$SOL trading shows significant strength in its on-chain component. Some of the available liquidity translated into better prices for $SOL.

$SOL is significantly represented on decentralized exchanges. Its native Solana trades offer some of the best market prices, an improvement on centralized price discovery.

Native Solana trading competes with the biggest exchanges, like Binance and OKX, for offering the best price. The arbitrage is unstable, as DEX trading often switches positions with centralized markets.

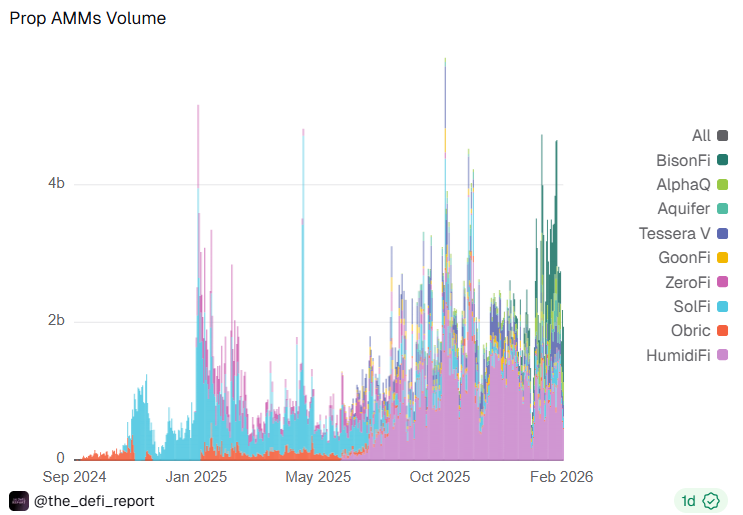

Prop AMM boost Solana volumes

Despite this, native decentralized $SOL trading has sufficient market depth and often surpasses the prices quoted on centralized exchanges. The main reason behind the improved price discovery is proprietary automated market makers (Prop AMM), specialized liquidity pools that offer efficient trading at specific price ranges.

In the past month, Prop AMM exchanges took over, compensating for some of the lagging DEX volume. The space became more competitive with new launches, leading to improved liquidity for $SOL.

$SOL trades with price anomalies on other chains

Some on-chain trading venues are not as efficient. WSOL, the wrapped version of $SOL on Ethereum, Base, and BNB Chain, trades within a vastly different price range.

WSOL ranges between $102 and $95, depending on the chain. Unfortunately, these markets offer limited chances for arbitrage, as some are extremely illiquid. Those chains also incur additional trading and bridging costs.

The Solana network is currently re-evaluating its use cases and the role of $SOL. DEXs are still important, though overall trading volumes have fallen by nearly 90% since October 2025.

What will $SOL treasury companies do in a bear market?

$SOL is seen as a leading indicator for crypto sentiment. The token reflects the sentiment of retail traders, on-chain risk-takers, and new tokenization trends.

Currently, treasury entities hold over 20M $SOL, with no net changes in their treasuries for months. The treasury companies are not yet selling, and around 50% of the treasuries are staked.

One of the opportunities is to tap native $SOL staking as a source of liquidity. This would encourage large entities and treasury holders to preserve their stake, while vitalizing the DeFi activity on Solana.

Jupiter recently introduced a new tool that could tap all natively staked $SOL as a liquid token.

$30B of $SOL is natively staked.

The largest pool of capital on Solana, earning yield but locked out of DeFi.

That changes today.

Introducing Native Staking as Collateral, now live on Jupiter Lend 👇 pic.twitter.com/rpL2xk3e04

— Jupiter (@JupiterExchange) February 16, 2026

The new liquidity opportunity will be available for all Solana validators from inside the Jupiter app. While some DAT companies have staked their $SOL in liquid staking protocols, native staking has remained linked to its basic return from block rewards and fees. Jupiter has unlocked additional value on Solana, while also retaining the passive income and security of native staking.

Historically, $SOL has been known for prolonged bear markets, with silent accumulation. This time, $SOL trades at a higher baseline, but it still raises the issue of whale holders liquidating some of their positions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Tether Gold

Tether Gold  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Pepe

Pepe  Falcon USD

Falcon USD  Aster

Aster  OKB

OKB  Bitget Token

Bitget Token  Pi Network

Pi Network  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BFUSD

BFUSD  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Cosmos Hub

Cosmos Hub  Ethena

Ethena  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Filecoin

Filecoin  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Aptos

Aptos  USDD

USDD  syrupUSDT

syrupUSDT  VeChain

VeChain  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Bonk

Bonk  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Jupiter

Jupiter  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Stable

Stable  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  pippin

pippin  A7A5

A7A5  Sei

Sei  clBTC

clBTC  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  EURC

EURC  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Virtuals Protocol

Virtuals Protocol  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Tezos

Tezos  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Decred

Decred  Story

Story  Lighter

Lighter  Optimism

Optimism  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kinesis Gold

Kinesis Gold  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  Ether.fi

Ether.fi  Gnosis

Gnosis  AINFT

AINFT  Liquid Staked ETH

Liquid Staked ETH  Humanity

Humanity  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  Kaia

Kaia  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  LayerZero

LayerZero  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  SPX6900

SPX6900  Injective

Injective  FLOKI

FLOKI  PRIME

PRIME  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  MYX Finance

MYX Finance  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  JasmyCoin

JasmyCoin  sBTC

sBTC  ADI

ADI  crvUSD

crvUSD  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Lido DAO

Lido DAO  Savings USDD

Savings USDD  Maple Finance

Maple Finance  Conflux

Conflux  Legacy Frax Dollar

Legacy Frax Dollar  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Starknet

Starknet  Telcoin

Telcoin  Helium

Helium  Staked Aave

Staked Aave  Ethereum Name Service

Ethereum Name Service