- The Bitcoin price wavering in consolidation revealed the formation of a bearish continuation pattern called inverted pennant.

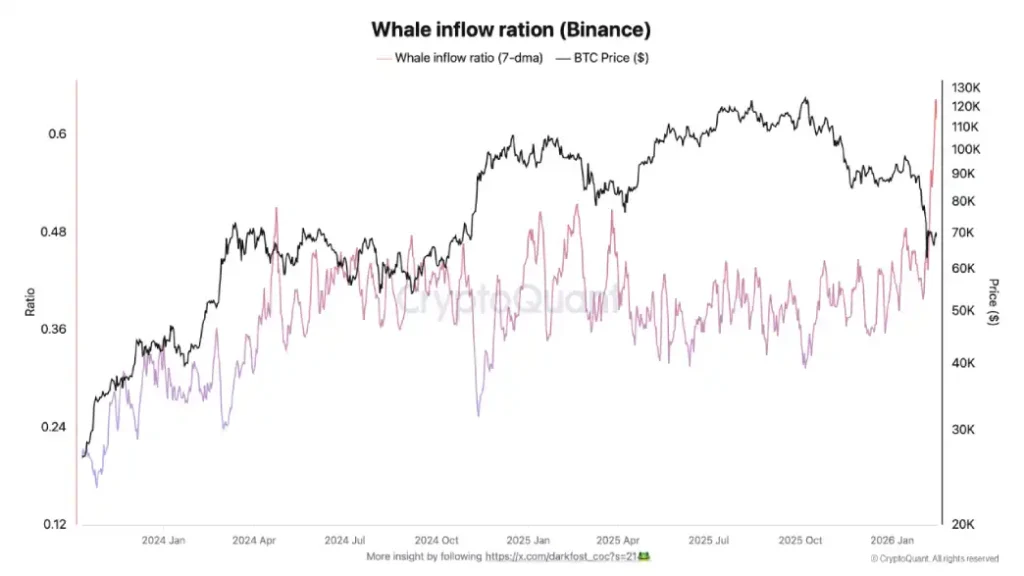

- Binance records a notable spike in whale inflow, suggesting an increased supply of coins available for trading.

- Crypto fear and greed index at 10% indicate a pessimistic sentiment among market participants.

The Bitcoin price is down roughly 2% during Tuesday’s U.S. market hours to exchange hands at $67,521. The downtick tracked declines in tech stocks and gold amid renewed geopolitical tension, indicating a shared macro-driven move. The selling pressure keeps $BTC wobbling in a narrow range around $70,000 projecting lack of initiation from buyers or sellers. In addition, the on-chain data shows a decisive spike in Whale Inflow Ratio, suggesting a heightened large-holder activity and risk for prolonged correction ahead.

Whale Transfers to Exchanges Suggest Potential Volatility Ahead for $BTC

On-chain metrics from CryptoQuant show interesting spikes in the activity of large holders on Binance during the current Bitcoin market downturn. A measure called whale inflow ratio – which divides Bitcoin deposits from the ten largest transactions by overall inflows to the exchange, then smoothes with a seven-day moving average – jumped from about 0.40 to 0.62 between February 2 and February 15.

This shift shows that a significantly larger amount of incoming $BTC for that time period came from major wallets, on scales not seen in over two years. Such patterns are often correlated with increased availability of coins to trade on the platform as large participants transfer assets from personal storage to exchange accounts.

Analysts attribute the uptick to a number of factors. One individual who comes to mind is a wallet belonging to Garrett Jin, sometimes referred to as the “19D5” or “Hyperunit whale,” who transferred almost 10,000 $BTC to Binance in recent weeks. Beyond this solitary player, wider data exists of various significant transfers flowing to the exchange because of its high liquidity amidst volatile conditions.

The surge comes as Bitcoin has pulled back from previous highs, with prices lingering around $67,000-$68,000 in mid-February after testing lower ranges. Investors in all categories seem to be adjusting positions against uncertainty, resulting in high exchange deposits from big holders.

Historically, whales moving $BTC to exchange has coincided with major market corrections and heightened selling pressure.

Bitcoin Price Analysis Reveals Key Bearish Continuation Pattern

The Bitcoin price has been wavering around $70,000 for the past two weeks. The consolidation struggles to sustain a long divergence from the aforementioned level, suggesting lack of confidence for buyers or sellers.

However, a deeper analysis of the 4-hours chart shows that price action has been resonating within two converging trendlines which revealed the formation of inverted pennant pattern. The prevailing downtrend displayed with a long downsloping trendline and a triangle formation shows the pattern formation.

Theoretically, this triangle acts as a breathing period for sellers to replenish bearish momentum before the next breakdown. If the chart setup holds true, the Bitcoin price is poised for a bearish breakdown from the pattern’s bottom trendline at $67,200, and the post-breakdown fall could push the asset another 18% down to hit $55,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Zcash

Zcash  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Cronos

Cronos  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Pepe

Pepe  Aster

Aster  Falcon USD

Falcon USD  Bittensor

Bittensor  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Circle USYC

Circle USYC  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BFUSD

BFUSD  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Quant

Quant  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  USDD

USDD  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  Usual USD

Usual USD  Stable

Stable  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  pippin

pippin  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  USDai

USDai  EURC

EURC  Stacks

Stacks  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Decred

Decred  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Injective

Injective  Kinesis Gold

Kinesis Gold  Story

Story  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Lighter

Lighter  Chiliz

Chiliz  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Curve DAO

Curve DAO  COCA

COCA  Ether.fi

Ether.fi  LayerZero

LayerZero  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  AINFT

AINFT  Bitcoin SV

Bitcoin SV  Kaia

Kaia  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Gnosis

Gnosis  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  ADI

ADI  The Graph

The Graph  SPX6900

SPX6900  IOTA

IOTA  Humanity

Humanity  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Aerodrome Finance

Aerodrome Finance  Renzo Restaked ETH

Renzo Restaked ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  sBTC

sBTC  Helium

Helium  crvUSD

crvUSD  Lido DAO

Lido DAO  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Savings USDD

Savings USDD  Optimism

Optimism  Legacy Frax Dollar

Legacy Frax Dollar  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Maple Finance

Maple Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Ethereum Name Service

Ethereum Name Service  Telcoin

Telcoin  DoubleZero

DoubleZero  Staked Aave

Staked Aave