Ethereum’s price isn’t just about blockchain upgrades or on-chain activity. It’s also tethered to the same macroeconomic winds that sway equities and bonds. With the U.S. government shutdown now delaying critical economic data, the Federal Reserve faces a blind spot ahead of its October policy meeting. That uncertainty feeds directly into how risk assets, including ETH, are priced. The chart shows Ethereum price in recovery mode, but the shutdown throws in a new layer of volatility.

Why the Shutdown Matters for ETH Price?

The shutdown halts the Bureau of Labor Statistics, meaning no official jobs report or inflation data. For the Fed, this is like steering without instruments. Normally, such data drives interest rate decisions, and rates in turn shape liquidity across markets. If the Fed hesitates to cut without reliable numbers, risk assets like ETH price could lose momentum. On the flip side, if private data (like ADP payrolls) looks weak, the Fed may lean toward more cuts, boosting liquidity and indirectly supporting crypto.

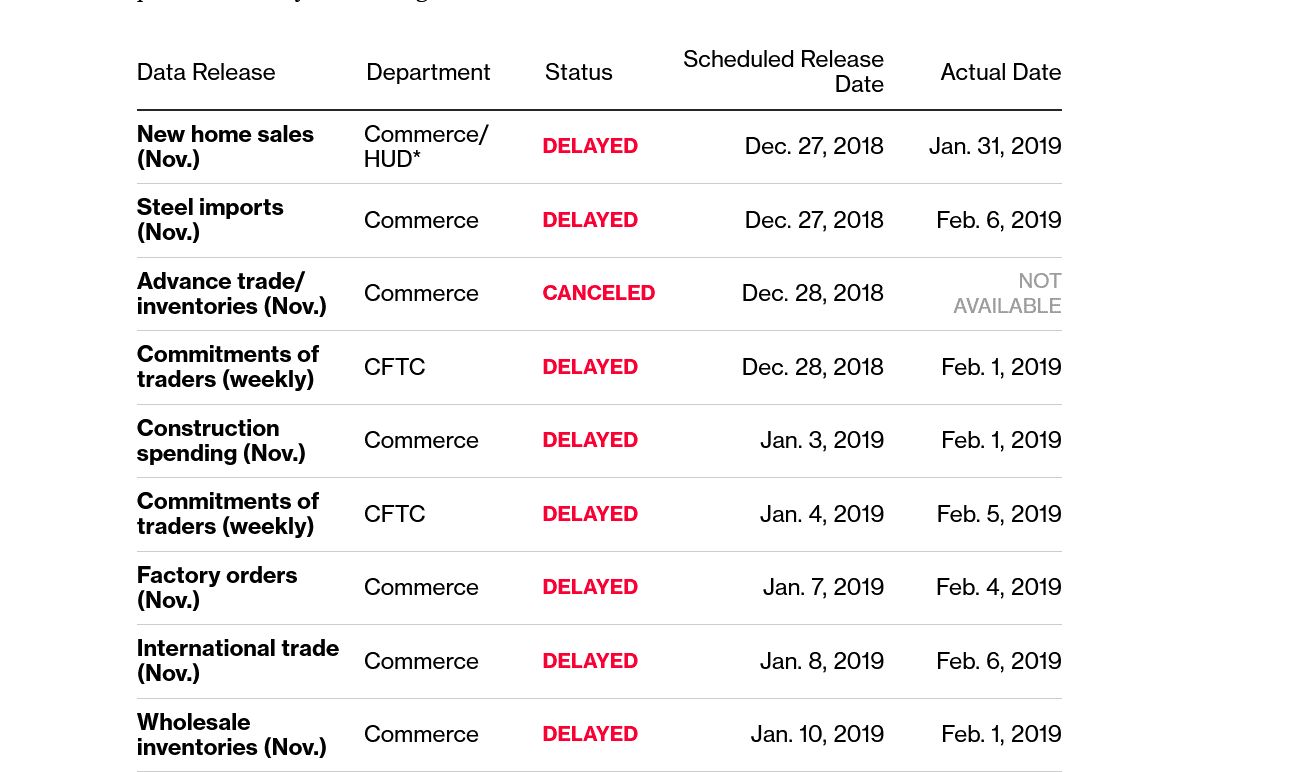

This isn’t just theory. During the 2018–2019 shutdown, delayed reports caused the Fed to pause its rate hikes, underscoring how policy can be swayed by missing data. If the current shutdown drags, ETH price could swing on shifting expectations of Fed policy rather than its own fundamentals. In the 17-day shutdown of October 2013, when the BLS last shut down, both the September and October reports were pushed back.

Ethereum Price Prediction: Reading the ETH Daily Chart

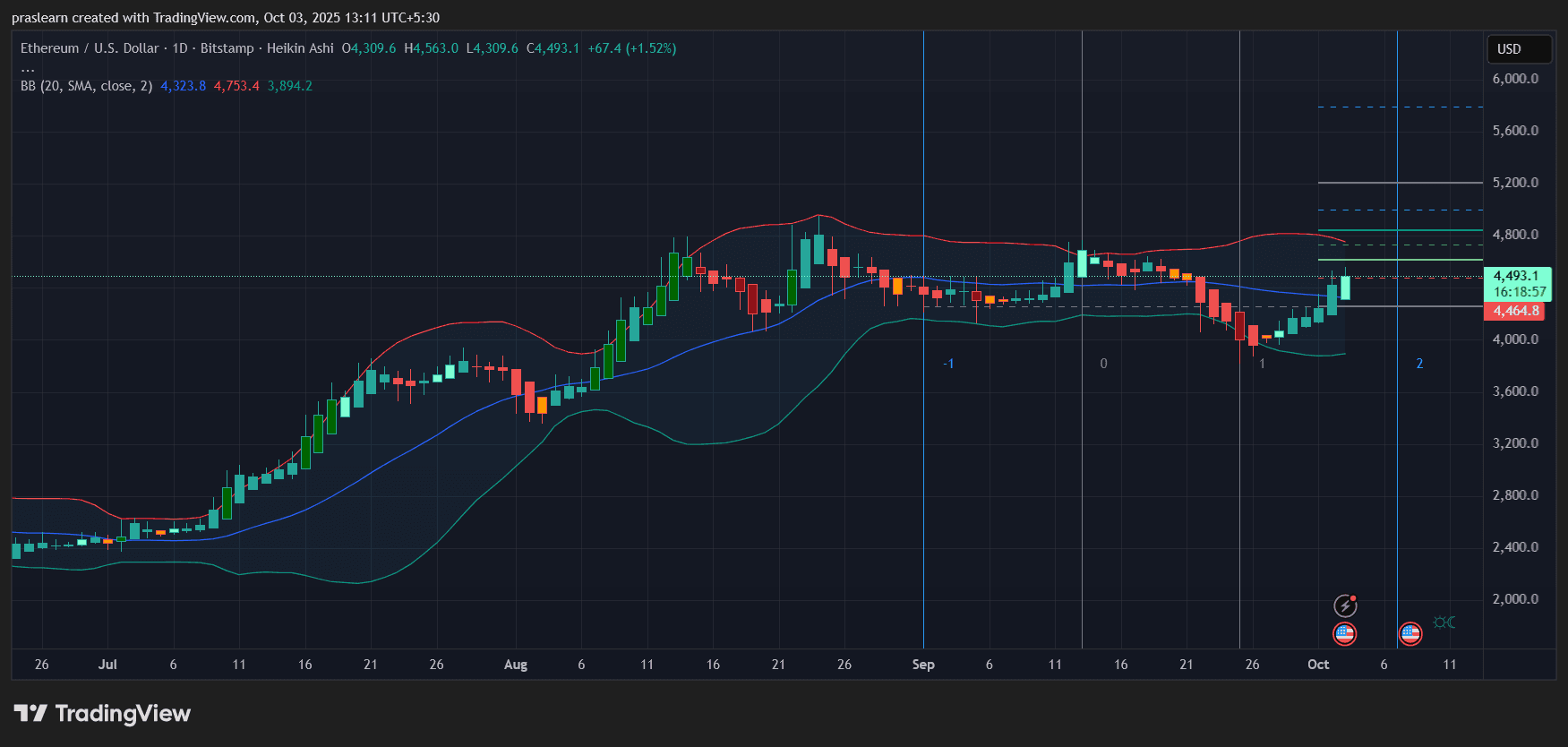

The chart shows Ethereum price bouncing strongly from the $4,300 zone, now trading around $4,493. Key technical signals:

- The lower Bollinger Band near $3,900 acted as support, with buyers stepping in aggressively.

- Price has reclaimed the middle band and is pushing toward the upper band near $4,750, which is the immediate resistance.

- A break above $4,750 could open the door to $5,200, with $5,600 in sight if momentum accelerates.

On the downside, if U.S. government shutdown-driven uncertainty pressures markets, ETH price could revisit $4,300 and then $3,900. The Heikin Ashi candles also show bullish reversal strength, but volume confirmation would be needed for a sustained breakout.

Shutdown Impact Scenarios for Ethereum Price Prediction

-

Short Shutdown, Weak Private Data

If ADP and other private indicators show job weakness and the Fed feels compelled to cut rates, ETH could break through resistance, benefiting from increased risk appetite. -

Prolonged Shutdown, Fed Stalls

With no reliable government data, the Fed might delay cuts, leaving markets in limbo. That indecision could cap ETH’s rally and keep it stuck in consolidation below $4,750. -

Market Overreaction to Uncertainty

If equities tumble on data blackouts and policy confusion, ETH could be pulled lower with broader risk assets, testing $4,300 support again.

Investor Psychology and Macro Correlation

Crypto traders often claim Ethereum price is decoupling from traditional markets, but history shows ETH price still reacts to macro catalysts. Rate cuts fuel liquidity, risk-on behavior, and stablecoin inflows into DeFi. Conversely, uncertainty starves ETH of speculative demand. Right now, the shutdown acts as a psychological overhang. Even if Ethereum’s fundamentals remain strong, the lack of clarity from Washington could amplify volatility in the coming weeks.

Conclusion

$Ethereum is at a crossroads. The daily chart points to bullish recovery, but the shutdown clouds the Fed’s decision-making process, which is crucial for ETH’s next leg. If the shutdown is resolved quickly or private data pushes the Fed toward easing, $ETH could climb toward $5,200 and beyond. But if political gridlock drags and the Fed stalls, Ethereum risks another dip toward $4,300. For now, traders should expect heightened volatility and watch both Bollinger Band levels and Fed signals closely.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Aster

Aster  Global Dollar

Global Dollar  Circle USYC

Circle USYC  OKB

OKB  HTX DAO

HTX DAO  Ripple USD

Ripple USD  syrupUSDC

syrupUSDC  Sky

Sky  Pepe

Pepe  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  KuCoin

KuCoin  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  MYX Finance

MYX Finance  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  USDtb

USDtb  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  LayerZero

LayerZero  clBTC

clBTC  Sei

Sei  EURC

EURC  Jupiter

Jupiter  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  pippin

pippin  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Story

Story  WrappedM by M0

WrappedM by M0  Chiliz

Chiliz  Decred

Decred  Kinesis Gold

Kinesis Gold  Stable

Stable  Optimism

Optimism  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Mantle Staked Ether

Mantle Staked Ether  River

River  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Resolv USR

Resolv USR  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Maple Finance

Maple Finance  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  Injective

Injective  crvUSD

crvUSD  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Legacy Frax Dollar

Legacy Frax Dollar  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Humanity

Humanity  Savings USDD

Savings USDD  SPX6900

SPX6900  Aerodrome Finance

Aerodrome Finance  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Telcoin

Telcoin  ADI

ADI  Axie Infinity

Axie Infinity  Staked Aave

Staked Aave