Bitcoin defends key support amid short-term volatility, with an analyst indicating that recent pullbacks are a result of temporary de-risking.

Bitcoin (BTC) is currently trading just above $89,000, experiencing a notable 5% drop in the past 24 hours. The daily chart shows significant volatility with BTC moving in a range between $87,901 and $92,258 during the day.

The recent decline is attributable to geopolitical risks and a bond market selloff, which have contributed to investor caution across various asset classes, including cryptos. As a result, BTC has faced some downward pressure, and despite a brief recovery from the low, it is still holding below the $90,000 psychological mark.

Bitcoin has decreased 6.6% over the past 7 days, signaling ongoing challenges in the market despite strong fundamentals. However, the crypto firstborn has remained resilient in the longer term, up 0.7% over the past 30 days.

Traders will be keeping an eye on the $89,000 to $90,000 range for signs of support and whether Bitcoin can regain momentum. Where next for Bitcoin?

What’s Next for BTC?

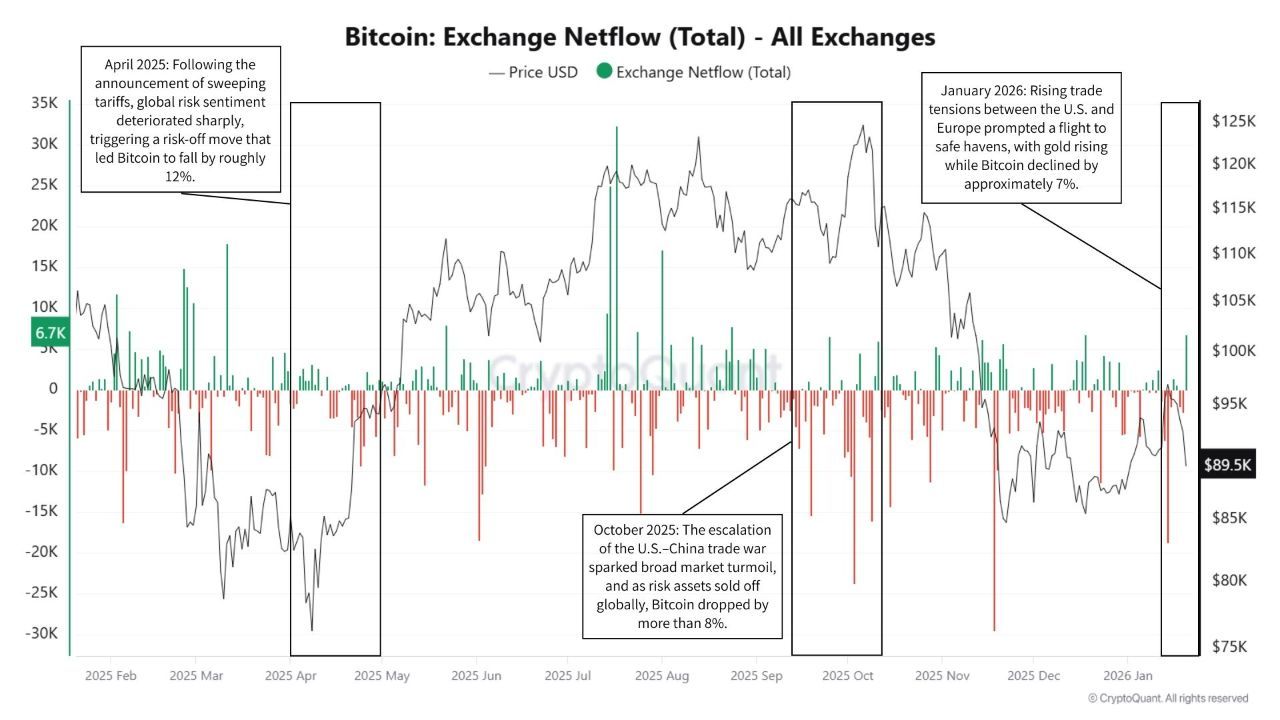

Notably, CryptosRus, an analyst on X, recently analyzed the Bitcoin pullbacks between 2025 and 2026, emphasizing that these price drops align with macro-level shocks related to tariffs and trade tensions. The key examples cited by CryptosRus include the April 2025 drop, where sweeping tariffs triggered a 12% decrease in Bitcoin’s price.

Similarly, in October 2025, the escalation of the U.S.–China trade conflict caused another significant pullback, with Bitcoin dropping around 8%. Lastly, the January 2026 decline occurred amid rising trade risks between the U.S. and Europe, leading to a 7% drop in Bitcoin’s price.

These occurrences highlight Bitcoin’s sensitivity to broader economic policies. They position it as a macro-sensitive risk asset impacted by changes in growth expectations, interest rates, and liquidity.

However, despite these price movements, CryptosRus points out an important detail: exchange netflows have not shown sustained dumping during these sell-offs. While there were temporary bursts of inflows during market drops, these were short-lived, indicating that the market quickly absorbed the selling pressure.

CryptosRus suggests that this behavior reflects temporary de-risking by market participants rather than a structural breakdown in demand for Bitcoin. If exchange inflows were to remain consistently high, this would signal a more significant shift in market sentiment. For now, the volatility appears to be driven by macro-level policy shocks, rather than an indication of the end of the Bitcoin cycle.

Bitcoin Technical Analysis

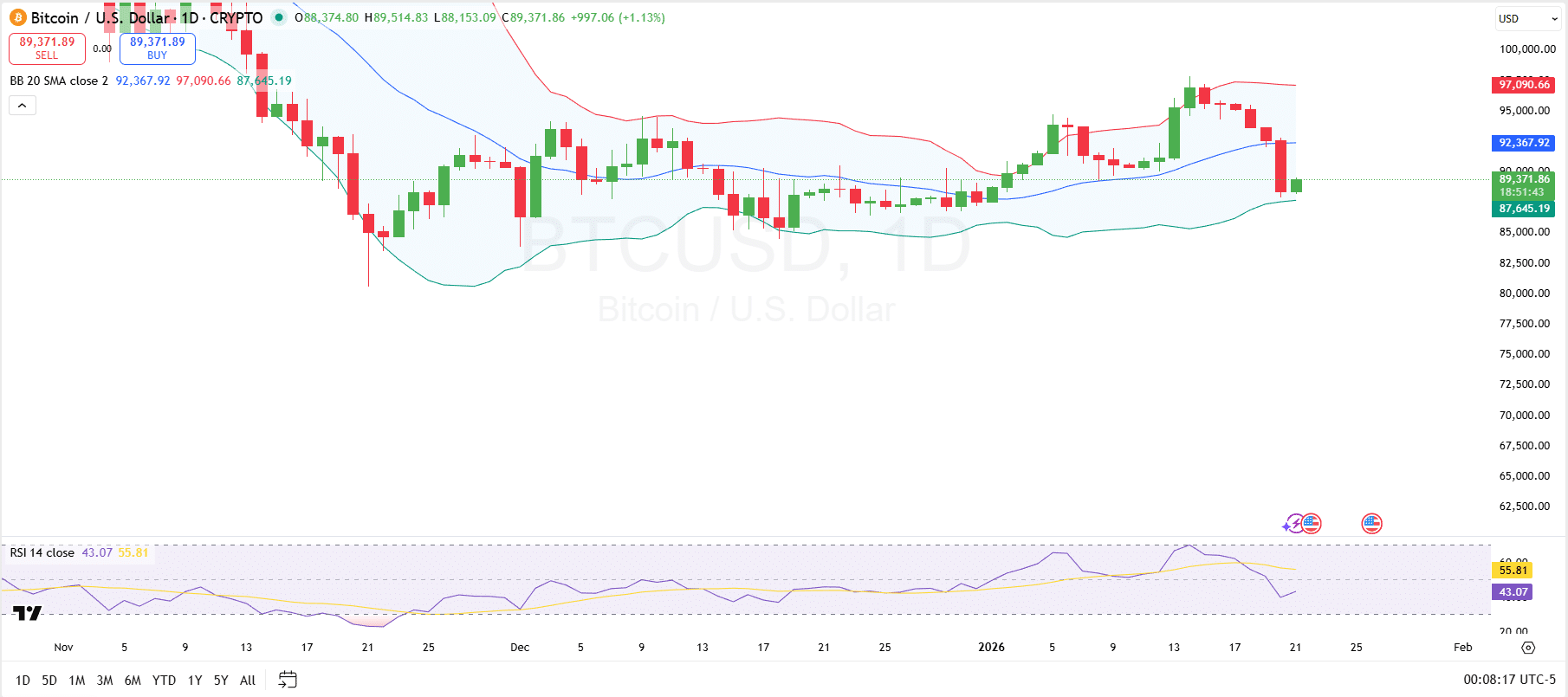

Looking at TradingView, price action has been testing the Bollinger Bands, with the price recently approaching the lower band around $87,645 and subsequently bouncing before touching it. The Relative Strength Index is currently at 43.07, indicating that Bitcoin is now moving towards neutral territory.

If the price manages to hold above the support found at $87,800 and break through the middle band near $92,367, it could be a signal for renewed buying pressure. Conversely, if Bitcoin fails to maintain its support at these levels, the downside risk remains, potentially testing the $87,645 and lower levels.

As the price moves above the middle band, it would indicate that buying momentum is gaining strength, potentially pushing the price toward the upper Bollinger Band near $97,081.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  MYX Finance

MYX Finance  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  LayerZero

LayerZero  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Decred

Decred  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Story

Story  WrappedM by M0

WrappedM by M0  Stable

Stable  pippin

pippin  Optimism

Optimism  Kinesis Gold

Kinesis Gold  Pudgy Penguins

Pudgy Penguins  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Lighter

Lighter  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  River

River  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Resolv USR

Resolv USR  Wrapped Flare

Wrapped Flare  Kaia

Kaia  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Humanity

Humanity  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Aerodrome Finance

Aerodrome Finance  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Olympus

Olympus  Axie Infinity

Axie Infinity  DoubleZero

DoubleZero  ADI

ADI  Staked Aave

Staked Aave