Ethereum remains under pressure as price action continues to reflect a broader bearish structure on the 4-hour chart. Although $ETH has stabilized near the $1,950 to $2,000 range, the recovery lacks conviction.

Sellers still control the trend, and momentum indicators show limited strength. Consequently, traders now focus on whether this consolidation marks a base or simply a pause before another leg lower.

Bearish Structure Keeps Pressure on Price

Ethereum peaked near $3,400 before entering a sustained decline marked by lower highs and lower lows. The breakdown below $2,600 accelerated downside momentum and pushed price toward the $1,746 macro support. That level, aligned with the 0 Fibonacci mark, triggered a relief bounce.

However, $ETH continues to trade below the 20, 50, 100, and 200 EMAs. This alignment confirms that sellers still dominate the broader structure.

Moreover, the $2,020 to $2,030 zone now acts as immediate resistance due to the EMA cluster. Price must reclaim this region to shift short-term momentum.

Above that, $2,137 represents the first key Fibonacci retracement barrier. A decisive move beyond this level could strengthen bullish sentiment.

However, the $2,380 area remains the critical structural ceiling. Only a sustained break above that level would confirm a more durable recovery phase.

On the downside, $ETH consolidates around the $1,950 to $1,960 range. Additionally, the $1,913 level aligns with the lower Bollinger Band and provides dynamic support.

If this floor fails, price could revisit the $1,746 swing low. A breakdown below that support would likely expose the $1,650 to $1,700 region. Hence, bulls must defend current levels to prevent renewed selling pressure.

Derivatives and Spot Flows Signal Caution

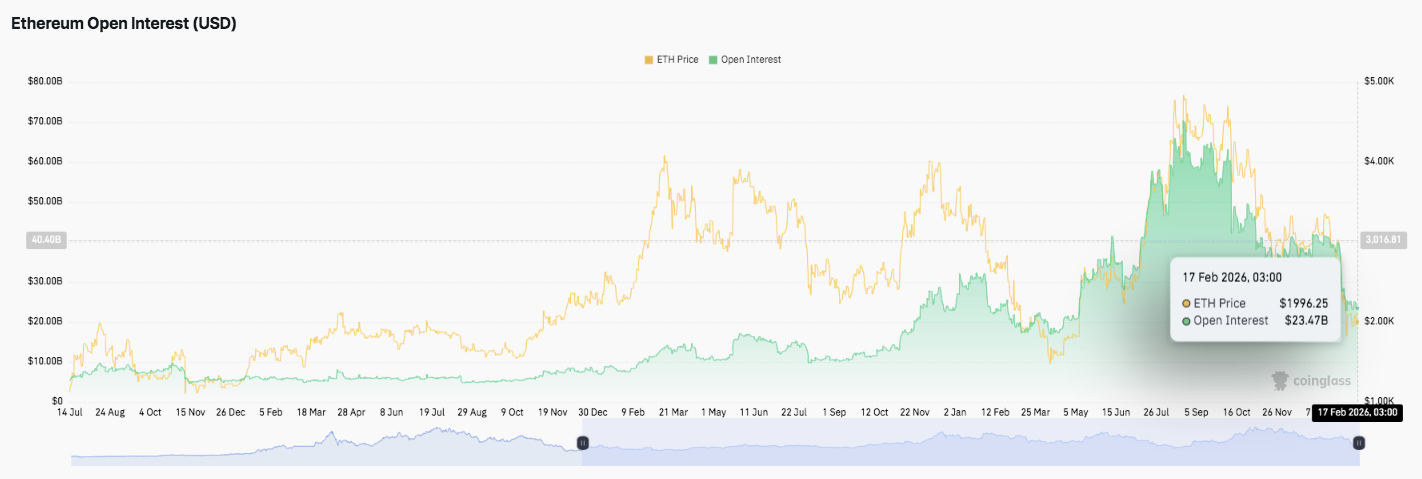

Open interest data reflects a clear cycle of expansion and contraction. During previous rallies, positioning surged and peaked above $60 billion. That buildup preceded a sharp unwind as price corrected. Recently, open interest stabilized near the mid-$20 billion range. This shift indicates lower leverage and more cautious participation in the derivatives market.

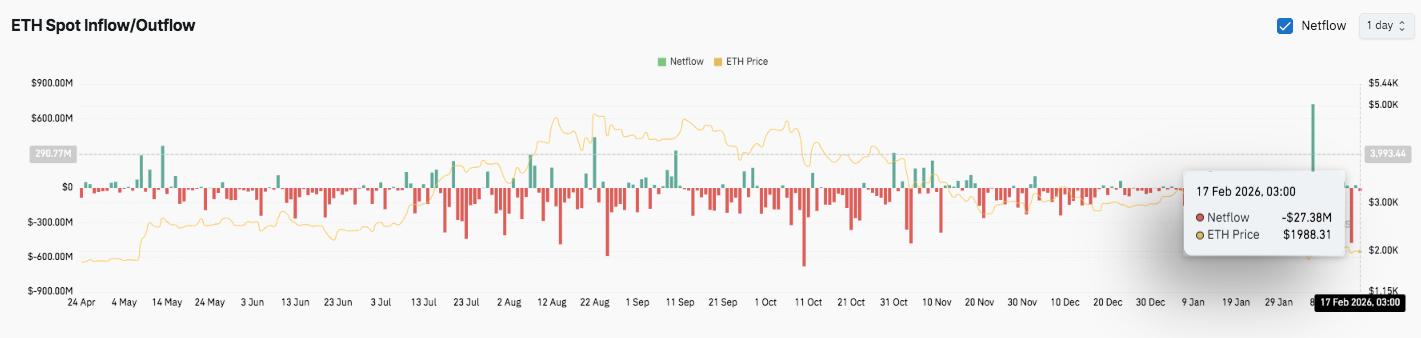

Significantly, spot flow data shows a prolonged period of net outflows stretching from late summer into early winter. Repeated large withdrawals reinforced persistent selling pressure.

However, February introduced a sharp inflow spike exceeding $600 million.

This development suggests renewed accumulation interest. If follow-through inflows continue, Ethereum could build a more stable foundation. Until then, resistance levels remain the key hurdle for any sustained upside recovery.

Technical Outlook for Ethereum ($ETH) Price

Key levels remain clearly defined as Ethereum consolidates after a sharp correction. Price continues to trade below major moving averages, keeping the broader structure cautious. However, short-term compression suggests a decisive move may approach.

Upside levels: $2,020–$2,030 serves as immediate resistance at the 20 and 50 EMA cluster. A sustained break above this zone could open the path toward $2,137 (0.236 Fib). Beyond that, $2,380 (0.382 Fib) stands as the first strong structural barrier. If bullish momentum strengthens, extension targets sit at $2,576 (0.5 Fib) and $2,772 (0.618 Fib), where medium-term trend reversal potential increases.

Downside levels: $1,950–$1,960 acts as the current consolidation floor. Below that, $1,913 aligns with the lower Bollinger Band dynamic support. A failure to defend this level exposes $1,746, the major swing low and Fib 0 base. A breakdown under $1,746 could accelerate losses toward $1,700 and potentially $1,650.

Resistance ceiling: The $2,380 region remains the key level to flip for medium-term bullish momentum. Until price reclaims this area, rallies may remain corrective within a broader downtrend.

Technically, Ethereum appears to be stabilizing after a steep decline from the $3,400 peak. The structure resembles a consolidation phase beneath descending resistance, where volatility compression often precedes expansion. Additionally, open interest has cooled significantly from prior highs, indicating reduced leverage risk. This reset could support a healthier base if spot inflows continue.

Will Ethereum Go Up?

Ethereum’s near-term direction depends on whether buyers can defend $1,913 and build momentum toward $2,137. Strong inflows and reclaiming the EMA cluster would strengthen recovery prospects.

However, failure to hold the $1,913–$1,950 zone risks renewed selling pressure. For now, $ETH remains in a pivotal range where confirmation, not speculation, will determine the next major move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Dai

Dai  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Pepe

Pepe  Aster

Aster  Falcon USD

Falcon USD  Bittensor

Bittensor  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Ripple USD

Ripple USD  Sky

Sky  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Gate

Gate  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Quant

Quant  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  USDD

USDD  Wrapped BNB

Wrapped BNB  Render

Render  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Usual USD

Usual USD  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  Stable

Stable  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  A7A5

A7A5  Solv Protocol BTC

Solv Protocol BTC  USDai

USDai  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Jupiter

Jupiter  pippin

pippin  clBTC

clBTC  Sei

Sei  EURC

EURC  Stacks

Stacks  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Decred

Decred  Chiliz

Chiliz  Kinesis Gold

Kinesis Gold  Story

Story  JUST

JUST  Lighter

Lighter  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Curve DAO

Curve DAO  Resolv wstUSR

Resolv wstUSR  COCA

COCA  AINFT

AINFT  Ether.fi

Ether.fi  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Sun Token

Sun Token  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Injective

Injective  Kaia

Kaia  Bitcoin SV

Bitcoin SV  PRIME

PRIME  Wrapped Flare

Wrapped Flare  Humanity

Humanity  Gnosis

Gnosis  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Pyth Network

Pyth Network  SPX6900

SPX6900  LayerZero

LayerZero  IOTA

IOTA  Optimism

Optimism  Binance-Peg XRP

Binance-Peg XRP  crvUSD

crvUSD  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Aerodrome Finance

Aerodrome Finance  The Graph

The Graph  sBTC

sBTC  Celestia

Celestia  JasmyCoin

JasmyCoin  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Lido DAO

Lido DAO  Savings USDD

Savings USDD  Olympus

Olympus  Maple Finance

Maple Finance  Conflux

Conflux  Marinade Staked SOL

Marinade Staked SOL  Helium

Helium  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Telcoin

Telcoin  AB

AB  ZKsync

ZKsync  Staked Aave

Staked Aave