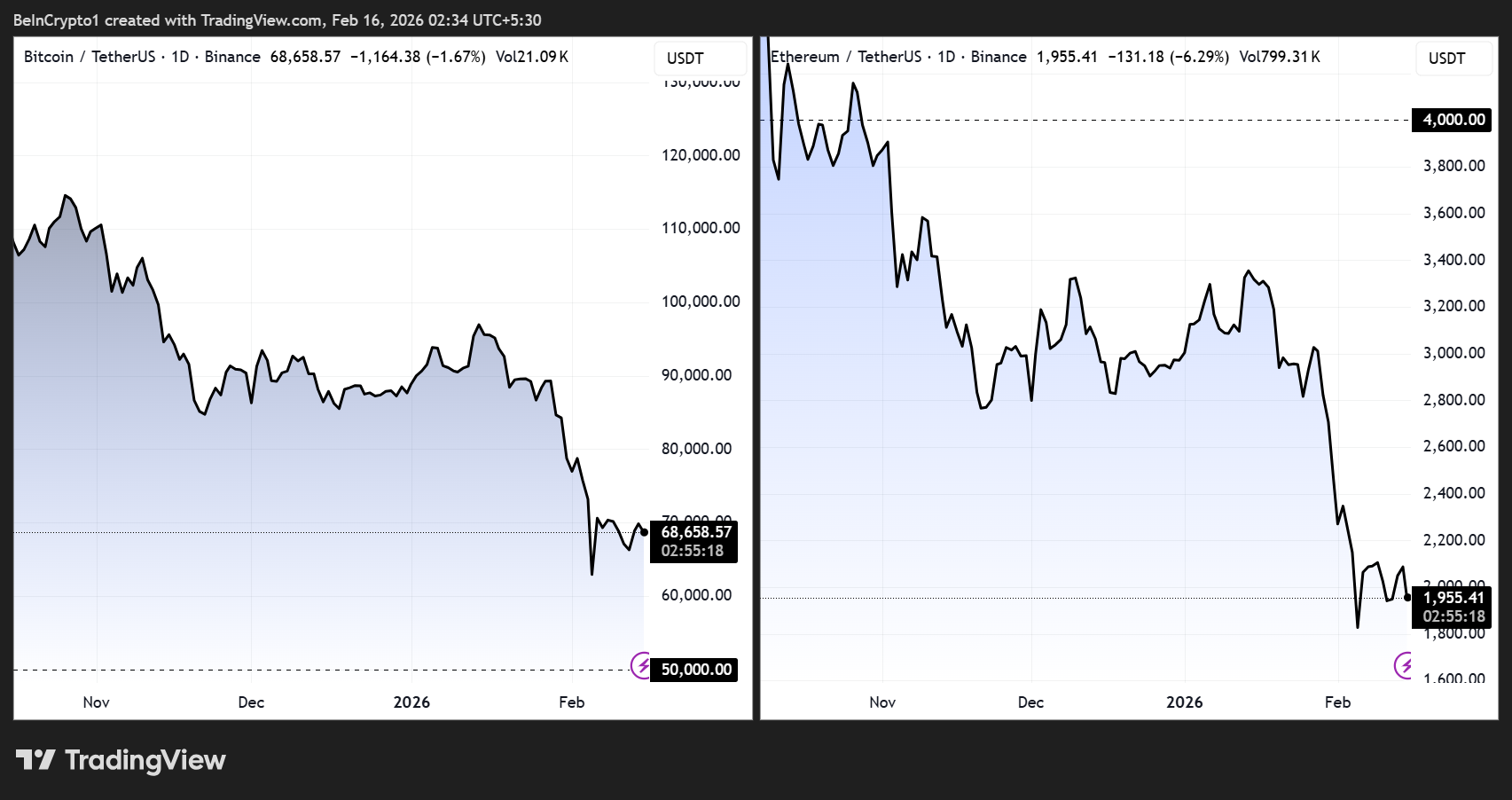

Ethereum ($ETH) has fallen 6.6% in the last 24 hours, trading around $1,947, as broader crypto markets continue to navigate volatility and macroeconomic headwinds.

Yet amidst the price turbulence, Coinbase CEO Brian Armstrong is pointing to a surprising source of optimism: retail investor resilience.

Retail “Diamond Hands” Hold Strong Despite Ethereum’s 7% Drop

Armstrong highlighted that, beyond weathering the market downturn, Coinbase’s retail users are actively buying the dip, resulting in net increases in $BTC and $ETH holdings.

“Retail users on Coinbase have been very resilient during these market conditions, according to our data,” Armstrong wrote. “They’ve been buying the dip.

According to the Coinbase executive, they have seen a native unit increase for retail users across $BTC and $ETH on the exchange.

Citing diamond hands, Armstrong says most of Coinbase’s customers had native unit balances in February equal to or greater than their balances in December.

The Coinbase CEO framed this trend as a bullish counter-narrative to the current market gloom. While Bitcoin has pulled back toward the $68,000–$69,000 range and Ethereum has seen a 7% drop to levels below $2,000, retail investors are demonstrating conviction rather than panic.

The “diamond hands” phenomenon, where users maintain or increase their crypto holdings despite drawdowns, suggests a maturing retail base that may help stabilize prices and underpin long-term adoption.

Mixed Views Emerge as Retail Conviction Faces Market Risks

However, not everyone shares Armstrong’s optimism. Some critics argue that holding through sharp declines merely reflects significant drawdowns rather than true resilience.

That doesn’t make them resilient that means they’re taking huge drawdowns

— based16z (@based16z) February 15, 2026

Beyond holding behavior, community members are also voicing broader policy and market access concerns.

“Retail users deserve access to yield on stablecoins and the reversal of the accredited investor law,” commented Wendy O.

This suggests that expanded DeFi participation and yield opportunities could further strengthen retail confidence.

The context is important, coming days after Coinbase’s Q4 2025 earnings revealed declining trading volumes amid an 11% drop in broader crypto market capitalization.

Yet the exchange continued to see inflows of native units from retail users, hinting at a floor of accumulation that may cushion the market during bearish stretches.

Historical crypto cycles show that periods of sustained retail conviction often precede rebounds, as retail holders absorb volatility while institutional participants adopt more cautious postures.

Therefore, while Armstrong’s message reassures the crypto community and subtly defends Coinbase’s performance amid a turbulent quarter, it also shows that the retail market is changing from short-term speculation to longer-term accumulation.

While prices may remain choppy in the near term, these patterns suggest that retail investors are increasingly acting as stabilizing forces in the market, potentially serving as a catalyst for recovery when broader sentiment shifts.

The post Ethereum 7% Dip Tests Retail “Diamond Hands,” But Coinbase CEO Sees Silver Lining appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Tether Gold

Tether Gold  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pepe

Pepe  Bittensor

Bittensor  Falcon USD

Falcon USD  Aster

Aster  OKB

OKB  Pi Network

Pi Network  Bitget Token

Bitget Token  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BFUSD

BFUSD  Internet Computer

Internet Computer  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  Worldcoin

Worldcoin  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Quant

Quant  Ethena

Ethena  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Filecoin

Filecoin  OUSG

OUSG  Aptos

Aptos  USDD

USDD  syrupUSDT

syrupUSDT  VeChain

VeChain  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Bonk

Bonk  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Stable

Stable  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  pippin

pippin  Sei

Sei  clBTC

clBTC  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  EURC

EURC  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Decred

Decred  Story

Story  Lighter

Lighter  Optimism

Optimism  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Kinesis Gold

Kinesis Gold  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  Ether.fi

Ether.fi  Gnosis

Gnosis  AINFT

AINFT  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Humanity

Humanity  Kaia

Kaia  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  LayerZero

LayerZero  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Pyth Network

Pyth Network  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  SPX6900

SPX6900  Injective

Injective  PRIME

PRIME  FLOKI

FLOKI  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  JasmyCoin

JasmyCoin  ADI

ADI  sBTC

sBTC  MYX Finance

MYX Finance  crvUSD

crvUSD  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Lido DAO

Lido DAO  Savings USDD

Savings USDD  Maple Finance

Maple Finance  Conflux

Conflux  Legacy Frax Dollar

Legacy Frax Dollar  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Helium

Helium  Starknet

Starknet  Telcoin

Telcoin  Staked Aave

Staked Aave