Ethereum’s slide toward $2,000 has left its exchange-traded fund (ETF) investors holding more than $5 billion in paper losses, extending a marketwide crypto drawdown that has also hit Bitcoin.

According to CryptoSlate’s data, the move has tracked a broader risk-off wave that has pushed the global crypto market value down by $2 trillion since October’s peak, with BTC and $ETH both under pressure as volatility spread through other risk assets, including tech shares.

The difference for Ethereum is that a growing share of the exposure now sits inside products built for traditional portfolios, where performance is marked daily, and selling can be executed as quickly as any other listed security.

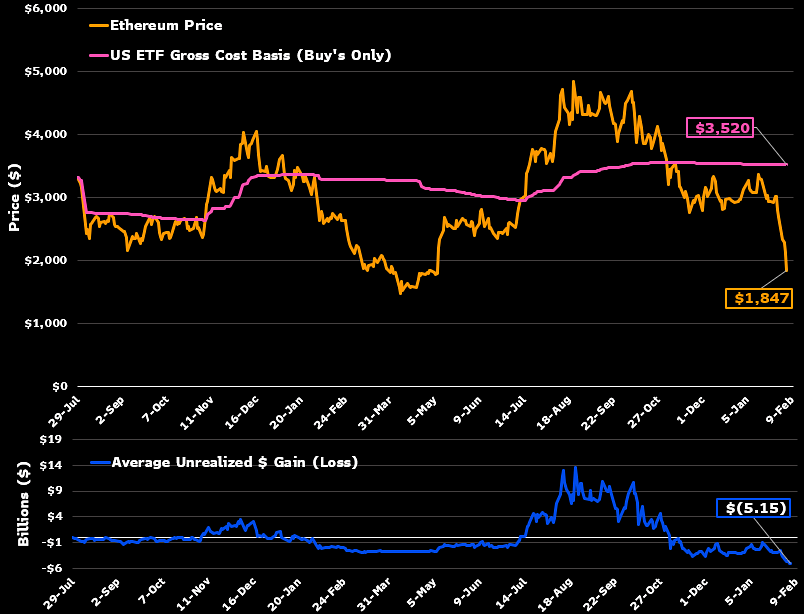

Quantifying Ethereum ETF holders losses

Over the past week, Bloomberg Intelligence ETF analyst James Seyffart has argued that the typical US spot Ethereum ETF holder is in a weaker position than Bitcoin ETF buyers.

In a post on X, he estimated the average cost basis for Ethereum ETF holders at around $3,500, and with $ETH trading under $2,000, the drawdown for the average ETF holder is roughly 44%.

Applying that drawdown to about $12 billion of remaining net inflows yields paper losses of about $5.3 billion.

The magnitude reflects how the ETF era concentrates exposure.

Capital was gathered when prices were higher, and the performance of that cohort is now captured in a daily-marked vehicle held in brokerage accounts alongside equities and other liquid risk exposures.

Seyffart’s framing also highlights the relative gap versus Bitcoin’s ETF cohort.

He described Ethereum ETF holders as in a worse position than their Bitcoin counterparts, based on the gap between the current Ether price and the group’s estimated average entry price.

ETF flows show holders stayed put, even as broader fund data turned negative

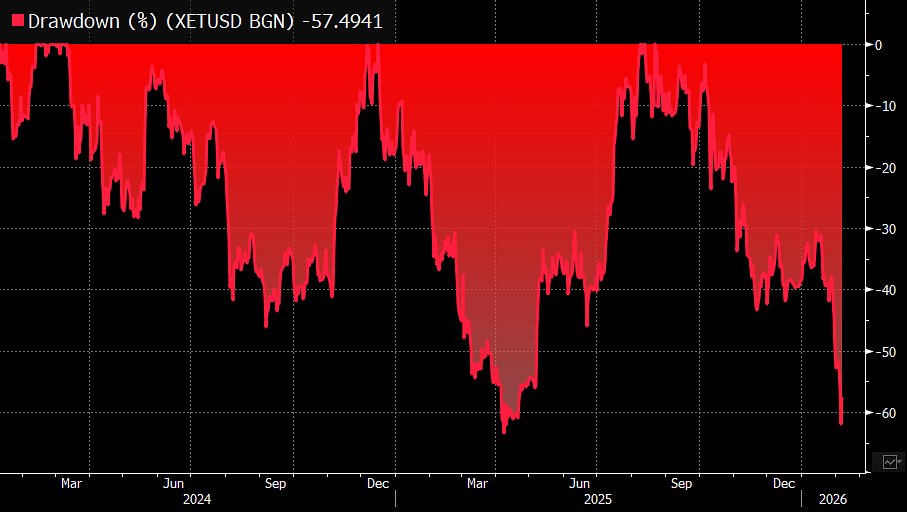

Seyffart said the latest leg down pushed $ETH ETF investors into a drawdown of more than 60% at the most recent bottom, broadly comparable to the percentage decline Ethereum experienced around its April 2025 low.

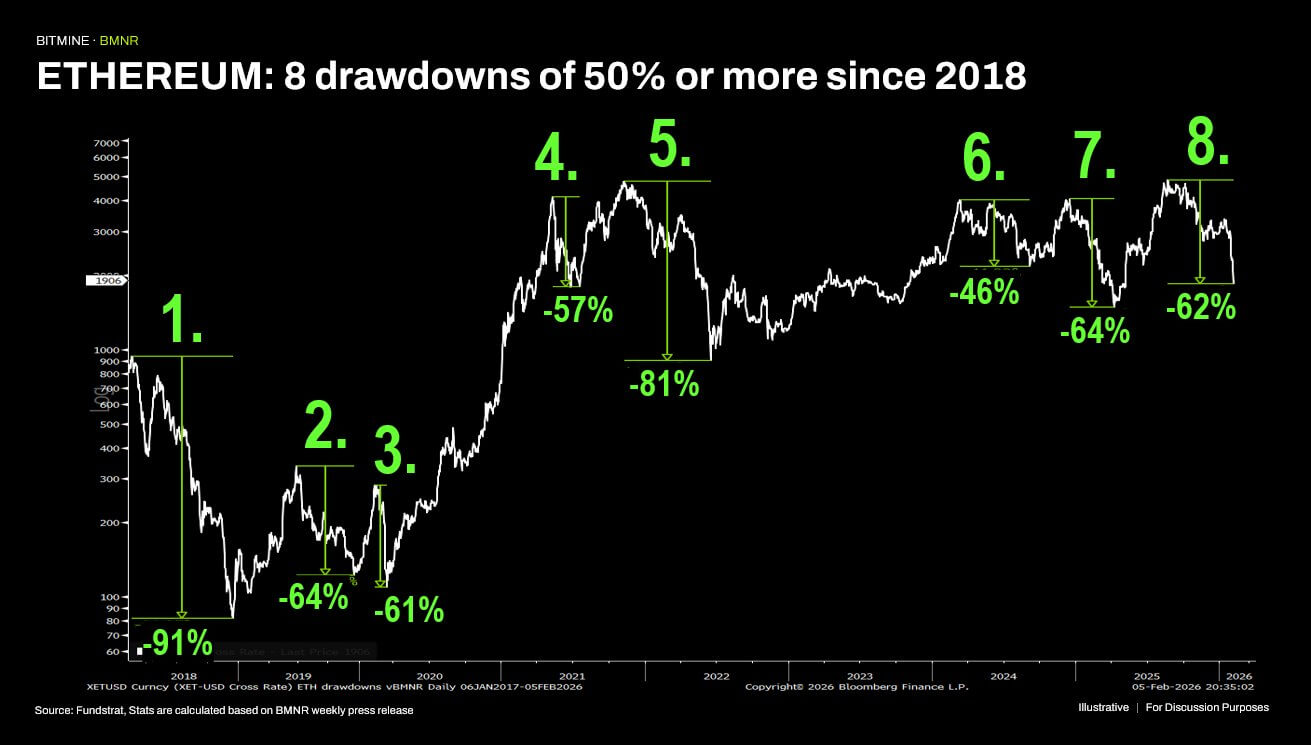

Tom Lee, BitMine’s chair, has emphasized how frequently Ethereum has experienced declines of that magnitude.

He said that since 2018, $ETH has recorded a drawdown of 60% or worse seven times in eight years. He described the pattern as roughly annual and also pointed to 2025, when $ETH declined by 64%.

That record does not soften current losses. It does, however, situate today’s price action within a recurring pattern that has characterized $ETH‘s market history, sharp drawdowns followed by periods of recovery.

The central question for the ETF era is whether a broader base of holders, including investors who prefer regulated brokerage products, responds to those swings in the same way as prior cycles.

Daily flow data has become the most direct tool for measuring that behavior.

On Feb. 11, US spot Ethereum ETFs recorded a net outflow of $129.1 million, led by large outflows from Fidelity’s FETH and BlackRock’s ETHA. A day earlier, on Feb. 10, the complex posted a net inflow of $13.8 million from the same dataset.

The reversal highlighted uneven positioning, with capital moving in both directions rather than exiting in a single wave.

The broader flow picture still points to a cohort that has not fully unwound.

Seyffart’s estimate that net inflows declined from about $15 billion to below $12 billion suggests meaningful redemptions, but not a wholesale retreat relative to the price decline from the $3,500 area toward $2,000.

That relative stickiness matters because ETFs compress decision-making. Investors do not need to move coins or change custody.

Exposure can be reduced the same way an equity position is trimmed, and advisors can rebalance within standard portfolio processes. In a risk-off market, that convenience can accelerate selling. It can also support holding behavior among investors who are prepared to absorb volatility.

Break-even near $3,500 could shape the next cycle’s market structure

If Seyffart’s estimate is close to accurate, around $3,500 functions as an approximate break-even level for the average Ethereum ETF holder.

During recovery, a return to that level can shift the emphasis from losses to repair. For investors who established exposure through a regulated wrapper, approaching break-even can influence whether allocations are increased, maintained, or reduced.

However, this level may also generate selling pressure. Investors who have endured a drawdown to $2,000 may opt to exit once they have recovered their initial capital.

Such selling is driven by portfolio constraints rather than by technical analysis, and ETFs exacerbate this behavior by clustering buyers within similar cost-basis ranges.

That means two paths could define the next phase.

One is macro stabilization, in which risk appetite improves, and ETFs shift from uneven leakage to renewed inflows, a dynamic that can amplify upside because the wrapper is liquid and accessible.

The alternative scenario involves a retest of the $1,800 zone, accompanied by negative flows, which would challenge the resolve of the remaining cohort.

For ETF holders, the near-term question is more operational than predictive: how will the cohort behave if $ETH climbs back toward its break-even zone, and whether that level draws renewed demand or becomes a point at which selling accelerates.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  Pepe

Pepe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Circle USYC

Circle USYC  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Internet Computer

Internet Computer  BFUSD

BFUSD  Pump.fun

Pump.fun  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Ethena

Ethena  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Algorand

Algorand  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Aptos

Aptos  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  VeChain

VeChain  syrupUSDT

syrupUSDT  USDD

USDD  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  pippin

pippin  Beldex

Beldex  Bonk

Bonk  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Stable

Stable  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  Sei

Sei  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  EURC

EURC  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Virtuals Protocol

Virtuals Protocol  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Tezos

Tezos  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Lighter

Lighter  Decred

Decred  Story

Story  Optimism

Optimism  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kinesis Gold

Kinesis Gold  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  COCA

COCA  MYX Finance

MYX Finance  Ether.fi

Ether.fi  Humanity

Humanity  Liquid Staked ETH

Liquid Staked ETH  LayerZero

LayerZero  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Bitcoin SV

Bitcoin SV  Gnosis

Gnosis  Kaia

Kaia  BitTorrent

BitTorrent  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Pyth Network

Pyth Network  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  FLOKI

FLOKI  IOTA

IOTA  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  Aerodrome Finance

Aerodrome Finance  PRIME

PRIME  sBTC

sBTC  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  ADI

ADI  Jupiter Staked SOL

Jupiter Staked SOL  Maple Finance

Maple Finance  Savings USDD

Savings USDD  crvUSD

crvUSD  Conflux

Conflux  Legacy Frax Dollar

Legacy Frax Dollar  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Starknet

Starknet  Telcoin

Telcoin  Helium

Helium  Staked Aave

Staked Aave