Claims that Wall Street trading firm Jane Street triggers a daily 10 a.m. Bitcoin “dump” resurfaced on December 12, after BTC saw a sharp intraday drop.

Social media speculation once again pointed to institutional traders and ETF market makers. A closer look at the data, however, tells a more nuanced story.

What is the “Jane Street 10 a.m.” Narrative?

The theory suggests Bitcoin often sells off around 9:30–10:00 a.m. ET, when US equity markets open. Jane Street is frequently named because it is a major market maker and an authorized participant for US spot Bitcoin ETFs.

The allegation claims these firms push prices lower to trigger liquidations, then buy back cheaper. However, no regulator, exchange, or data source has ever confirmed such coordinated activity.

BREAKING: The 10am manipulation is back.

Bitcoin dropped $2,000 in 35 minutes and wiped out $40 billion from its market cap.

$132 million worth of longs have been liquidated in the past 60 minutes.

This is getting ridiculous. pic.twitter.com/RByT4CWF65

— Bull Theory (@BullTheoryio) December 12, 2025

Bitcoin Futures Data Doesn’t Show Aggressive Dumping

Bitcoin traded sideways today through the US market open, holding a tight range near $92,000–$93,000. There was no sudden or abnormal sell-off exactly at 10:00 a.m. ET.

The sharp drop came later in the session, closer to mid-day US hours. BTC briefly fell below $90,000 before stabilizing, suggesting delayed pressure rather than an open-driven move.

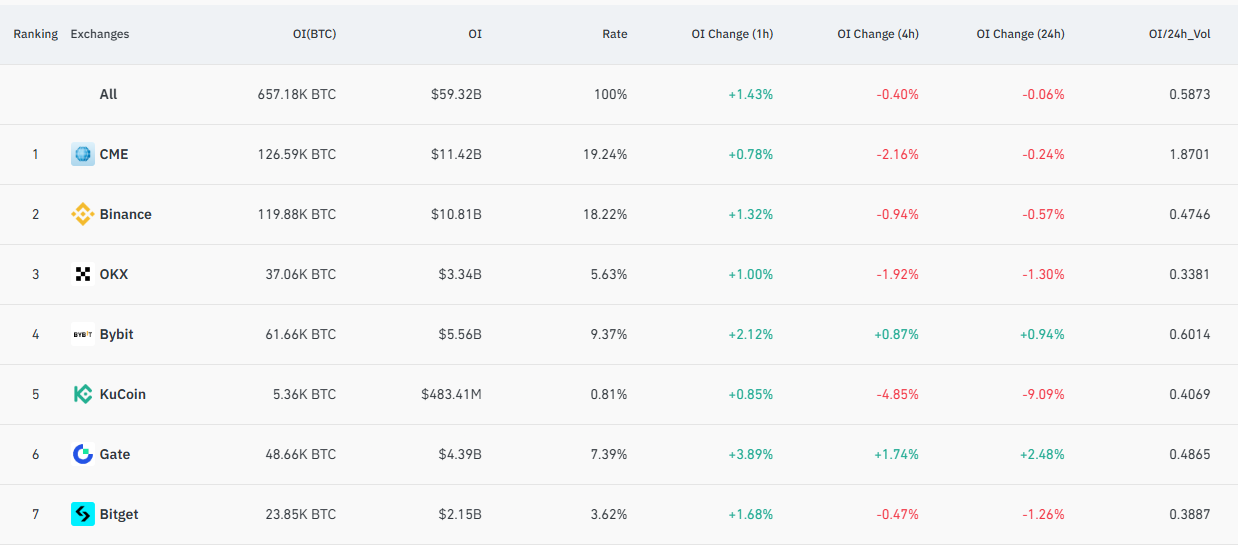

Bitcoin futures open interest across major exchanges remained broadly stable. Total open interest was nearly flat on the day, indicating no large buildup of new short positions.

On CME, the most relevant venue for institutional trading, open interest declined modestly. That pattern typically reflects risk reduction or hedging, not aggressive directional selling.

If a major proprietary firm were driving a coordinated dump, a sharp spike or collapse in open interest would normally appear. It did not.

Liquidations Explain the Move

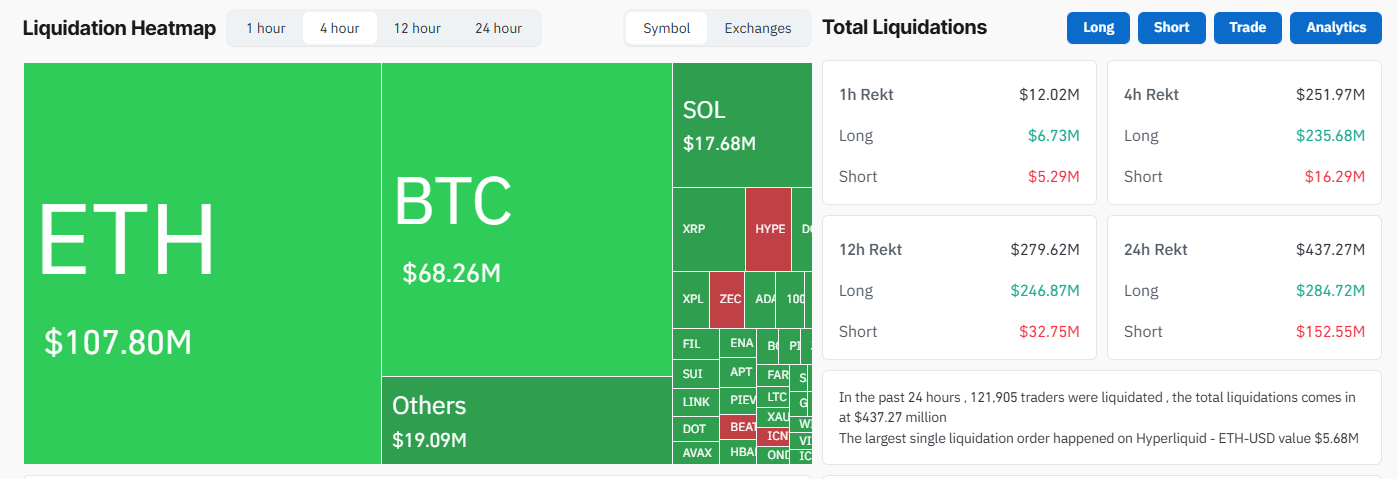

Liquidation data provides a clearer explanation. Over the past 24 hours, total crypto liquidations exceeded $430 million, with long positions accounting for the majority.

Bitcoin alone saw more than $68 million in liquidations, while Ethereum liquidations were even higher. This indicates a leverage flush across the market, not a Bitcoin-specific event.

When prices slip below key levels, forced liquidations can accelerate declines. This often creates sharp drops without requiring a single dominant seller.

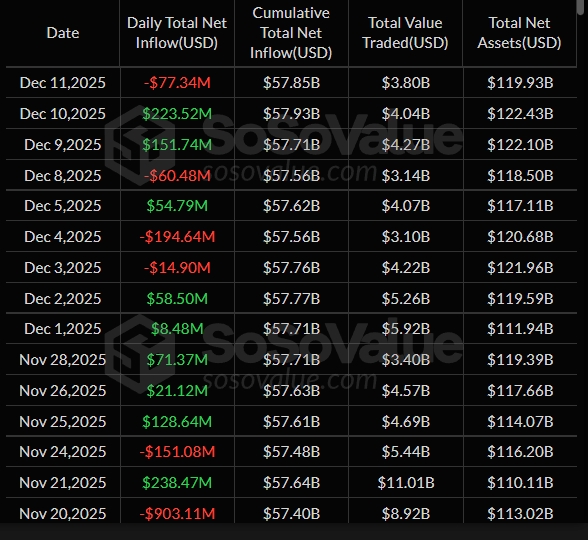

Most notably, US spot Bitcoin ETFs recorded $77 million outflow on December 11, after two days of steady inflow. Today’s brief price shock was largely reflected in this move.

No Single Venue Led the Sell-Off

The move was distributed across exchanges, including Binance, CME, OKX, and Bybit. There was no evidence of selling pressure concentrated on one venue or one instrument.

That matters because coordinated manipulation typically leaves a footprint. This event showed broad, cross-market participation consistent with automated risk unwinds.

Why the Jane Street Narrative Keeps Returning

Bitcoin volatility often clusters around US market hours due to ETF trading, macro data releases, and institutional portfolio adjustments. These structural factors can make price moves appear patterned.

Jane Street Bots already entered Polymarket xD

While most traders chase narratives, one Polymarket account turned 15-minute crypto prediction windows into a mechanical profit engine.

Trader didn’t build a sophisticated arbitrage bot.

He found something simpler, momentum lag on… pic.twitter.com/KHUJog4u6C

— gemchanger (@gemchange_ltd) December 12, 2025

Jane Street’s visibility in ETF market making makes it an easy target for speculation. But market making involves hedging and inventory management, not directional price attacks.

Today’s move fits a familiar pattern in crypto markets. Leverage builds, price slips, liquidations cascade, and narratives follow.

The post Did Jane Street Cause Another 10 a.m. Bitcoin Dump Today? appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Bitget Token

Bitget Token  Aave

Aave  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Ripple USD

Ripple USD  OKB

OKB  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Pepe

Pepe  Sky

Sky  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  MYX Finance

MYX Finance  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Wrapped BNB

Wrapped BNB  Official Trump

Official Trump  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  LayerZero

LayerZero  EURC

EURC  Jupiter

Jupiter  Stacks

Stacks  pippin

pippin  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Decred

Decred  WrappedM by M0

WrappedM by M0  Story

Story  River

River  Kinesis Gold

Kinesis Gold  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Stable

Stable  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sun Token

Sun Token  Kaia

Kaia  Kinesis Silver

Kinesis Silver  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.fi

Ether.fi  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  crvUSD

crvUSD  Resolv USR

Resolv USR  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Lido DAO

Lido DAO  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Legacy Frax Dollar

Legacy Frax Dollar  Olympus

Olympus  Jupiter Staked SOL

Jupiter Staked SOL  JasmyCoin

JasmyCoin  Savings USDD

Savings USDD  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  SPX6900

SPX6900  Marinade Staked SOL

Marinade Staked SOL  Humanity

Humanity  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  ADI

ADI  Telcoin

Telcoin  Axie Infinity

Axie Infinity