Kamino Lending, the growing DeFi protocol on Solana, will rebrand and offer six new products. Kamino announced its plans during the Solana Breakpoint event in Abu Dhabi.

Kamino will shift from pure crypto lending to a wider selection of DeFi products, offering six new services. The app is trying to adapt to a shifting DeFi climate, as Solana attempts to gain a wider share of DeFi and external liquidity.

The biggest shift on Kamino will affect its capacity to tokenize real-world assets. Kamino chose this path of expansion after significant RWA growth in the past year.

Introducing the new Kamino

A refreshed brand. Six new products. A platform built for the next generation of assets and institutions moving onchain.

Welcome to the next chapter 🧵 pic.twitter.com/MVrfl3NGro

— Kamino (@kamino) December 12, 2025

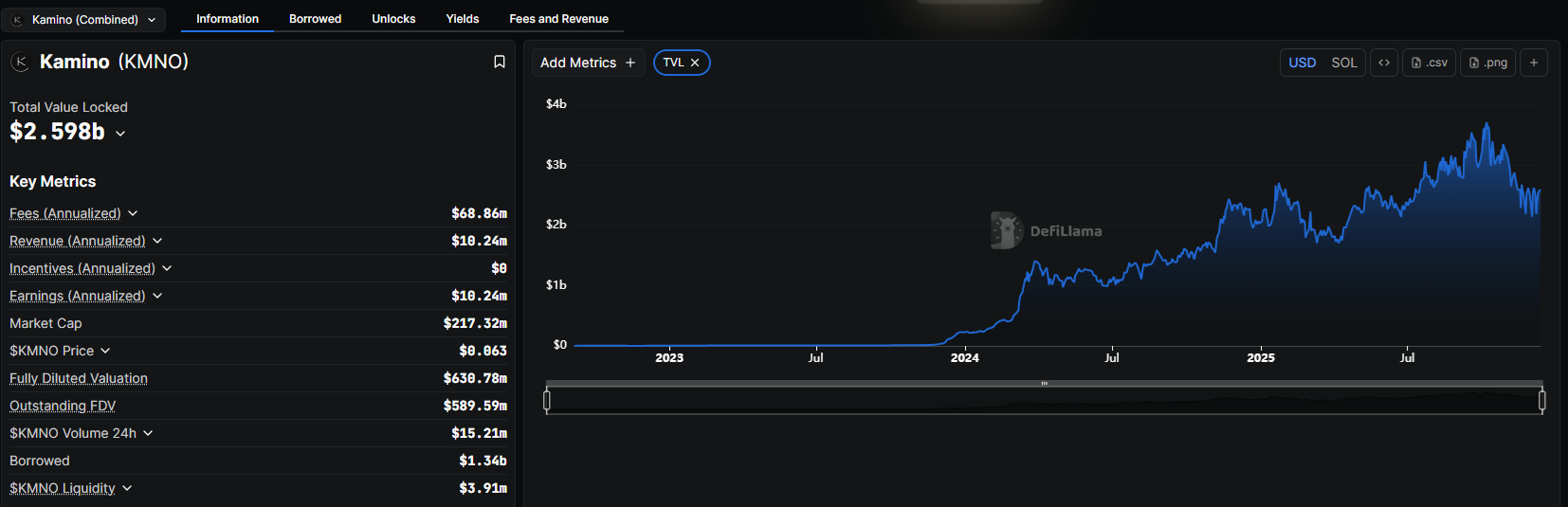

Kamino previously worked to provide liquidity and increase its influence by accepting multiple meme tokens as collateral. The protocol accrued $2.59B in total value locked.

The slower Solana meme market and the risky collateral, however, led Kamino to reshape its business. The protocol now aims to become the bridge between asset tokenization and DeFi.

Kamino targets institutional users

During the Solana meme boom, Kamino served retail and whale insiders, providing USDC liquidity against stablecoins.

For 2026, Kamino set a new plan, aiming to offer institutional-grade services. To that end, Kamino unveiled its six new products, partially linked to its lending structure.

Kamino will add a fixed-rate product, locking the borrowing rate for a certain term. FalconX will become the pilot borrower, demonstrating the institutional-grade credit.

Another product will build a lending market through borrowing intents. Potential borrowers will post their desired terms, and will be matched with lenders.

Lending in the crypto space is a bit too volatile. Rates depend on liquidity pool utilization and can vary widely, creating high-risk, unpredictable loans. By necessity, crypto has also had to use much larger collateral to secure some of its loans, leading to inefficiencies that are not acceptable to institutions.

Kamino will also integrate off-chain collateral, allowing on-chain borrowing for assets in qualified custody. The protocol will use Chainlink data and issue loans in partnership with Anchorage Digital. Kamino will also join the private credit trend by launching a new BTC-backed USDC vault.

For RWA expansion, the protocol aims to launch a specialized DEX. The protocol will build liquidity for tokenized assets, while also using precise oracles for pricing. Currently, XStocks is the standard of Solana-based tokenized stocks, but the assets are not integrated into DeFi.

The last new product will be a Build Kit, targeting developers with SDK and API access, to integrate Kamino yield into other apps.

Kamino is still the leading lending protocol on Solana

Kamino Lend is still the biggest lending protocol on Solana. As a whole, the chain carries $3.6B locked in lending liquidity, of which Kamino has a share of up to 75%.

The biggest competitor of Kamino is Jupiter Lend, which emerged in the second half of 2025 and quickly started accumulating loans. Initially, Kamino even tried to prevent its users from using Jupiter Lend.

The recent expansion with new products may boost the overall market share of Kamino and offset some of the lost revenues from retail users switching to Jupiter Lend.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Rain

Rain  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Bitget Token

Bitget Token  Aave

Aave  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Sky

Sky  OKB

OKB  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Pepe

Pepe  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Quant

Quant  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  Midnight

Midnight  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  MYX Finance

MYX Finance  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  LayerZero

LayerZero  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  TrueUSD

TrueUSD  pippin

pippin  clBTC

clBTC  Sei

Sei  EURC

EURC  Stacks

Stacks  Jupiter

Jupiter  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Decred

Decred  WrappedM by M0

WrappedM by M0  Story

Story  Stable

Stable  Kinesis Gold

Kinesis Gold  Pudgy Penguins

Pudgy Penguins  Optimism

Optimism  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Curve DAO

Curve DAO  River

River  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Kaia

Kaia  AINFT

AINFT  Wrapped Flare

Wrapped Flare  Kinesis Silver

Kinesis Silver  Maple Finance

Maple Finance  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.fi

Ether.fi  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  crvUSD

crvUSD  PRIME

PRIME  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Humanity

Humanity  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  IOTA

IOTA  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Resolv USR

Resolv USR  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  JasmyCoin

JasmyCoin  Savings USDD

Savings USDD  Celestia

Celestia  Olympus

Olympus  ADI

ADI  Marinade Staked SOL

Marinade Staked SOL  SPX6900

SPX6900  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Aerodrome Finance

Aerodrome Finance  Telcoin

Telcoin  Axie Infinity

Axie Infinity