DeFi activity moved to the highest levels since the October 10-11 crash. The recent market capitulation turned into a DeFi stress test, with most protocols surviving the sudden spike in activity.

DeFi activity picked up during the latest market downturn, reaching its highest levels of DEX activity in the past few months.

Leading decentralized protocols still produce some of their highest fees, with most activity concentrated on Aave, Morpho, Jupiter, and other leading DeFi protocols and DEXs. The most active elements of the DeFi ecosystem are still perpetual futures DEX, lending, and general DEX aggregators and markets.

The major difference during this crypto cycle is that the downturn has not caused cascading liquidations or the breakdown of DeFi protocols. All involved DEXs and chains handled the extreme trades and traffic.

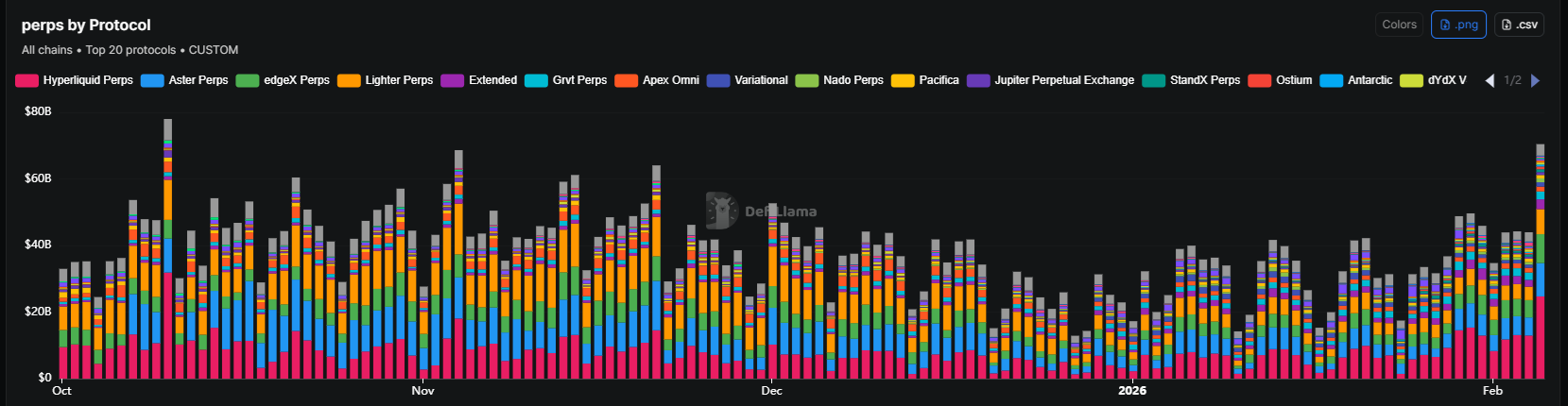

The biggest shift in activity came from perpetual futures DEXs, which have already turned into some of the most liquid markets. Peak liquidity was concentrated on Hyperliquid and Aster.

The current market downturn did not cause major rug pulls, liquidity problems, or DeFi liquidations, as most of the protocols installed sufficient protections. Hyperliquid survived its current trading overload, with fewer cascading liquidations compared to October’s event.

DeFi slows down, but avoids crash

DeFi activity slowed down, as value locked fell to levels not seen since March 2024. Most of the protocols remained relatively resilient, as the collaterals were deposited at a lower price range.

Despite the drawdown, protocols like Aave and Lido continue to draw in deposits and active lending, among the biggest fee producers in the Ethereum ecosystem. On-chain lending remains well above its 2022 levels, holding over $51B in value locked.

During previous market cycles, lending was heavily affected by drawdowns due to panic and the lack of protection. In the latest market cycle, most of the leading protocols showed no signs of distress or bad loans.

$ETH liquidation levels are slightly lower than the market, with the first significant liquidation level in the $1,890 range. The busiest protocols like Morpho reported 5,000 liquidations valued at $105M in the past 24 hours, but the remaining vaults and positions remain stable. Other protocols are processing loan repayments as usual, avoiding a liquidation cascade.

Despite the relative stability, users are urged not to take out new loans on decentralized protocols. The increased market volatility may accelerate liquidations in the future. However, the unwinding is still gradual compared to previous cycles.

Does DeFi still hold risks?

While DeFi has shown it is technically robust, the ecosystem still holds risk during a protracted market downward move.

The first major risk is $ETH-based liquidity, which may trigger liquidations if not all loans are repaid.

Other risks include the draining of liquidity from some of the leading trading pairs, especially those concentrating liquidity at a certain price range.

The biggest risk is a liquidation cascade if funds have been reused across protocols, opening more positions than the initial $ETH collateral supports.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  MYX Finance

MYX Finance  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  Jupiter

Jupiter  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  Decred

Decred  LayerZero

LayerZero  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Stable

Stable  WrappedM by M0

WrappedM by M0  Story

Story  pippin

pippin  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Lighter

Lighter  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  River

River  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Resolv USR

Resolv USR  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  crvUSD

crvUSD  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  PRIME

PRIME  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Axie Infinity

Axie Infinity  Olympus

Olympus  DoubleZero

DoubleZero  ADI

ADI  Staked Aave

Staked Aave