Bitcoin mining took a direct hit from January’s U.S. winter storm, with Cryptoquant data showing sharp declines in hashrate, production, and miner revenue across the network.

Bitcoin Mining Production Falls to Post-Halving Lows

According to Cryptoquant researchers, several large U.S.-based mining firms curtailed operations as severe weather disrupted power availability, accelerating a networkwide hashrate drawdown of roughly 12%.

Cryptoquant notes this marks the steepest decline since October 2021, pushing total hashrate down massively, its lowest level since September 2025. The researchers emphasize that the weather shock compounded an already fragile setup.

Even before the storm, the firm’s report observes hashrate trending lower as bitcoin corrected from its $126,000 all-time high toward the $100,000 range, tightening margins for miners operating under elevated difficulty conditions.

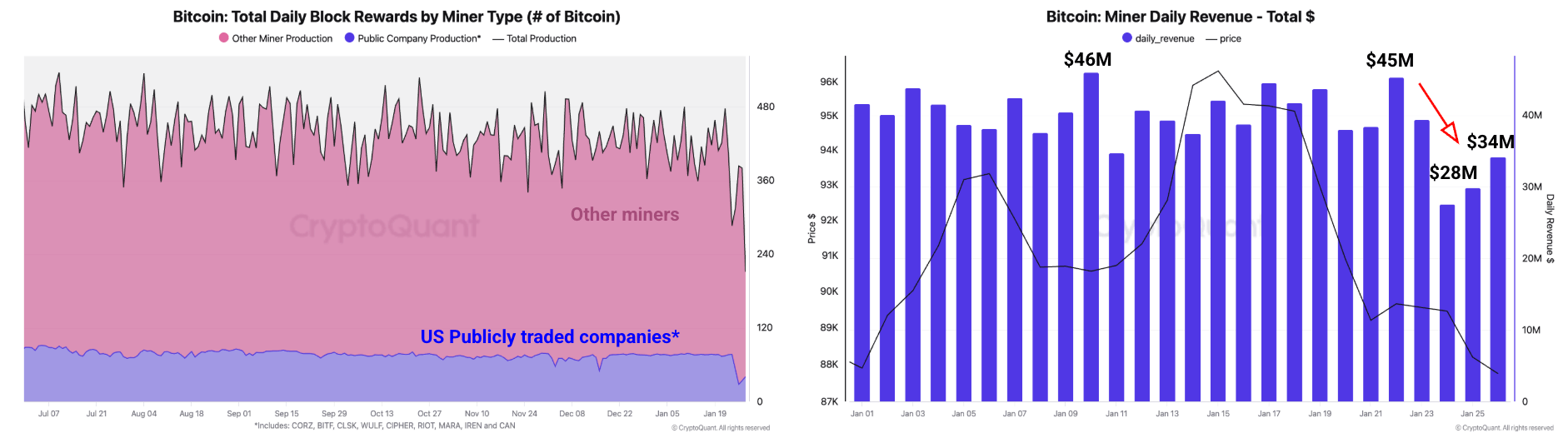

Mining revenues followed suit. Cryptoquant data shows daily bitcoin mining revenue fell from roughly $45 million on Jan. 22 to a yearly low near $28 million just two days later. While revenue partially recovered to around $34 million by Jan. 26, the analysts stress that earnings remain well below pre-storm levels.

Production metrics paint a similar picture. The report notes that output from the largest publicly traded mining companies dropped from 77 $BTC per day to just 28 $BTC during the disruption. At the same time, production from other miners slid from 403 $BTC to 209 $BTC, underscoring the broad-based nature of the slowdown.

On a 30-day basis, Cryptoquant describes the contraction as the sharpest since mid-2024, shortly after the last bitcoin halving. Publicly traded miners saw production fall by as much as 48 $BTC, while other miners collectively lost about 215 $BTC over the same period, according to the firm’s on-chain tracking.

Profitability indicators are flashing deeper stress. Cryptoquant’s Miner Profit/Loss Sustainability Index fell to 21, the lowest reading since November 2024. The firm interprets this level as signaling that miners are “extremely underpaid” under current price and difficulty conditions.

Notably, analysts point out that this strain persists even after multiple downward difficulty adjustments over the past five epochs. Lower difficulty has offered some relief, but not enough to offset weaker prices, reduced block production, and weather-related outages.

Also read: Crypto Sentiment Falters as Fear Index Lingers Near Extreme Levels

From Cryptoquant’s perspective, the episode highlights how external shocks, such as extreme weather, can ripple quickly through bitcoin’s mining economy. Concentration of large-scale mining operations in the U.S. has increased the network’s exposure to regional disruptions, a theme the firm has flagged in prior research.

Looking ahead, the researchers suggest that sustained recovery in miner profitability will likely depend on a combination of improved price conditions, stable energy availability, and time for difficulty to recalibrate. Until then, the firm’s data indicates miners remain under pressure, even as the storm itself clears.

FAQ ⛏️

- Why did bitcoin mining decline in January 2026?Cryptoquant data shows a U.S. winter storm forced miners to curtail operations, cutting hashrate and production.

- How much did bitcoin hashrate fall?According to Cryptoquant, network hashrate dropped about 12%, the largest drawdown since 2021.

- What happened to mining revenue?Cryptoquant reports daily mining revenue slid from $45 million to about $28 million before a partial rebound.

- Are bitcoin miners profitable right now?Cryptoquant’s Miner Profit/Loss Sustainability Index shows miners are extremely underpaid under current conditions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  MYX Finance

MYX Finance  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  LayerZero

LayerZero  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Story

Story  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Decred

Decred  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  pippin

pippin  Stable

Stable  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Curve DAO

Curve DAO  River

River  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Resolv USR

Resolv USR  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Lido DAO

Lido DAO  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Humanity

Humanity  Bitcoin SV

Bitcoin SV  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Celestia

Celestia  Savings USDD

Savings USDD  SPX6900

SPX6900  Legacy Frax Dollar

Legacy Frax Dollar  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Olympus

Olympus  DoubleZero

DoubleZero  Axie Infinity

Axie Infinity  Pyth Network

Pyth Network