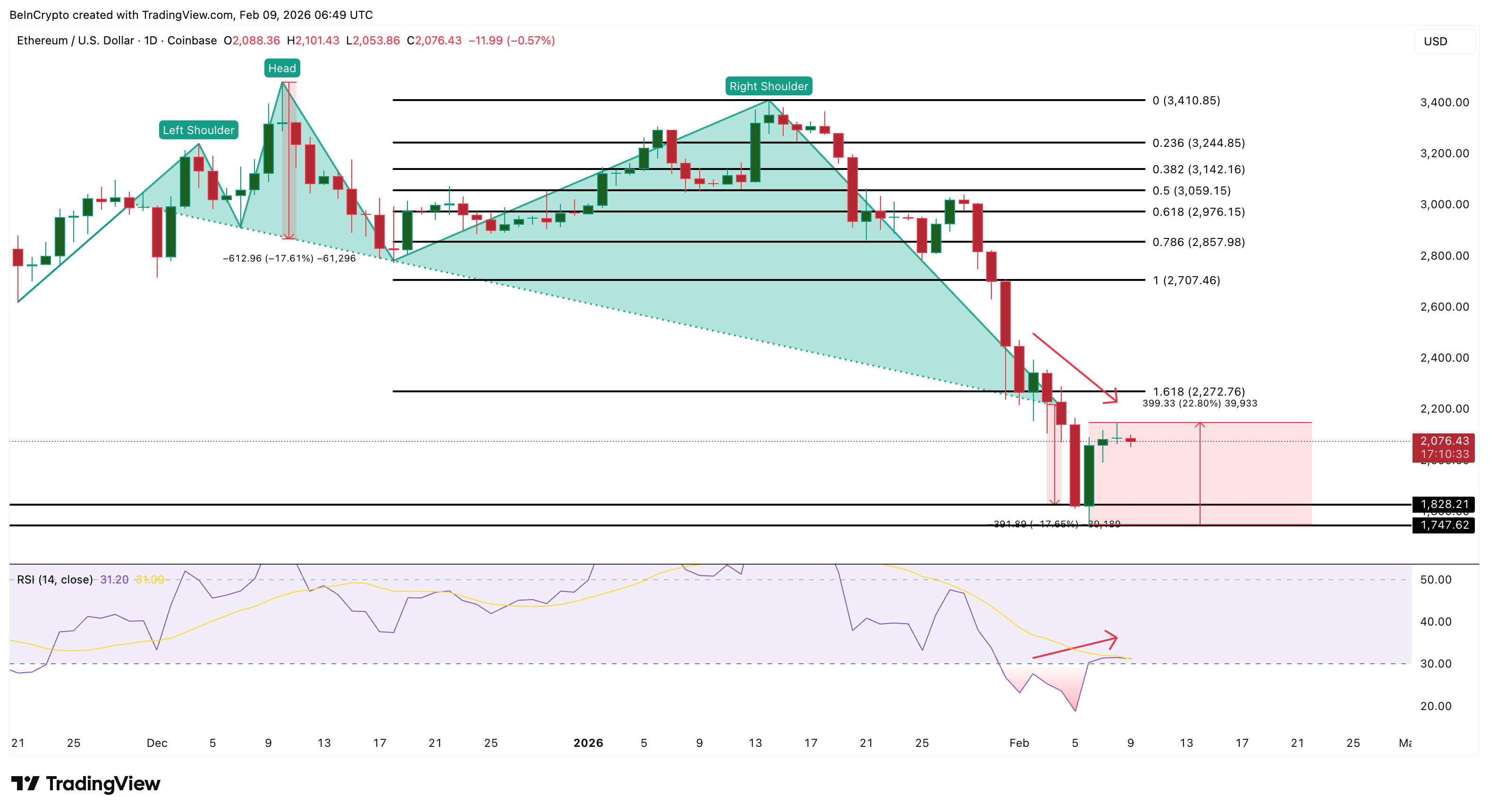

Ethereum price hit its projected breakdown target near $1,800 in early February. It even slipped to $1,740 before bouncing. Since then, $ETH has rebounded almost 23%, giving traders hope that the worst may be over.

But price rebounds inside downtrends often look strong at first. The real question is whether this bounce is supported by strong buyers. Right now, charts, on-chain data, and technical metrics suggest that support remains weak. Several warning signs still point to downside risk.

The $ETH Price Breakdown Worked, But the Rebound Lacks Real Strength

On February 5, Ethereum completed a major breakdown pattern on the daily chart, as predicted by BeInCrypto analysts. This pattern usually signals that sellers are taking control. The projected target was near $1,800. Ethereum price followed that path and dropped to $1,740 on February 6.

After hitting this zone, $ETH rebounded about 23%. At first glance, this looks like strong dip buying as the February 6 price candle saw a large lower wick. But momentum tells a different story.

Between February 2 and February 8, the price made lower highs. At the same time, the Relative Strength Index (RSI), which tracks short-term momentum, moved higher.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This creates a hidden bearish divergence, where momentum improves but price fails to follow.

In simple terms, price is struggling to rise, even though short-term momentum looks better. That usually means sellers are still active in the background. So while the breakdown target was reached, the rebound does not yet show deep conviction.

This weak follow-through sets the stage for the next risk.

Short-Term Bounce Is Slipping Into Another Bearish Setup

Because the rebound lacks strong follow-through, the next thing to watch is the structure of the move. On the 12-hour chart, Ethereum is forming a bearish pole and flag.

First, the price dropped sharply. Then it rebounded inside a rising channel. This is a classic continuation pattern in downtrends.

It often leads to another leg lower as volume confirms the risk. On-Balance Volume, which tracks real buying and selling activity, is staying weak. It is not rising aggressively, like the price. This means fewer real buyers are supporting the rebound. Additionally, the OBV metric itself is close to breaking down its own ascending trendline. If volume breaks down, this flag structure could fail.

$ETH Price Pattern”>

$ETH Price Pattern”>

That would open the door to deeper losses, around 50% from the lower trendline levels. To understand whether buyers, who led the 23% rebound, can prevent that, we need to look on-chain.

Are Short-Term Traders Buying As Long-Term Holders Sell?

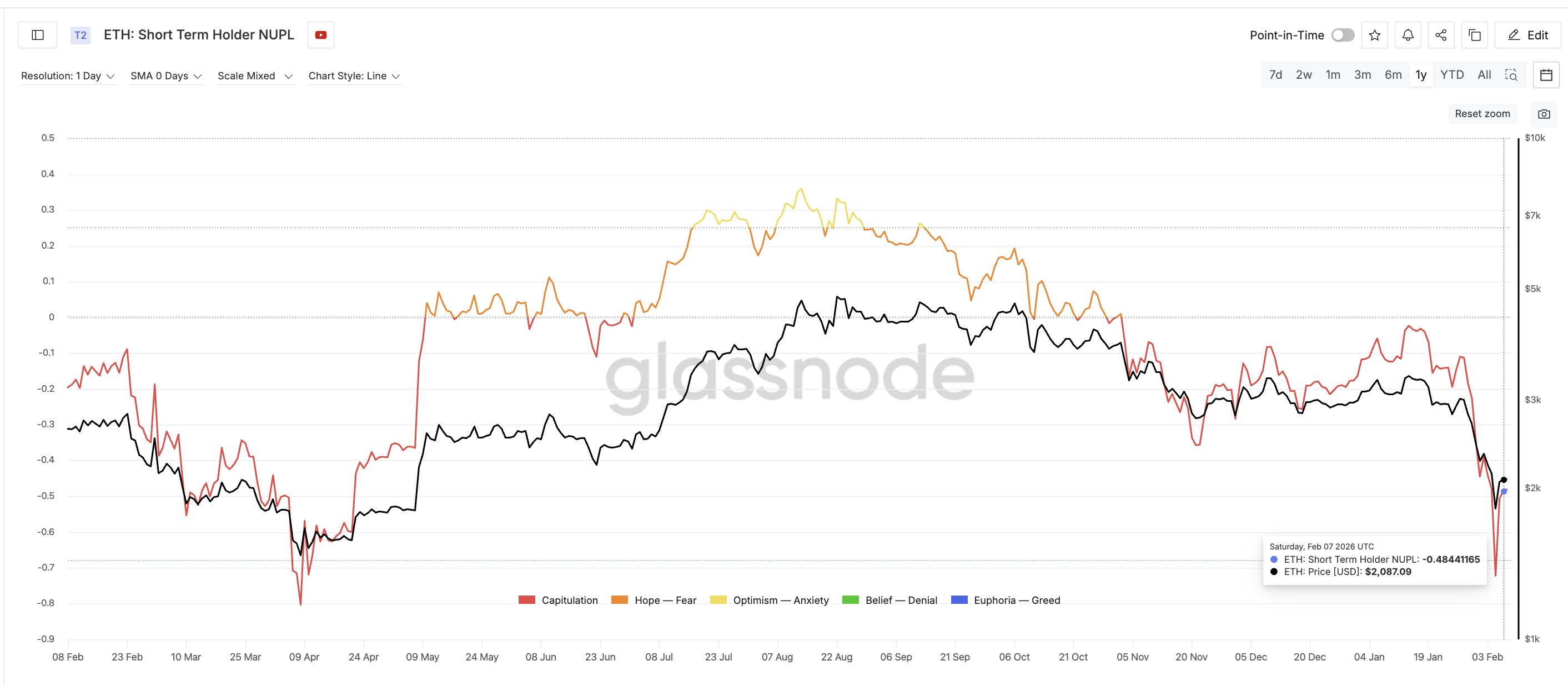

On-chain data shows that the recent rebound is being driven mainly by short-term traders, not long-term investors.

A key metric here is short-term Holder NUPL, which measures whether recent buyers are sitting in profit or loss.

In early February, as Ethereum dropped to $1,740, short-term holder NUPL fell to around -0.72, placing it firmly in the capitulation zone. This reflected heavy unrealized losses among recent buyers.

During the 23% rebound, however, NUPL recovered to about -0.47. That is an improvement of roughly 35% from the bottom. While it remains negative, the speed of this recovery shows that many short-term traders rushed in to buy the dip.

This pattern closely resembles past failed bottom formations.

On March 10, 2025, NUPL also rebounded to around -0.45 while $ETH traded near $1,865. At that time, many traders believed a bottom had formed. A more durable bottom only appeared on April 8, 2025, when NUPL dropped close to -0.80, roughly 75% deeper than the March level. That phase marked true seller exhaustion and preceded a sustained recovery. The price was around $1,470 at the time.

Today’s structure looks much closer to March 2025 than April 2025. Losses have eased too early, suggesting that panic has not fully cleared. At the same time, long-term holders remain cautious.

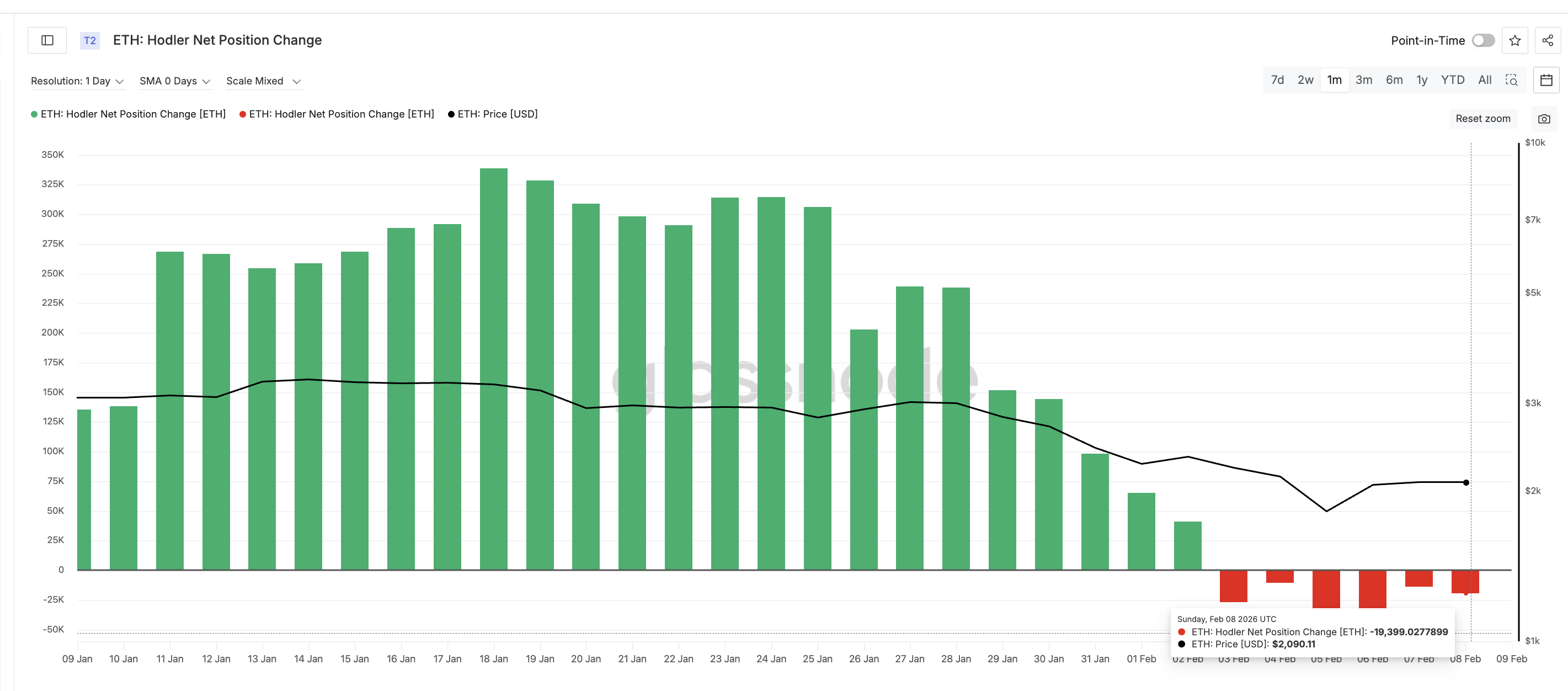

The 30-day rolling Hodler Net Position Change, which tracks investors holding $ETH for more than 155 days, remains negative. On February 4, outflows stood near -10,681 $ETH. By February 8, they had widened to around -19,399 $ETH.

$ETH HODLers”>

$ETH HODLers”>

This represents an increase in net selling of roughly 82% in just four days. This signals weak conviction at current levels. So the rebound is being driven mainly by short-term traders chasing a bounce, while long-term investors continue reducing exposure.

Key Ethereum Price Levels Show Why the $1,000 Risk Is Still Alive

All technical and on-chain signals now point to a weak structure. Ethereum must reclaim key resistance to stay safe. The first resistance is near $2,150.

Holding above this would ease short-term pressure. The major invalidation level is $2,780.

Only above this would the bearish structure truly break. On the downside, risk remains heavy.

Key support levels are:

- $1,990: short-term support

- $1,750: Fibonacci support

- $1,510: major retracement zone (close to the April 8, 2025 bottom)

- $1,000: bear flag projection

A daily close below $1,990 would weaken the rebound. Losing $1,750 would expose the $1,500 $ETH price zone. If the bearish flag fully breaks, the projected move points toward $1,000.

That would mean a drop of nearly 50% from current levels. Right now, Ethereum is still below major resistance.

Volume is weak. Long-term holders are selling. And Short-term traders dominate activity. Until these conditions change, the risk of a much deeper Ethereum price move remains real.

The post Ethereum Price Hits Breakdown Target — But Is a Bigger Drop to $1,000 Coming? appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  Zcash

Zcash  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Rain

Rain  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Tether Gold

Tether Gold  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  Aave

Aave  Bitget Token

Bitget Token  Circle USYC

Circle USYC  OKB

OKB  Global Dollar

Global Dollar  Pepe

Pepe  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Sky

Sky  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Pi Network

Pi Network  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  USDD

USDD  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Midnight

Midnight  USDtb

USDtb  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  NEXO

NEXO  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  OUSG

OUSG  Aptos

Aptos  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  Render

Render  syrupUSDT

syrupUSDT  VeChain

VeChain  Arbitrum

Arbitrum  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  MYX Finance

MYX Finance  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  pippin

pippin  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  Sei

Sei  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  EURC

EURC  Jupiter

Jupiter  River

River  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Stable

Stable  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Pudgy Penguins

Pudgy Penguins  LayerZero

LayerZero  Story

Story  Decred

Decred  Optimism

Optimism  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  Kinesis Gold

Kinesis Gold  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  JUST

JUST  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  Lighter

Lighter  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  Sun Token

Sun Token  Gnosis

Gnosis  Ether.fi

Ether.fi  Wrapped Flare

Wrapped Flare  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Maple Finance

Maple Finance  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Humanity

Humanity  Bitcoin SV

Bitcoin SV  PRIME

PRIME  ADI

ADI  Binance-Peg XRP

Binance-Peg XRP  JasmyCoin

JasmyCoin  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  IOTA

IOTA  sBTC

sBTC  The Graph

The Graph  Lido DAO

Lido DAO  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Kinesis Silver

Kinesis Silver  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Aerodrome Finance

Aerodrome Finance  DoubleZero

DoubleZero  Marinade Staked SOL

Marinade Staked SOL  Pyth Network

Pyth Network  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Olympus

Olympus  SPX6900

SPX6900  Telcoin

Telcoin  Starknet

Starknet  Staked Aave

Staked Aave