Ethereum continues to trade sideways as uncertainty weighs on the broader crypto market. The altcoin king has struggled to regain decisive bullish momentum.

While the current structure suggests potential bottom formation, large holders appear to be making aggressive moves.

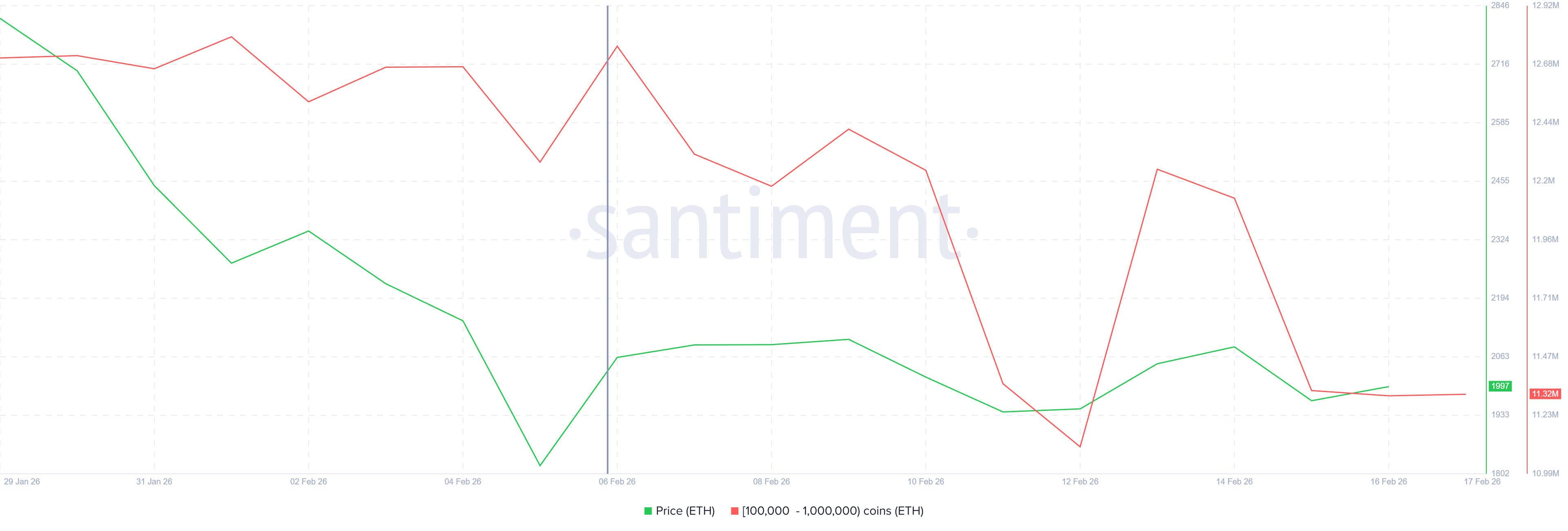

Ethereum Whales Selling Has Not Stopped

Ethereum whales have demonstrated erratic behavior in recent sessions. Sharp accumulation phases have been followed by equally aggressive distribution. This volatility signals uncertainty among high-capital participants.

Over the past two weeks, addresses holding between 100,000 and 1 million $ETH have sold approximately 1.43 million $ETH. At current valuations, that equals roughly $2.7 billion. Such large-scale distribution significantly impacts liquidity conditions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This level of selling often reflects late-cycle stress rather than early panic. Historically, heavy whale exits tend to occur near capitulation phases. Large holders sometimes reduce exposure before the broader acceptance of a market bottom. These episodes frequently precede structural reversals once selling pressure exhausts.

Ethereum Bottom Signals Strengthen

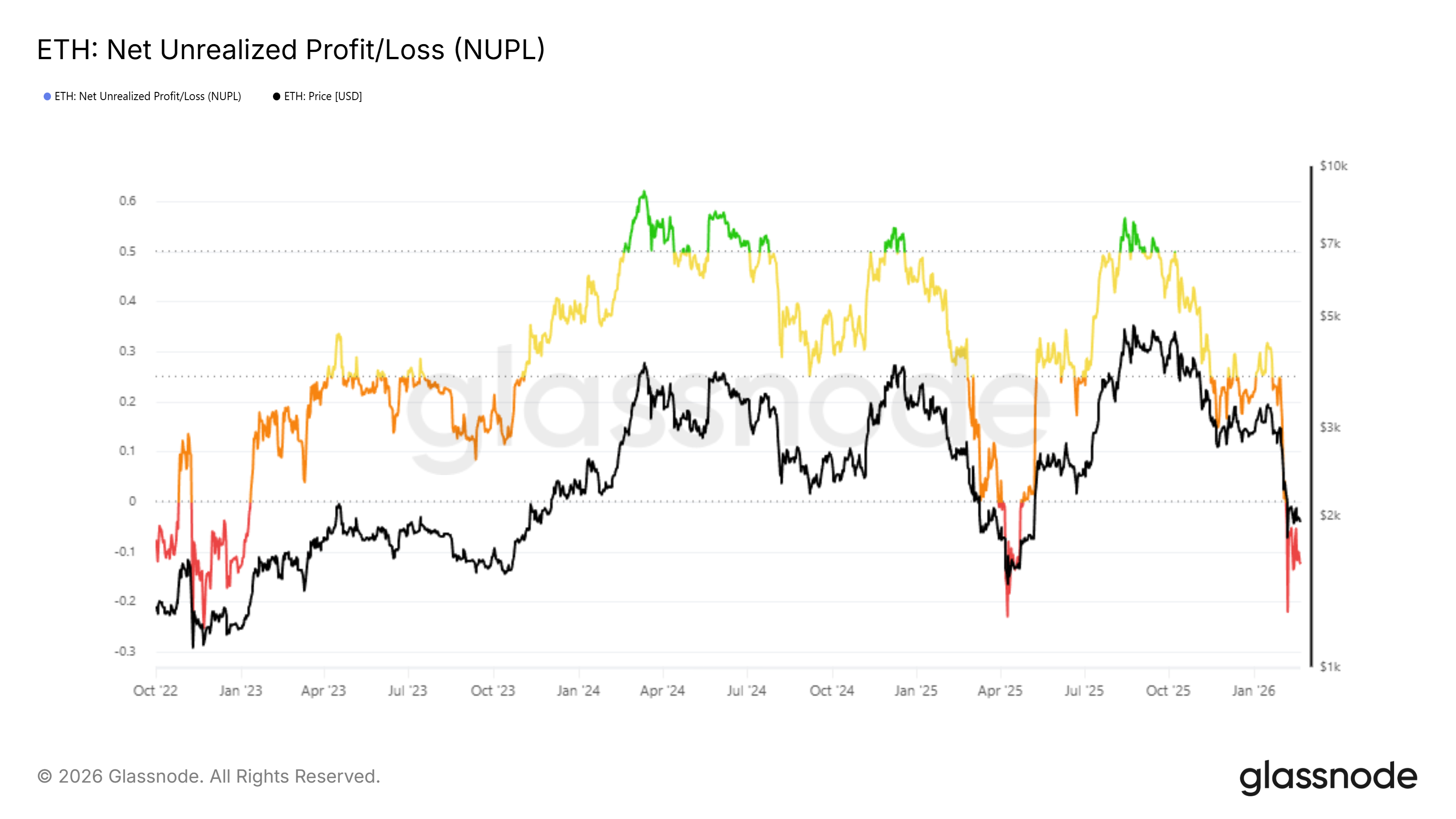

On-chain data provides additional context. The Net Unrealized Profit and Loss, or NUPL, indicator shows Ethereum in the capitulation zone. This reading indicates that average holders face substantial unrealized losses.

In prior cycles, similar NUPL conditions preceded meaningful reversals. However, Ethereum typically remains in this zone for extended periods. Capitulation does not imply immediate recovery.

Sustained time in the capitulation band often reduces speculative selling. As weaker hands exit positions, remaining holders tend to exhibit stronger conviction. Gradual stabilization in NUPL readings can signal diminishing downside momentum before recovery begins.

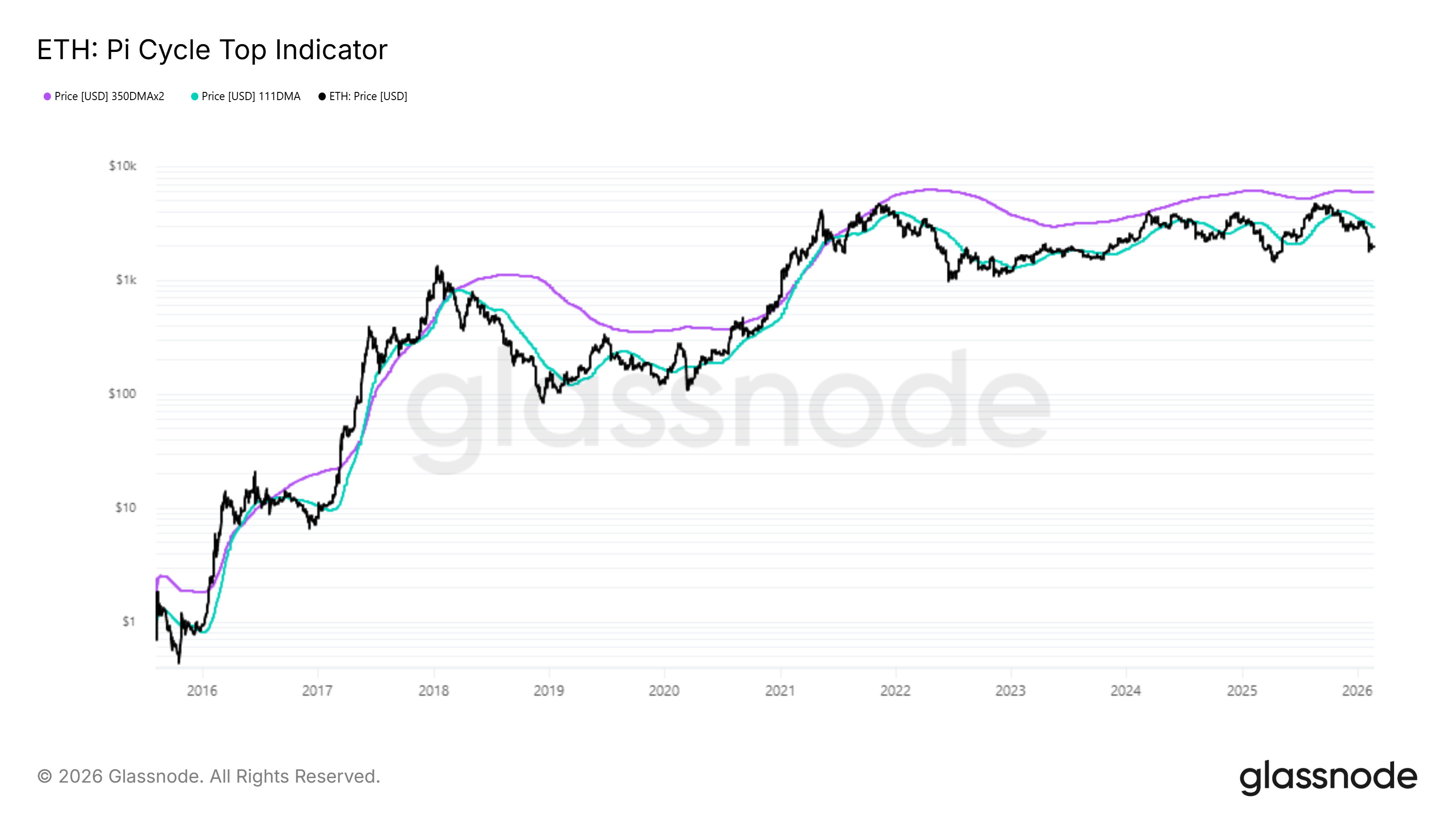

The Pi Cycle Top Indicator also supports a potential $ETH bottoming narrative. This metric tracks the relationship between short-term and long-term moving averages. Historically, convergence signals overheating near cycle tops.

Conversely, extreme divergence between these averages often aligns with cyclical bottoms. Current readings show meaningful separation between the two curves. Similar divergence patterns previously marked recovery zones.

Historical instances demonstrate that widening gaps preceded upward reversals. Although timing remains uncertain, this structural setup aligns with late-stage correction behavior. Combined with capitulation metrics, the data suggests Ethereum may be approaching stabilization rather than early bear expansion.

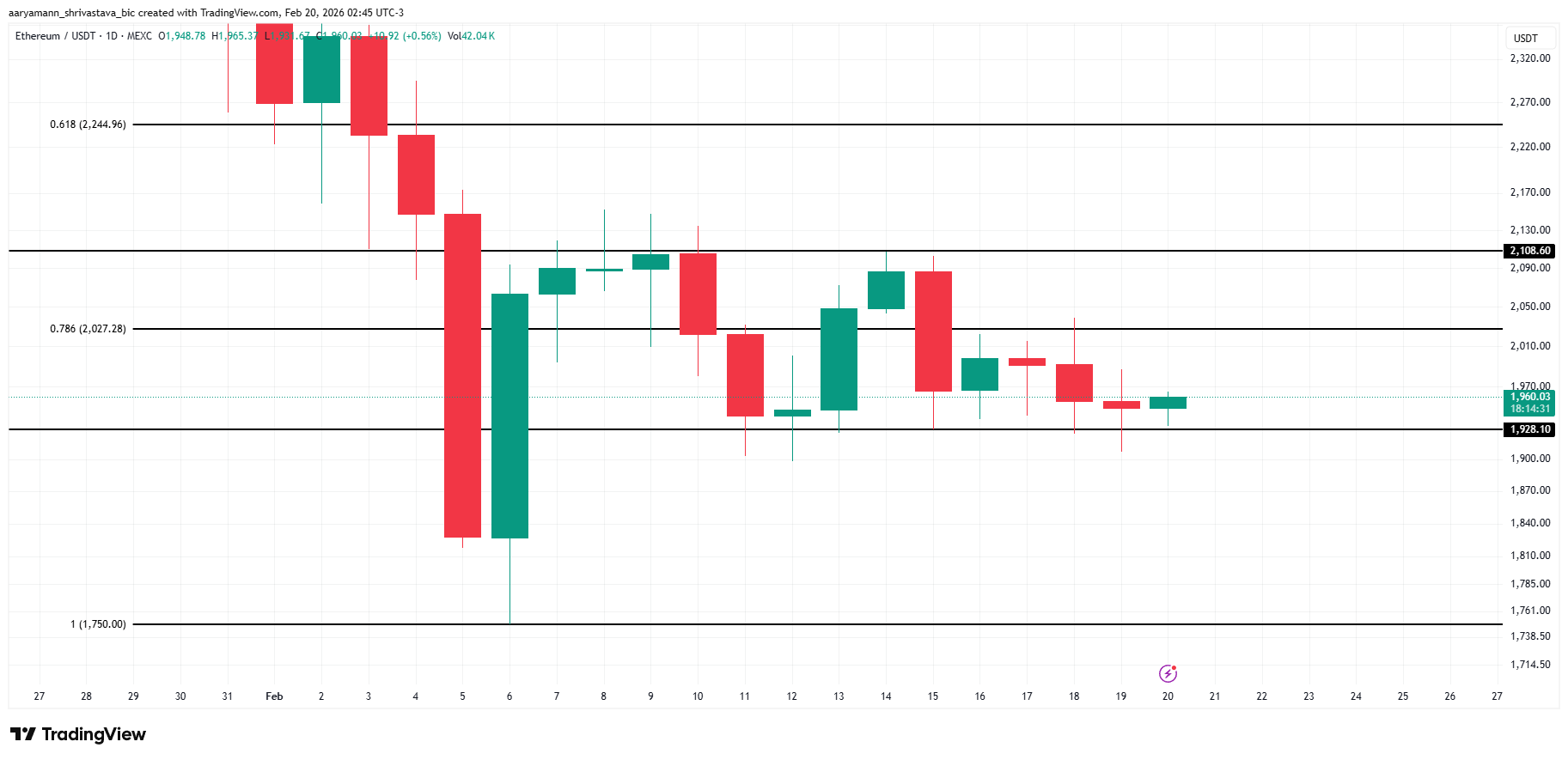

$ETH Price Holds Above Support

Ethereum trades at $1,960 at the time of writing. The asset has consistently held above the $1,928 support level despite whale distribution. This zone remains technically significant in maintaining short-term structure.

Although overall sentiment remains cautious, underlying demand has prevented a sharper breakdown. Buyers appear willing to accumulate near perceived value levels. Sustained support may enable Ethereum to challenge the $2,027 resistance. Clearing $2,108 would confirm a breakout from consolidation.

$ETH Price Analysis. “>

$ETH Price Analysis. “>

However, downside risks cannot be ignored. If bearish momentum intensifies, Ethereum could lose $1,928 support. A breakdown may expose $1,820 as the next potential floor. Continued weakness could extend toward $1,750, invalidating the near-term bullish thesis.

The post Ethereum Whales Dump $2.7 Billion in $ETH, but Bottom Signals Are Flashing appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Zcash

Zcash  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Falcon USD

Falcon USD  Aster

Aster  Pepe

Pepe  Bittensor

Bittensor  Global Dollar

Global Dollar  OKB

OKB  Bitget Token

Bitget Token  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Pi Network

Pi Network  Sky

Sky  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Gate

Gate  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Ethena

Ethena  Binance-Peg WETH

Binance-Peg WETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  USDD

USDD  Wrapped BNB

Wrapped BNB  Render

Render  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  pippin

pippin  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Arbitrum

Arbitrum  Bonk

Bonk  Stable

Stable  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Jupiter

Jupiter  USDai

USDai  clBTC

clBTC  Sei

Sei  EURC

EURC  Decred

Decred  Stacks

Stacks  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  WrappedM by M0

WrappedM by M0  Tezos

Tezos  JUST

JUST  Kinesis Gold

Kinesis Gold  Story

Story  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Lighter

Lighter  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Chiliz

Chiliz  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Injective

Injective  Resolv wstUSR

Resolv wstUSR  COCA

COCA  Curve DAO

Curve DAO  PRIME

PRIME  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Ether.fi

Ether.fi  Sun Token

Sun Token  LayerZero

LayerZero  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Gnosis

Gnosis  ADI

ADI  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Bitcoin SV

Bitcoin SV  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Humanity

Humanity  Pyth Network

Pyth Network  IOTA

IOTA  crvUSD

crvUSD  Aerodrome Finance

Aerodrome Finance  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  SPX6900

SPX6900  Renzo Restaked ETH

Renzo Restaked ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  sBTC

sBTC  Celestia

Celestia  Legacy Frax Dollar

Legacy Frax Dollar  Helium

Helium  Jupiter Staked SOL

Jupiter Staked SOL  Olympus

Olympus  Savings USDD

Savings USDD  Conflux

Conflux  BTSE Token

BTSE Token  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Optimism

Optimism  Maple Finance

Maple Finance  ZKsync

ZKsync  AB

AB  Staked Aave

Staked Aave  Ethereum Name Service

Ethereum Name Service