Binance Research Weekly: Structural Strength Emerges Amid Crypto Market Reset and Institutional DeFi Adoption

The main question now is not how deep the correction may go, but rather when demand could meaningfully return, according to a recent review of the state of cryptocurrency markets, conducted by Binance Research during a prolonged risk-off period. The report presents the current state of affairs as a macro-driven reset, as opposed to a disintegration of the long-term structural narrative of cryptocurrency.

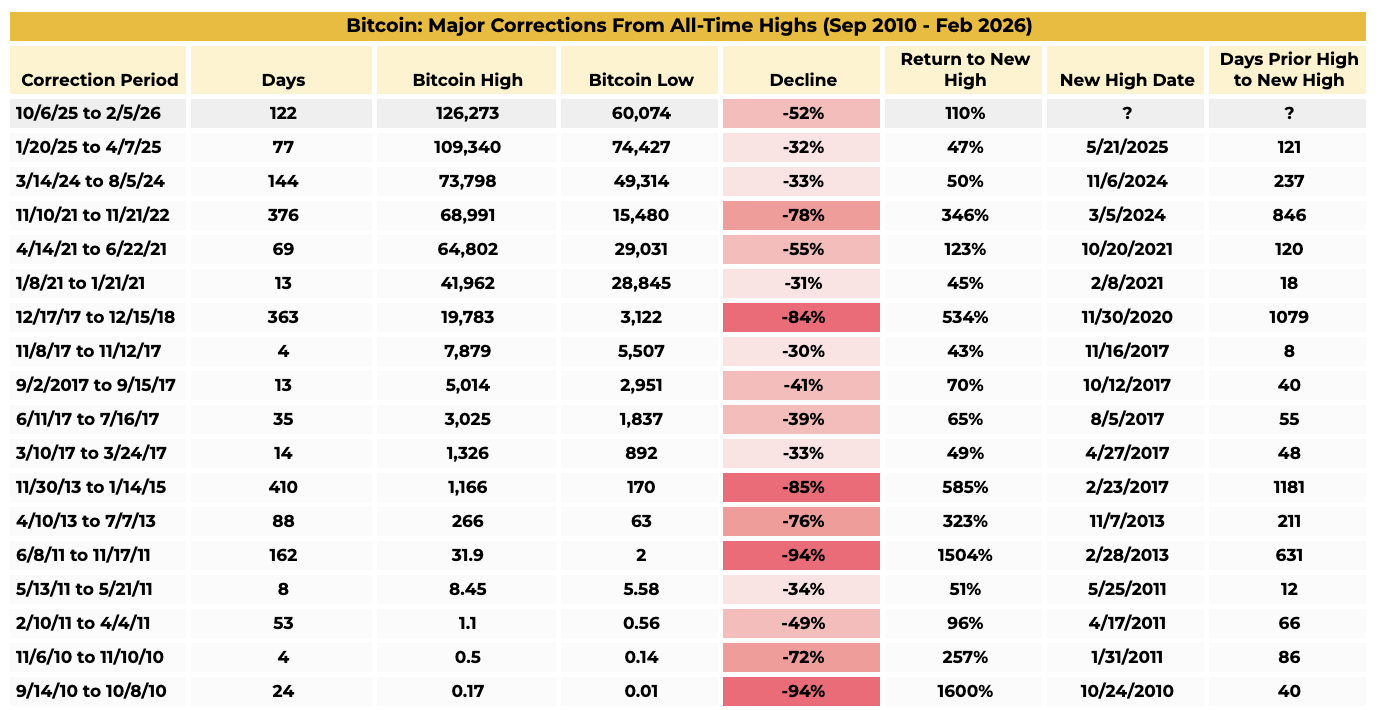

The price of Bitcoin has dropped about half from its peak in October 2025, returning to levels close to $60,000 before leveling off. Although similar drawdowns have happened frequently in past cycles, the market today is different because of more established liquidity channels and deeper institutional participation. Since speculative capital is still winding down, investors are shifting their investments toward bigger, supposedly safer assets, which is why altcoins have underperformed more severely.

Macro conditions shape up market

Price action is still primarily shaped by macro conditions. Employment data strengthened the Fed’s cautious approach by lowering expectations of impending rate cuts. The desire for risky assets has also been curbed by ongoing geopolitical unrest and policy uncertainty. As a result of their historical sensitivity to global liquidity conditions, cryptocurrency markets have encountered persistent challenges.

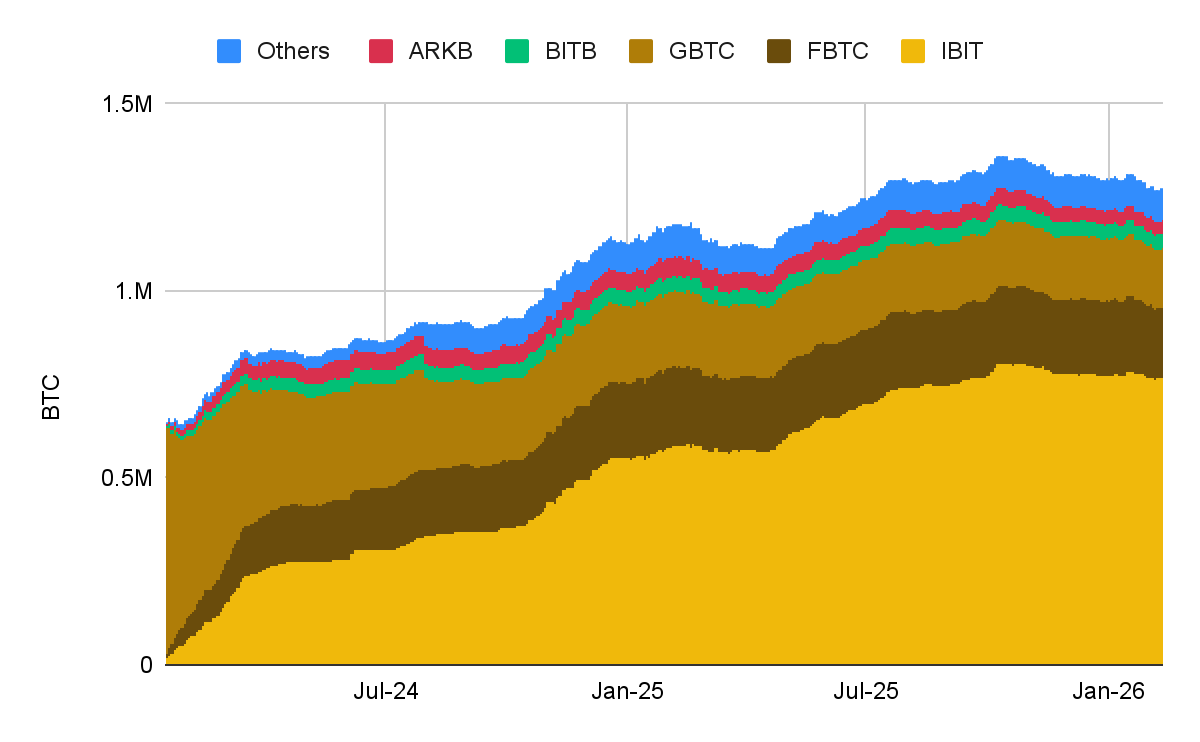

Binance Research points to a number of signs of underlying resilience in spite of price weakness. In contrast to the price, the assets under management of the spot Bitcoin ETF have only slightly decreased, indicating that investors are viewing these allocations as long-term investments rather than speculative transactions. The supply of stablecoins is still close to all-time highs, indicating that capital has mostly remained in on-chain ecosystems rather than leaving them completely.

RWAs enter scene

Additionally, real-world asset tokenization is still attracting investment. In tokenized U.S. Commodities, yield products and treasuries are growing, providing defensive exposure and bolstering blockchain’s function in financial infrastructure.

The most noteworthy development in the report is BlackRock’s decision to use Uniswap’s infrastructure to settle trades for its tokenized Treasury fund, which is a significant step toward institutional use of decentralized finance rails. When reliable infrastructure and regulatory alignment are in place, institutional liquidity is ready to participate, according to Binance Research.

It is anticipated that volatility will continue to be high in the future, as markets wait for more precise signals from monetary policy and macro data. Even though prices have dropped, Binance Research finds that fundamental advancements in tokenization, DeFi and institutional adoption are still being made, setting up the industry for a possible comeback when liquidity conditions improve.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Dai

Dai  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Pepe

Pepe  Aster

Aster  Falcon USD

Falcon USD  Bittensor

Bittensor  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Ripple USD

Ripple USD  Sky

Sky  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Gate

Gate  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Quant

Quant  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  USDD

USDD  Wrapped BNB

Wrapped BNB  Render

Render  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Usual USD

Usual USD  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  Stable

Stable  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  A7A5

A7A5  Solv Protocol BTC

Solv Protocol BTC  USDai

USDai  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Jupiter

Jupiter  pippin

pippin  clBTC

clBTC  Sei

Sei  EURC

EURC  Stacks

Stacks  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Decred

Decred  Chiliz

Chiliz  Kinesis Gold

Kinesis Gold  Story

Story  JUST

JUST  Lighter

Lighter  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Curve DAO

Curve DAO  Resolv wstUSR

Resolv wstUSR  COCA

COCA  AINFT

AINFT  Ether.fi

Ether.fi  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Sun Token

Sun Token  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Injective

Injective  Kaia

Kaia  Bitcoin SV

Bitcoin SV  PRIME

PRIME  Wrapped Flare

Wrapped Flare  Humanity

Humanity  Gnosis

Gnosis  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Pyth Network

Pyth Network  SPX6900

SPX6900  LayerZero

LayerZero  IOTA

IOTA  Optimism

Optimism  Binance-Peg XRP

Binance-Peg XRP  crvUSD

crvUSD  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Aerodrome Finance

Aerodrome Finance  The Graph

The Graph  sBTC

sBTC  Celestia

Celestia  JasmyCoin

JasmyCoin  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Lido DAO

Lido DAO  Savings USDD

Savings USDD  Olympus

Olympus  Maple Finance

Maple Finance  Conflux

Conflux  Marinade Staked SOL

Marinade Staked SOL  Helium

Helium  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Telcoin

Telcoin  AB

AB  ZKsync

ZKsync  Staked Aave

Staked Aave