Major public mining companies are aggressively raising billions of dollars through convertible bonds, the largest capital push since 2021.

This could mark a turning point toward AI expansion, but also carries the risk of equity dilution and mounting debt pressure if profits fail to accelerate.

A New Wave of Large-Scale Debt Issuance

The year 2025 marks a clear shift in how Bitcoin miners raise capital. Bitfarms recently announced a $500 million offering of convertible senior notes due 2031. TeraWulf proposed a $3.2 billion senior secured note issuance to expand its data center operations.

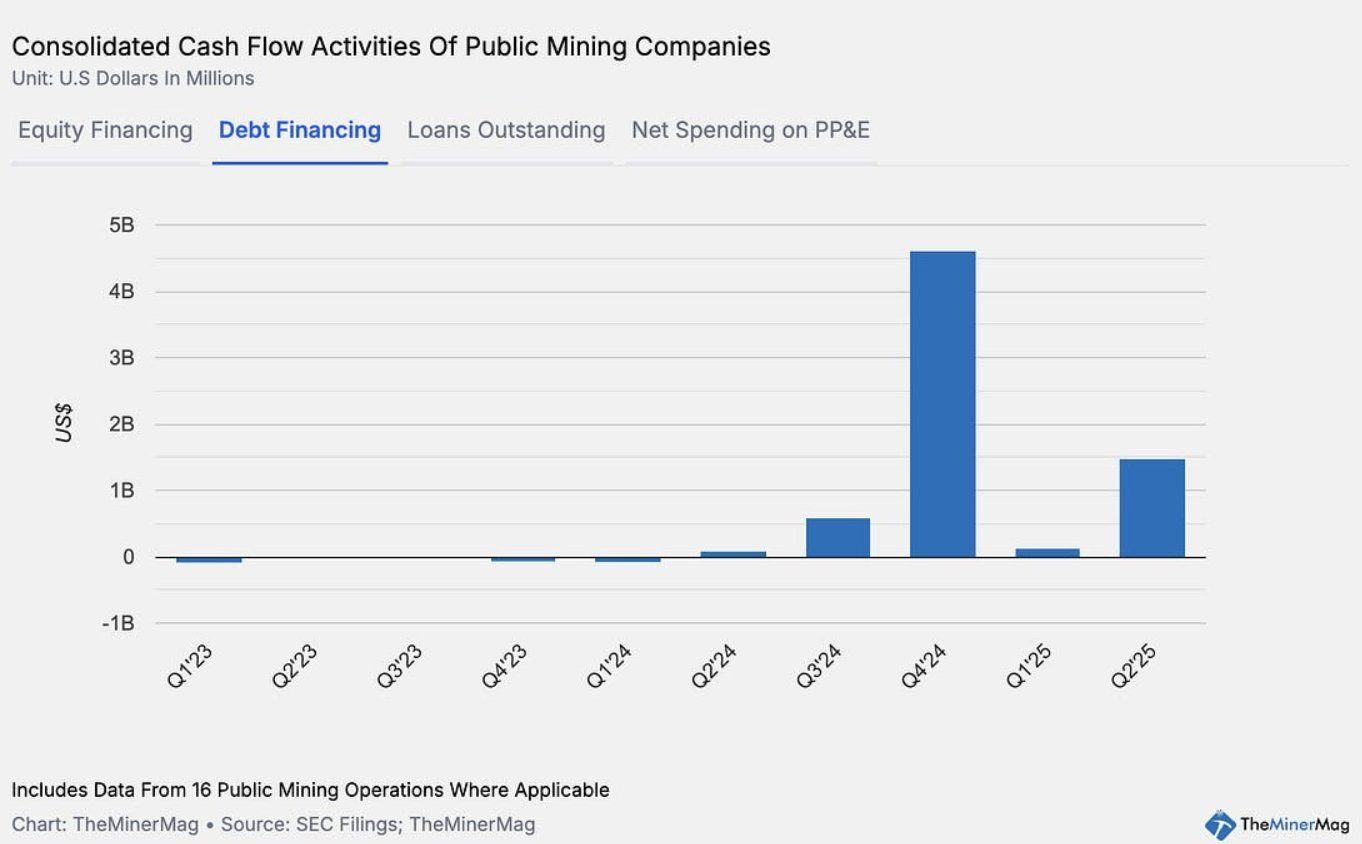

According to TheMinerMag, the total value of convertible and debt note issuances from 15 public mining companies reached a record $4.6 billion in Q4 2024. That figure fell below $200 million in early 2025 before surging again to $1.5 billion in Q2.

This capital strategy mirrors what MicroStrategy has done successfully in recent years. However, today’s debt model fundamentally differs from the 2021 cycle in the mining industry. Back then, ASIC mining rigs were often used as collateral for loans.

Public mining companies increasingly turn to convertible notes as a more flexible approach to financing. This strategy shifts financial risk from equipment repossession to potential equity dilution.

While this gives companies more breathing room to operate and expand, it also demands stronger performance and revenue growth to avoid weakening shareholder value.

Opportunities and Risks

If miners pivot toward new business models, such as building HPC/AI infrastructure, offering cloud computing services, or leasing hash power, these capital inflows could become a powerful growth lever.

Diversifying into data services promises longer-term stability than pure Bitcoin mining.

For instance, Bitfarms has secured a $300 million loan from Macquarie to fund HPC infrastructure at its Panther Creek project. Should AI/HPC revenues prove sustainable, this financing model could be far more resilient than the ASIC-lien structure used in 2021.

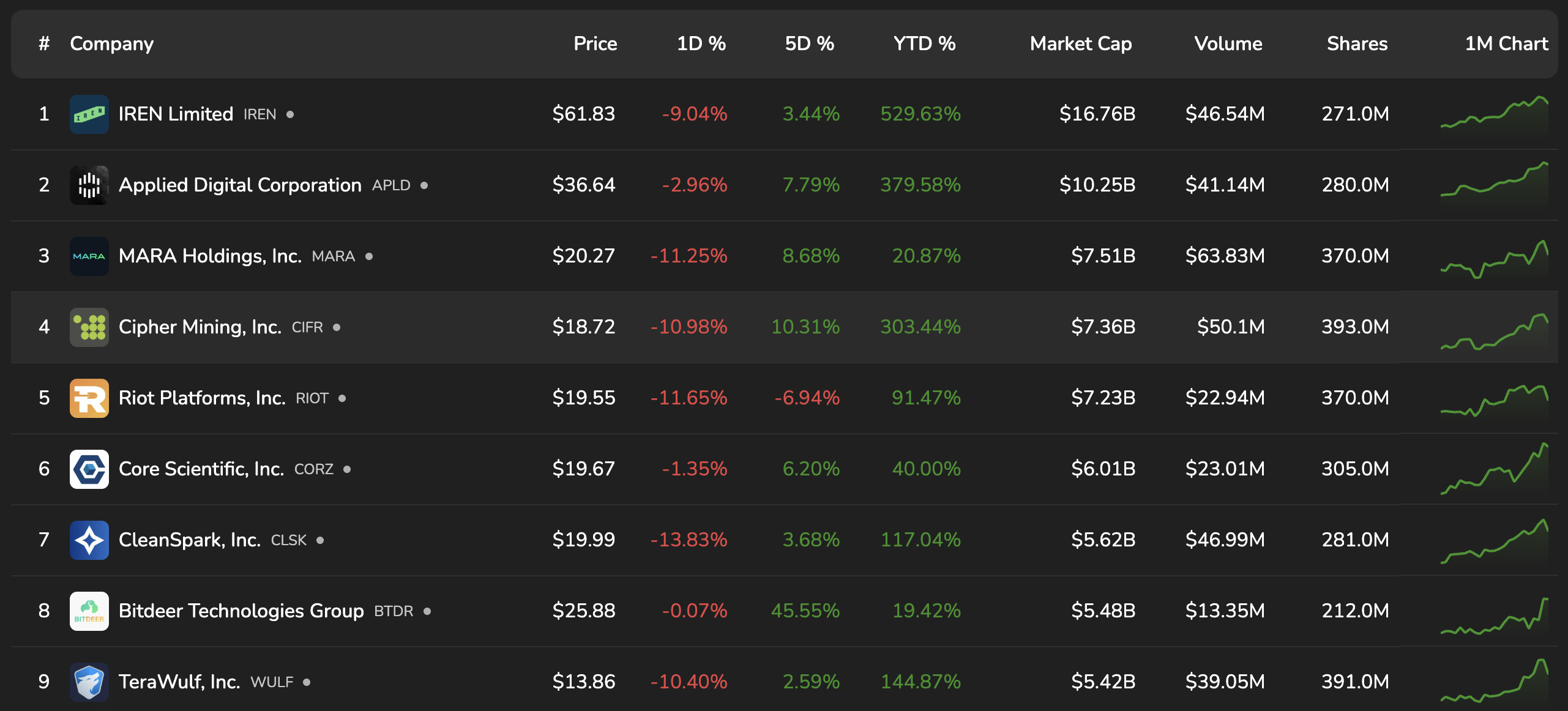

The market has seen a positive reaction from mining stocks when companies announce debt issuances, with stock prices rallying as the expansion and growth narrative is emphasized. However, there are risks if expectations are not met.

Suppose the sector fails to generate additional income to offset financing and expansion costs. In that case, equity investors will bear the brunt through heavy dilution — instead of equipment repossession as in previous cycles.

This comes when Bitcoin’s mining difficulty has reached an all-time high, cutting into miners’ margins, while mining performance across major companies has been trending downward in recent months.

In short, the mining industry is once again testing the limits of financial engineering — balancing between innovation and risk — as it seeks to transform from energy-intensive mining to>Public Mining Companies Raise Billions in Debt to Fund AI Pivot appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Rain

Rain  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Bitget Token

Bitget Token  Aave

Aave  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Sky

Sky  OKB

OKB  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Pepe

Pepe  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Quant

Quant  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  Midnight

Midnight  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  MYX Finance

MYX Finance  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  LayerZero

LayerZero  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  TrueUSD

TrueUSD  pippin

pippin  clBTC

clBTC  Sei

Sei  EURC

EURC  Stacks

Stacks  Jupiter

Jupiter  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Decred

Decred  WrappedM by M0

WrappedM by M0  Story

Story  Stable

Stable  Kinesis Gold

Kinesis Gold  Pudgy Penguins

Pudgy Penguins  Optimism

Optimism  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Curve DAO

Curve DAO  River

River  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Kaia

Kaia  AINFT

AINFT  Wrapped Flare

Wrapped Flare  Kinesis Silver

Kinesis Silver  Maple Finance

Maple Finance  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.fi

Ether.fi  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  crvUSD

crvUSD  PRIME

PRIME  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Humanity

Humanity  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  IOTA

IOTA  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Resolv USR

Resolv USR  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  JasmyCoin

JasmyCoin  Savings USDD

Savings USDD  Celestia

Celestia  Olympus

Olympus  ADI

ADI  Marinade Staked SOL

Marinade Staked SOL  SPX6900

SPX6900  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Aerodrome Finance

Aerodrome Finance  Telcoin

Telcoin  Axie Infinity

Axie Infinity