Bitcoin slipped under $90,000 this week as liquidation pressure, weak ETF demand, and macro uncertainty converged.

The fall erased gains from earlier attempts to reclaim the $94,000–$95,000 zone, marking the second major breakdown this month.

Forced Liquidations Across the Market

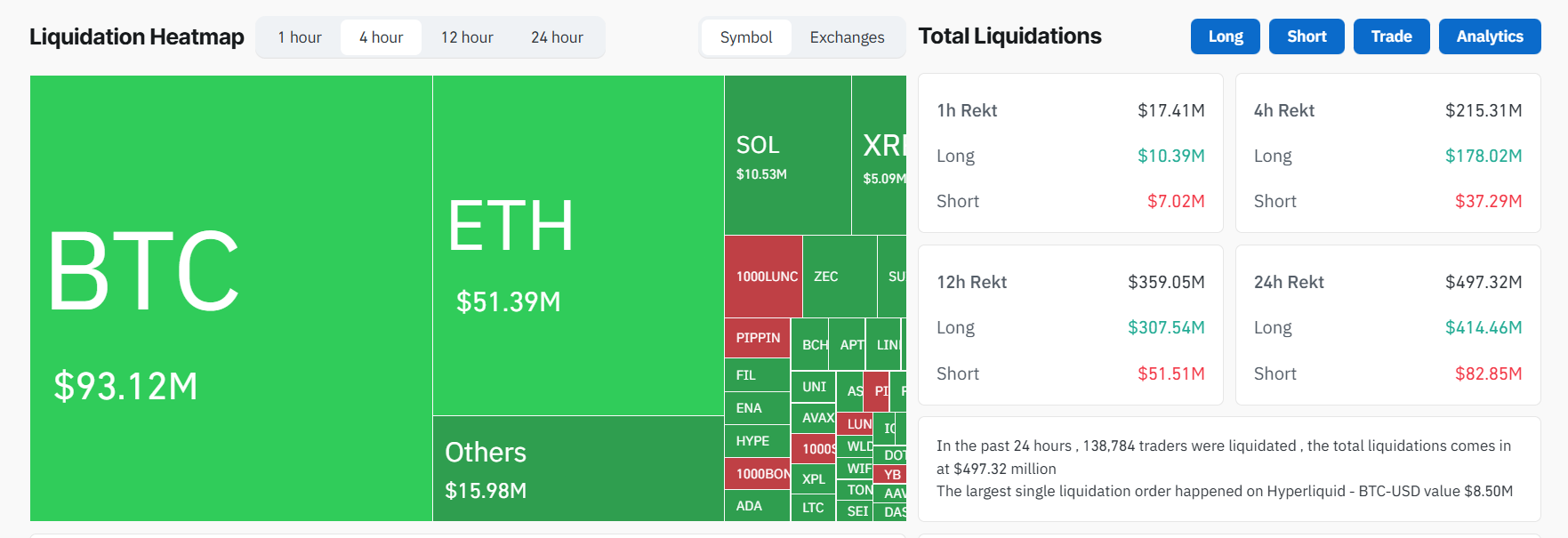

The catalyst was a cascade of forced long liquidations. Nearly $500 million was wiped out across exchanges, including around $420 million in long positions, and over 140,000 traders were liquidated in a 24-hour window.

ETF flows failed to absorb the selling. BlackRock’s iShares Bitcoin Trust recorded six straight weeks of outflows totaling more than $2.8 billion.

US ETF inflows fell to just $59 million on December 3, signalling fading appetite from institutions.

Macro Pressure Added Fuel to the Drop

The macro backdrop turned hostile. The Bank of Japan signaled a possible rate hike, threatening the carry-trade liquidity that helped sustain global risk assets.

Traders also derisked ahead of the US PCE inflation release, forcing Bitcoin into a cautious $91,000–$95,000 holding pattern.

BREAKING: Bitcoin pumped $1500 on the lower than expected PCE data. But then it crashed -$3500 in 60 minutes.

This wiped out $155 million worth of long positions in last 1 hour.

There is no negative news or sudden FUD which could cause this type of sudden dump.

It appears that… pic.twitter.com/G3twQw0Yud

— Bull Theory (@BullTheoryio) December 5, 2025

The latest US PCE data arrived broadly in line with expectations, showing cooling core inflation but still above the Federal Reserve’s target.

Markets reacted cautiously, interpreting the print as evidence that inflation continues to ease, but not fast enough to guarantee rapid rate cuts.

Corporate signals amplified the fear. MicroStrategy warned it may sell Bitcoin if its treasury-valuation ratio weakens, triggering a 10% decline in its stock.

Miner stress increased as energy costs rose, hashrate fell, and high-cost operators began liquidating BTC to remain solvent.

On-chain flows reflected split sentiment. Matrixport moved more than 3,800 BTC off Binance into cold storage, suggesting accumulation among long-term holders.

However, analysts estimate that a quarter of all circulating supply remains underwater at current prices.

Matrixport has withdrawn 3,805 $BTC($352.5M) from #Binance over the past 24 hours. pic.twitter.com/54whKSsISy

— Lookonchain (@lookonchain) December 5, 2025

Community Sentiment Shows Fear — With Pockets of Optimism

Traders on social platforms debated whether the move was natural or manipulated. Market analysts largely blamed excess leverage, thin liquidity, and macro-hedging rather than coordinated price intervention.

Others pointed to long-term optimism, citing JPMorgan’s fresh $170,000 price model for 2026.

Bitcoin now trades near a critical pivot. Liquidation clusters between $90K and $86K leave the market vulnerable without renewed ETF inflows or easing macro pressure.

A move back above $96,000–$106,000 is needed to confirm recovery momentum.

For now, volatility rules the tape. Bitcoin has fallen, rebounded, and broken again — and traders are watching for the next decisive move.

The post Why Did Bitcoin Drop Below $90,000 Again? A Breakdown of the Latest Sell-Off appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  MYX Finance

MYX Finance  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  LayerZero

LayerZero  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Decred

Decred  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Story

Story  WrappedM by M0

WrappedM by M0  Stable

Stable  pippin

pippin  Optimism

Optimism  Kinesis Gold

Kinesis Gold  Pudgy Penguins

Pudgy Penguins  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Lighter

Lighter  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  River

River  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Resolv USR

Resolv USR  Wrapped Flare

Wrapped Flare  Kaia

Kaia  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Humanity

Humanity  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Aerodrome Finance

Aerodrome Finance  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Olympus

Olympus  Axie Infinity

Axie Infinity  DoubleZero

DoubleZero  ADI

ADI  Staked Aave

Staked Aave