- An evening star candle pattern at the resistance trendline of the falling wedge pattern signals a potential downswing in Ethereum price.

- The 1,000–10,000 ETH cohort made the heaviest selling at the peak and continues to distribute coins at the current market.

- A potential death crossover between 100-and 200-day EMA slopes could accelerate the market selling pressure.

ETH, the native cryptocurrency of the Ethereum blockchain, slips over 3.5% during Friday’s U.S. market hours to trade just above $2,000. The broader crypto market shows a similar downtick, as it seems that the early weeks recuperated the exhausted bearish momentum. However, the Ethereum price faced additional selling pressure as mid-size whales (1K–10K ETH) carried out heavy distribution. Will the top altcoin lose $3,000 again?

Middle-Tier Ethereum Whales Drive Post-Peak Selling Pressure

Over the past three months, the Ethereum price has witnessed a steady downtrend from its $4,955 all-time high (ATH) to its current trading value of $3,040, registering a 39% loss.

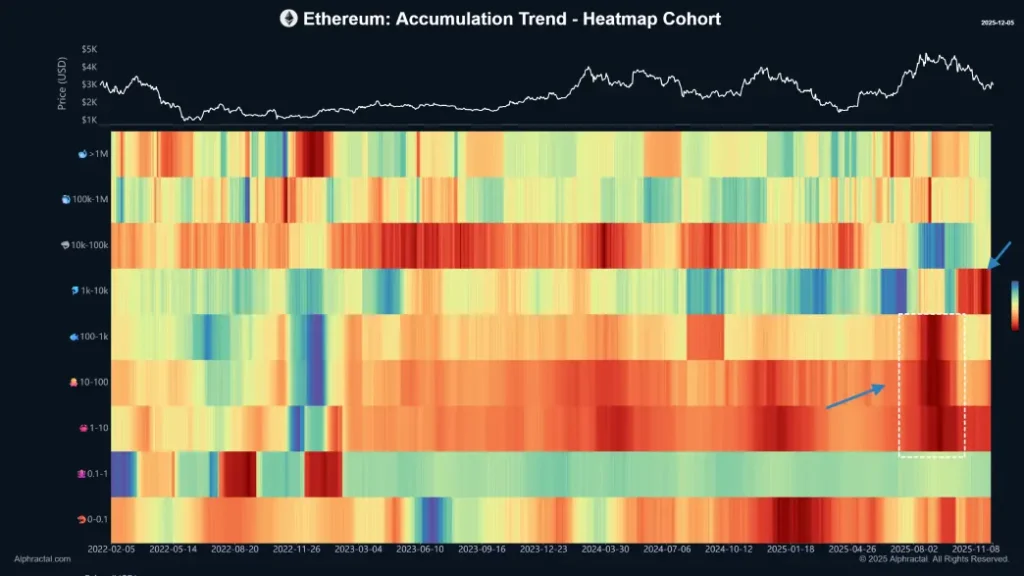

On-chain data of Ethereum’s supply distribution indicates that holders with balances between 1,000 and 10,000 ETH made the bulk of sales at the recent ATH. This cohort sold off positions aggressively at the peak of the price while there was widespread optimism among other market participants, celebrating the new highs.

The same bracket keeps on shrinking the holdings in the present moment, creating more persistent downward pressure despite the price trying to stabilize above $4,000. Daily net outflows from these addresses are still higher than pre-rally levels.

On the other hand, addresses with control over 10,000 ETH have shown much lower activity. Their collective balance has only decreased slightly since the top, with no indication of acceleration in selling or the accumulation of much. Transfers between the largest wallets remain within normal ranges, suggesting a wait-and-see approach rather than active repositioning.

Smaller holders below 1000 ETH have exhibited mixed behavior, with some cohorts adding tokens on dips and others trimming positions, although their combined impact is dwarfed by the middle-tier group.

The divergence can be seen in real-time supply measures: the 1,000-10,000 ETH tier has lost around 4-6% of its total supply since the local peak; the 10,000+ tier has lost less than 0.5% over the same period. This imbalance points out which segment currently controls the short-term direction of price action.

Ethereum Price Risks $2,500 Breakdown With this Reversal

In the last two days, the Ethereum price has shown a bearish pullback from $3,240 to its current trading value of $3,022, registering a 4.74% loss. This downtick displays an evening star bearish candle pattern at the resistance line of a falling wedge pattern.

The chart setup is characterized by two converging trendlines, which provide dynamic resistance and support to coin traders. Their downsloping nature drives the current price correction while maintaining a sell-the-bounce sentiment.

As the ETH price dives below the 20-day exponential moving average slope, the sellers could strengthen their group over this asset for a prolonged period. The post-reversal fall could push the price another 29% to seek the wedge pattern support at $2,115.

The current price position below the key EMAs (20, 50, 100, and 200) accentuates that the path of least resistance is down.

On the contrary, if the buyers flipped the overhead resistance into a potential support, ETH could recoup its bullish momentum for a sustainable price recovery. The post-breakout rally could face key resistance at $3,466, followed by $4,250.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Bitget Token

Bitget Token  Aave

Aave  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Ripple USD

Ripple USD  OKB

OKB  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Sky

Sky  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  MYX Finance

MYX Finance  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Wrapped BNB

Wrapped BNB  Official Trump

Official Trump  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  LayerZero

LayerZero  EURC

EURC  Jupiter

Jupiter  Stacks

Stacks  pippin

pippin  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Decred

Decred  WrappedM by M0

WrappedM by M0  Story

Story  River

River  Kinesis Gold

Kinesis Gold  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Stable

Stable  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sun Token

Sun Token  Kaia

Kaia  Kinesis Silver

Kinesis Silver  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.fi

Ether.fi  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  crvUSD

crvUSD  Resolv USR

Resolv USR  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Lido DAO

Lido DAO  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Legacy Frax Dollar

Legacy Frax Dollar  Olympus

Olympus  Jupiter Staked SOL

Jupiter Staked SOL  JasmyCoin

JasmyCoin  Savings USDD

Savings USDD  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  SPX6900

SPX6900  Marinade Staked SOL

Marinade Staked SOL  Humanity

Humanity  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  ADI

ADI  Telcoin

Telcoin  Axie Infinity

Axie Infinity