Zerolend, a multichain decentralized lending protocol, has just announced it is shutting down its lending markets after years of building. This is part of a broader wave of projects in the DeFi sector facing shutdowns due to similar reasons.

The decision to sunset Zerolend operations gradually comes after around three years of building. According to the team, it was not an easy decision, but it was necessary in the face of unsustainable conditions.

Why Zerolend is shutting down

According to a post from the team, the main reasons behind the decision include:

- Inactivity or significant drops in liquidity/activity in many of the supported chains

- Oracle provides discontinuing support

- Hacks and exploits

There is also the problem of thin profit margins in lending, which led to prolonged losses. As part of the wind-down of the protocol, most markets have had their loan-to-value (LTV) ratios set to 0%, meaning borrowing is disabled and only withdrawals are allowed.

The team has urged users to withdraw their funds as soon as possible via the app. For assets stuck in low-liquidity chains, the team promised upgrades that will enable recovery. The announcement and subsequent process are an attempt by the protocol to end things honorably rather than shocking its users with sudden death.

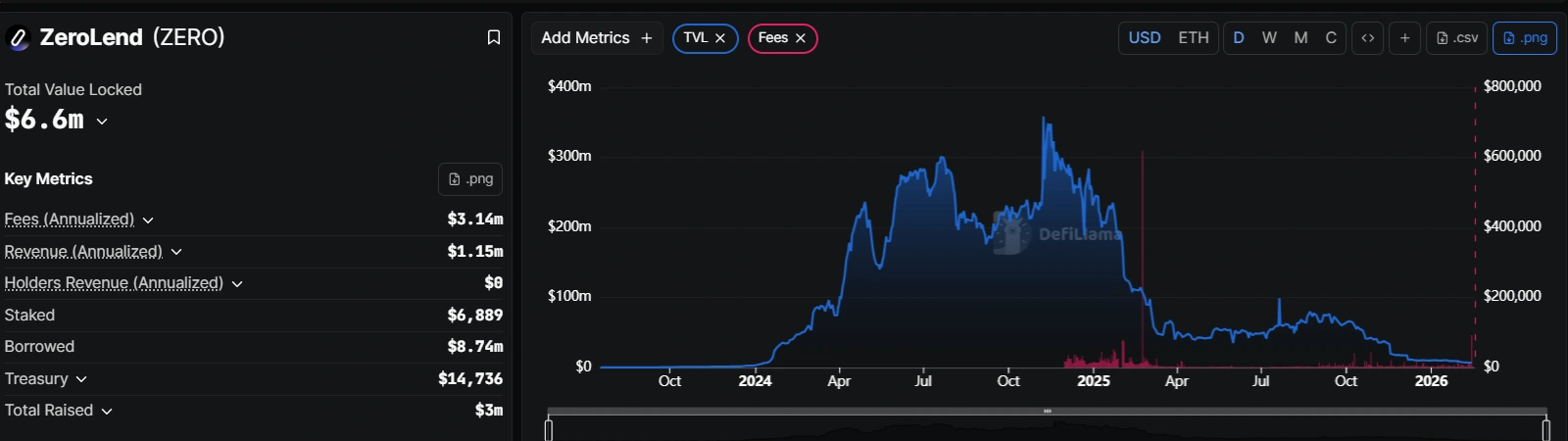

The protocol burst onto the scene in early 2024 and grew significantly on L2 chains like Linea and Zksync. It currently has a TVL of $6.6 million, a value that is near all-time lows post wind-down.

Other DeFi projects have shutdown for similar reasons

Zerolend has announced plans to shut down, citing unfavorable conditions, but it is not the only project to do so. Some other DeFi protocols have announced shutdowns or strategic pivots amid the maturing market.

A good example is Polynomial, a DeFi derivatives protocol that announced it was ceasing operations around February 14, 2026. This puts an end to the Polynomial chain and Polynomial trade. The process includes forced liquidations, liquidity layer closure, and full chain shutdown.

The protocol had initially planned a TGE for Q1 2026, but that has been shelved with the team citing it as a worthless venture since the product is dying. In the future, the team will pivot to new projects with priority for early backers.

Another good example of a DeFi protocol that has packed up is Alpaca Finance, a leveraged yield farming and lending protocol on BNB. It announced plans to fully sunset its activities by the end of 2025, citing revenue struggles and delisting from major exchanges like Binance.

Elixir’s deUSD has also shut down after raking in heavy losses linked to the $93M collapse of Stream Finance, a protocol it was connected to.

To be clear, what is happening is not a mass exodus of DeFi projects. If experts are to be believed, this is a natural pruning occurring in a maturing environment. Most of the protocols facing shutdowns are on the smaller end; meanwhile, the bigger, more prominent projects have been getting more attention.

This suggests that the market is rallying around battle-tested projects while others face natural attrition. Some of the thriving protocols include Aave, the undisputed leader where on-chain lending is concerned, Morpho, a next-gen option in lending, and Compound, one of the original projects that sparked DeFi summer.

While Aave is thriving, it has also had to make some strategic cuts in response to the market conditions. For example, it has had to shut down its Avara web3 brand to ensure 100% of its focus is channeled towards preserving its lending franchise.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  Pepe

Pepe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Circle USYC

Circle USYC  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Internet Computer

Internet Computer  BFUSD

BFUSD  Pump.fun

Pump.fun  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Ethena

Ethena  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Algorand

Algorand  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Aptos

Aptos  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  VeChain

VeChain  syrupUSDT

syrupUSDT  USDD

USDD  pippin

pippin  Ondo US Dollar Yield

Ondo US Dollar Yield  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Beldex

Beldex  Bonk

Bonk  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Stable

Stable  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  Jupiter

Jupiter  Sei

Sei  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  EURC

EURC  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Lighter

Lighter  Decred

Decred  Story

Story  Optimism

Optimism  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kinesis Gold

Kinesis Gold  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  MYX Finance

MYX Finance  Humanity

Humanity  LayerZero

LayerZero  Liquid Staked ETH

Liquid Staked ETH  Bitcoin SV

Bitcoin SV  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  Kaia

Kaia  Gnosis

Gnosis  Ether.fi

Ether.fi  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Pyth Network

Pyth Network  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  FLOKI

FLOKI  Celestia

Celestia  The Graph

The Graph  Binance-Peg XRP

Binance-Peg XRP  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  JasmyCoin

JasmyCoin  PRIME

PRIME  sBTC

sBTC  Lido DAO

Lido DAO  Aerodrome Finance

Aerodrome Finance  ADI

ADI  Jupiter Staked SOL

Jupiter Staked SOL  crvUSD

crvUSD  Savings USDD

Savings USDD  Maple Finance

Maple Finance  Conflux

Conflux  Legacy Frax Dollar

Legacy Frax Dollar  Marinade Staked SOL

Marinade Staked SOL  DoubleZero

DoubleZero  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Olympus

Olympus  Starknet

Starknet  Telcoin

Telcoin  Ethereum Name Service

Ethereum Name Service  Staked Aave

Staked Aave